Single family rentals offer traditional housing with higher property values and strong appreciation potential, appealing to buyers seeking stability and long-term investment returns. Manufactured homes provide affordable, flexible living options with lower acquisition costs and quicker construction timelines, making them accessible for budget-conscious renters. Explore the benefits and challenges of each housing type to determine the best fit for your real estate goals.

Why it is important

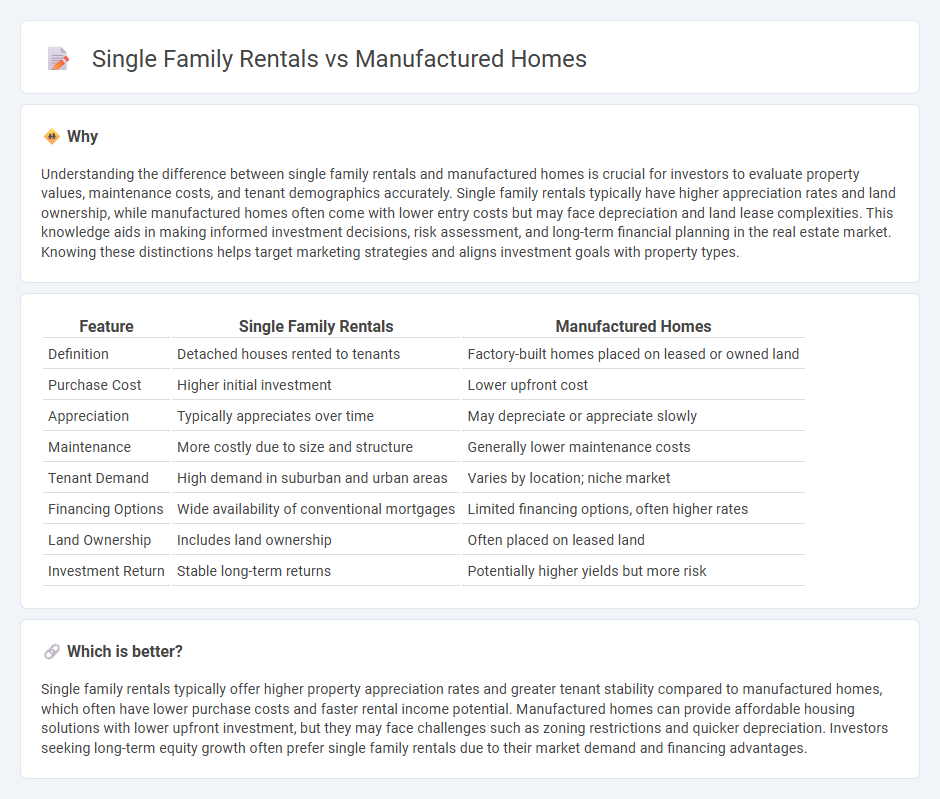

Understanding the difference between single family rentals and manufactured homes is crucial for investors to evaluate property values, maintenance costs, and tenant demographics accurately. Single family rentals typically have higher appreciation rates and land ownership, while manufactured homes often come with lower entry costs but may face depreciation and land lease complexities. This knowledge aids in making informed investment decisions, risk assessment, and long-term financial planning in the real estate market. Knowing these distinctions helps target marketing strategies and aligns investment goals with property types.

Comparison Table

| Feature | Single Family Rentals | Manufactured Homes |

|---|---|---|

| Definition | Detached houses rented to tenants | Factory-built homes placed on leased or owned land |

| Purchase Cost | Higher initial investment | Lower upfront cost |

| Appreciation | Typically appreciates over time | May depreciate or appreciate slowly |

| Maintenance | More costly due to size and structure | Generally lower maintenance costs |

| Tenant Demand | High demand in suburban and urban areas | Varies by location; niche market |

| Financing Options | Wide availability of conventional mortgages | Limited financing options, often higher rates |

| Land Ownership | Includes land ownership | Often placed on leased land |

| Investment Return | Stable long-term returns | Potentially higher yields but more risk |

Which is better?

Single family rentals typically offer higher property appreciation rates and greater tenant stability compared to manufactured homes, which often have lower purchase costs and faster rental income potential. Manufactured homes can provide affordable housing solutions with lower upfront investment, but they may face challenges such as zoning restrictions and quicker depreciation. Investors seeking long-term equity growth often prefer single family rentals due to their market demand and financing advantages.

Connection

Single family rentals and manufactured homes intersect as key affordable housing solutions, with manufactured homes often serving as a cost-effective option within single family rental markets. Investors capitalize on the lower acquisition costs and quicker deployment of manufactured homes to expand rental portfolios. This synergy enhances housing accessibility while diversifying real estate investment strategies.

Key Terms

Title ownership

Manufactured homes are often titled like vehicles, which can complicate financing and transfer of ownership compared to single-family rentals that have real property deeds. Title ownership impacts tax assessments, resale value, and mortgage options, making single-family rentals generally more straightforward investments. Explore the nuances of title ownership to make informed real estate decisions.

Zoning regulations

Manufactured homes often face more restrictive zoning regulations compared to single family rentals, limiting their placement predominantly to designated manufactured housing communities or specific zoning districts. Single family rentals benefit from broader zoning allowances, typically permitted in various residential zones without the need for special exceptions. Discover more about how zoning laws impact your investment options in housing types.

Depreciation

Manufactured homes typically experience faster depreciation compared to single-family rentals due to their construction materials and shorter lifespan, impacting long-term investment value and tax benefits. Single-family rentals, built on permanent foundations with durable materials, generally appreciate over time, offering more stable equity growth and favorable depreciation schedules for investors. Explore deeper insights on how depreciation differences affect your real estate investment strategy.

Source and External Links

Clayton Homes of Boise - Offers a wide selection of manufactured and modular homes in Boise, Idaho, built with the same materials as site-built homes in a controlled factory environment.

United Family Homes - Provides new and pre-owned manufactured homes for sale in Nampa, Idaho, offering durability and customization options with Kit West floorplans.

Jensen Homes - A longtime leader in the manufactured home industry, serving Idaho, Nevada, and Oregon, with a focus on high-quality, affordable homes and comprehensive customer support.

dowidth.com

dowidth.com