Fractional ownership platforms enable investors to buy a specific portion of a high-value property, securing direct equity and usage rights, while crowdfunding real estate pools capital from numerous investors to finance projects without granting property shares. These platforms provide diversified investment options with varying levels of involvement, liquidity, and regulatory frameworks. Explore the benefits and distinctions of fractional ownership and crowdfunding to optimize your real estate investment strategy.

Why it is important

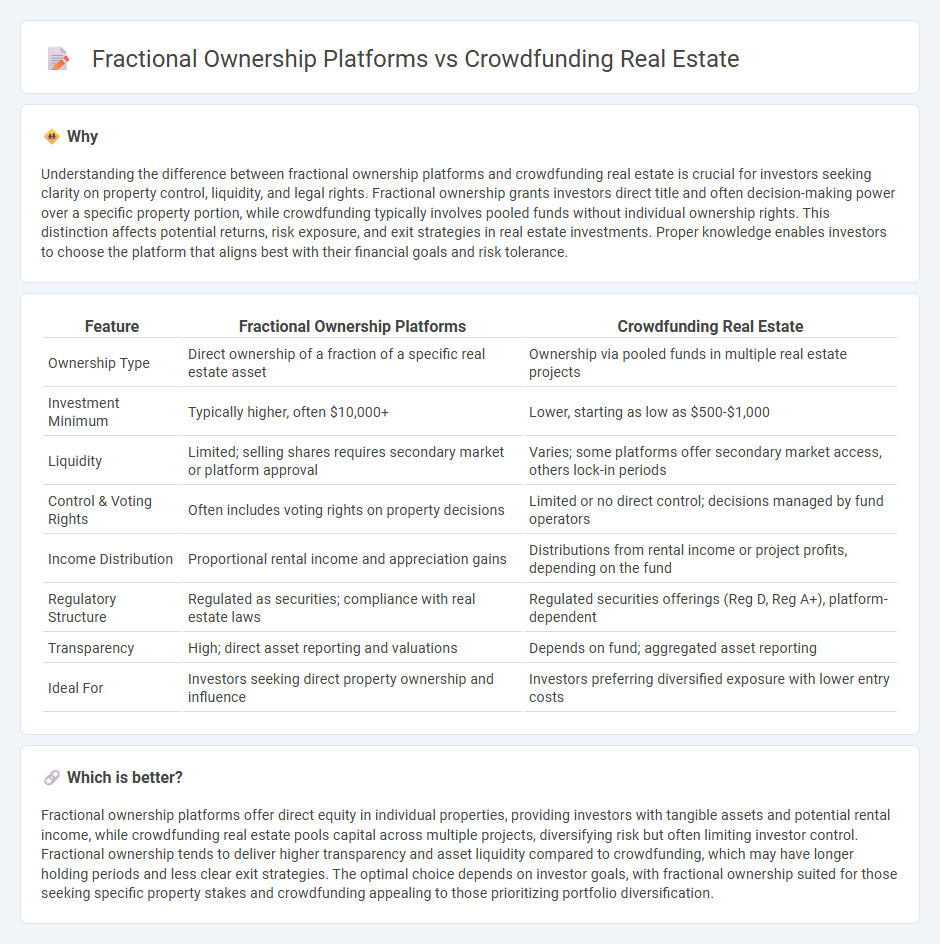

Understanding the difference between fractional ownership platforms and crowdfunding real estate is crucial for investors seeking clarity on property control, liquidity, and legal rights. Fractional ownership grants investors direct title and often decision-making power over a specific property portion, while crowdfunding typically involves pooled funds without individual ownership rights. This distinction affects potential returns, risk exposure, and exit strategies in real estate investments. Proper knowledge enables investors to choose the platform that aligns best with their financial goals and risk tolerance.

Comparison Table

| Feature | Fractional Ownership Platforms | Crowdfunding Real Estate |

|---|---|---|

| Ownership Type | Direct ownership of a fraction of a specific real estate asset | Ownership via pooled funds in multiple real estate projects |

| Investment Minimum | Typically higher, often $10,000+ | Lower, starting as low as $500-$1,000 |

| Liquidity | Limited; selling shares requires secondary market or platform approval | Varies; some platforms offer secondary market access, others lock-in periods |

| Control & Voting Rights | Often includes voting rights on property decisions | Limited or no direct control; decisions managed by fund operators |

| Income Distribution | Proportional rental income and appreciation gains | Distributions from rental income or project profits, depending on the fund |

| Regulatory Structure | Regulated as securities; compliance with real estate laws | Regulated securities offerings (Reg D, Reg A+), platform-dependent |

| Transparency | High; direct asset reporting and valuations | Depends on fund; aggregated asset reporting |

| Ideal For | Investors seeking direct property ownership and influence | Investors preferring diversified exposure with lower entry costs |

Which is better?

Fractional ownership platforms offer direct equity in individual properties, providing investors with tangible assets and potential rental income, while crowdfunding real estate pools capital across multiple projects, diversifying risk but often limiting investor control. Fractional ownership tends to deliver higher transparency and asset liquidity compared to crowdfunding, which may have longer holding periods and less clear exit strategies. The optimal choice depends on investor goals, with fractional ownership suited for those seeking specific property stakes and crowdfunding appealing to those prioritizing portfolio diversification.

Connection

Fractional ownership platforms and crowdfunding real estate both enable multiple investors to pool resources and acquire partial stakes in properties, democratizing access to real estate markets. These platforms utilize digital technology to facilitate transparent transactions, reduce entry barriers, and increase liquidity in traditionally illiquid asset classes. The integration of crowdfunding mechanisms strengthens fractional ownership models by aggregating capital and diversifying investor portfolios across various real estate projects.

Key Terms

Pooling of Funds

Crowdfunding real estate platforms pool funds from numerous investors to finance entire properties or projects, allowing for diversified investment opportunities with relatively low capital entry. Fractional ownership platforms divide property shares among investors, offering direct equity stakes but often requiring higher minimum investments and more active management. Explore further to understand which pooling method aligns best with your investment goals and risk tolerance.

Ownership Structure

Crowdfunding real estate platforms pool funds from multiple investors who collectively own shares in a property without direct title transfer, typically through a legal entity such as an LLC. Fractional ownership platforms divide the actual property ownership into distinct shares, granting investors legal title to their portion and often usage rights. Explore the differences further to determine which ownership structure aligns best with your investment goals.

Liquidity

Crowdfunding real estate platforms typically offer higher liquidity by allowing investors to trade shares more frequently on secondary markets, whereas fractional ownership platforms often involve longer holding periods with limited exit options. Liquidity is a critical factor influencing investor flexibility and the ability to quickly reallocate capital in response to market changes. Explore detailed comparisons to understand which investment vehicle best suits your liquidity needs.

Source and External Links

Real Estate Crowdfunding Explained - BetterWorld - This webpage provides a detailed explanation of how real estate crowdfunding works, including both equity and debt investments.

Crowdfunding Real Estate: What to Know - This article discusses real estate crowdfunding as a way for multiple investors to pool funds to invest in properties they otherwise couldn't afford individually.

CrowdStreet - Direct Access to Private Market Investing - CrowdStreet offers a platform for investors to engage in real estate crowdfunding, focusing on commercial properties and diverse investment opportunities.

dowidth.com

dowidth.com