Institutional landlords are large organizations or entities owning substantial real estate portfolios, often managing properties directly to generate income and long-term value. Real Estate Investment Trusts (REITs) allow investors to buy shares in diversified real estate assets, offering liquidity and professional management without direct ownership responsibilities. Discover key differences and benefits between institutional landlords and REITs to make informed real estate investment decisions.

Why it is important

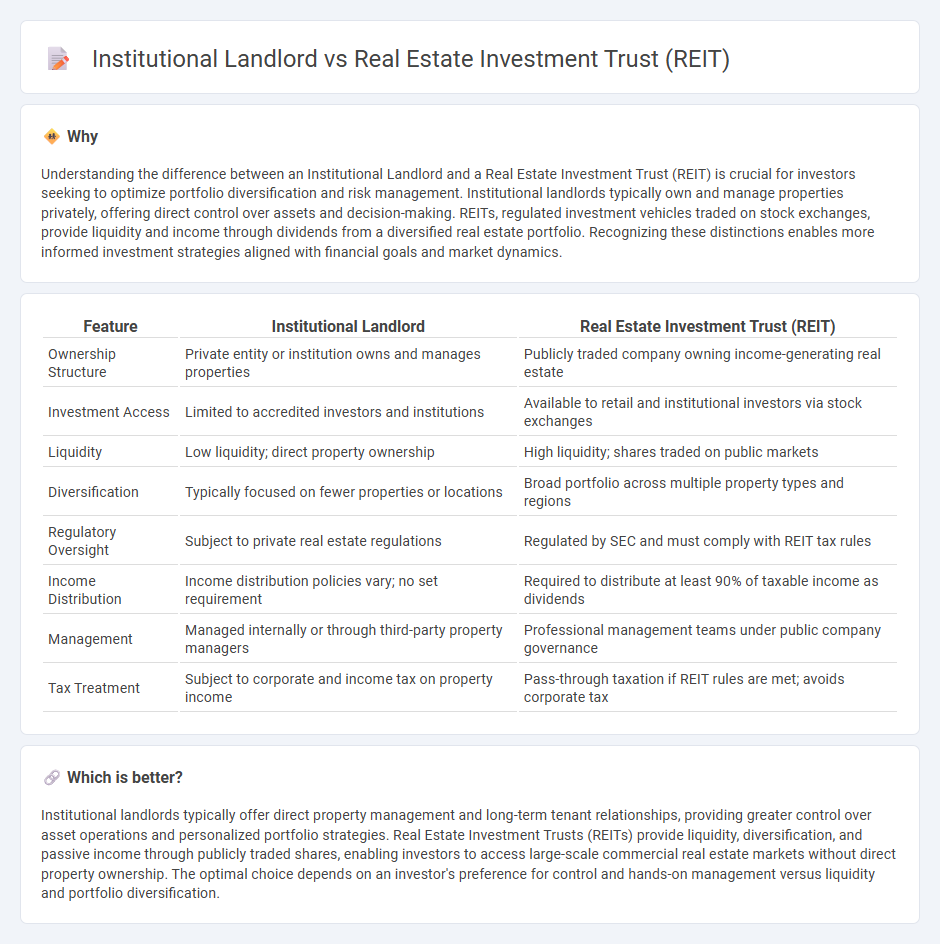

Understanding the difference between an Institutional Landlord and a Real Estate Investment Trust (REIT) is crucial for investors seeking to optimize portfolio diversification and risk management. Institutional landlords typically own and manage properties privately, offering direct control over assets and decision-making. REITs, regulated investment vehicles traded on stock exchanges, provide liquidity and income through dividends from a diversified real estate portfolio. Recognizing these distinctions enables more informed investment strategies aligned with financial goals and market dynamics.

Comparison Table

| Feature | Institutional Landlord | Real Estate Investment Trust (REIT) |

|---|---|---|

| Ownership Structure | Private entity or institution owns and manages properties | Publicly traded company owning income-generating real estate |

| Investment Access | Limited to accredited investors and institutions | Available to retail and institutional investors via stock exchanges |

| Liquidity | Low liquidity; direct property ownership | High liquidity; shares traded on public markets |

| Diversification | Typically focused on fewer properties or locations | Broad portfolio across multiple property types and regions |

| Regulatory Oversight | Subject to private real estate regulations | Regulated by SEC and must comply with REIT tax rules |

| Income Distribution | Income distribution policies vary; no set requirement | Required to distribute at least 90% of taxable income as dividends |

| Management | Managed internally or through third-party property managers | Professional management teams under public company governance |

| Tax Treatment | Subject to corporate and income tax on property income | Pass-through taxation if REIT rules are met; avoids corporate tax |

Which is better?

Institutional landlords typically offer direct property management and long-term tenant relationships, providing greater control over asset operations and personalized portfolio strategies. Real Estate Investment Trusts (REITs) provide liquidity, diversification, and passive income through publicly traded shares, enabling investors to access large-scale commercial real estate markets without direct property ownership. The optimal choice depends on an investor's preference for control and hands-on management versus liquidity and portfolio diversification.

Connection

Institutional landlords and Real Estate Investment Trusts (REITs) are interconnected through their shared focus on large-scale property ownership and management. Institutional landlords often invest in or operate REITs to leverage diversified portfolios of commercial real estate assets, enhancing liquidity and risk management. REITs provide these landlords with access to substantial capital markets, facilitating efficient acquisition, development, and operation of income-generating properties.

Key Terms

Ownership Structure

Real estate investment trusts (REITs) are publicly traded companies that pool investor capital to own, operate, and finance income-generating real estate, offering liquidity and diversification. Institutional landlords, such as pension funds and insurance companies, directly own substantial real estate portfolios with long-term hold strategies and less liquidity compared to REITs. Explore more about how ownership structures impact investment strategies and risk profiles in real estate markets.

Capital Source

Real estate investment trusts (REITs) primarily raise capital through public equity markets, allowing widespread investor participation and liquidity. Institutional landlords, on the other hand, rely on private funds such as pension funds, insurance companies, or private equity, often resulting in larger but less liquid capital pools. Explore the distinctions between these capital sources to better understand investment strategies and risk profiles.

Regulatory Requirements

Real estate investment trusts (REITs) are subject to strict regulatory requirements, including adherence to the Internal Revenue Code Section 856, mandates on asset composition, income sourcing, and distribution of at least 90% of taxable income as dividends to shareholders. Institutional landlords operate under broader commercial property regulations but lack the stringent tax and distribution rules that govern REITs, allowing more operational flexibility but less tax advantage. Explore deeper insights into regulatory frameworks and compliance obligations by reviewing specialized financial and legal resources.

Source and External Links

Real estate investment trust - A REIT is a company that owns and typically operates income-producing real estate like offices, apartments, hospitals, and shopping centers, offering investors an accessible way to invest in real estate with tax advantages and categorized mainly into commercial and residential types.

What's a REIT (Real Estate Investment Trust)? - REITs own, operate, or finance income-producing real estate and provide investors with regular income streams, diversification, and potential long-term capital appreciation, mostly traded publicly on stock exchanges.

Real Estate Investment Trusts (REITs) - REITs offer individuals a way to invest in large-scale real estate that produces income, including commercial properties and mortgages, without directly buying or managing the properties; they come in publicly traded and non-traded forms.

dowidth.com

dowidth.com