iBuyers utilize technology-driven platforms to provide instant home offers, streamlining property sales for convenience and speed, while Real Estate Investment Trusts (REITs) pool investor capital to acquire, manage, and generate income from diversified real estate portfolios. iBuyers focus on direct residential transactions with rapid liquidity, contrasting with REITs' longer-term investment strategies and income distribution through dividends. Explore the key differences and benefits of iBuyers versus REITs to determine which aligns with your real estate investment goals.

Why it is important

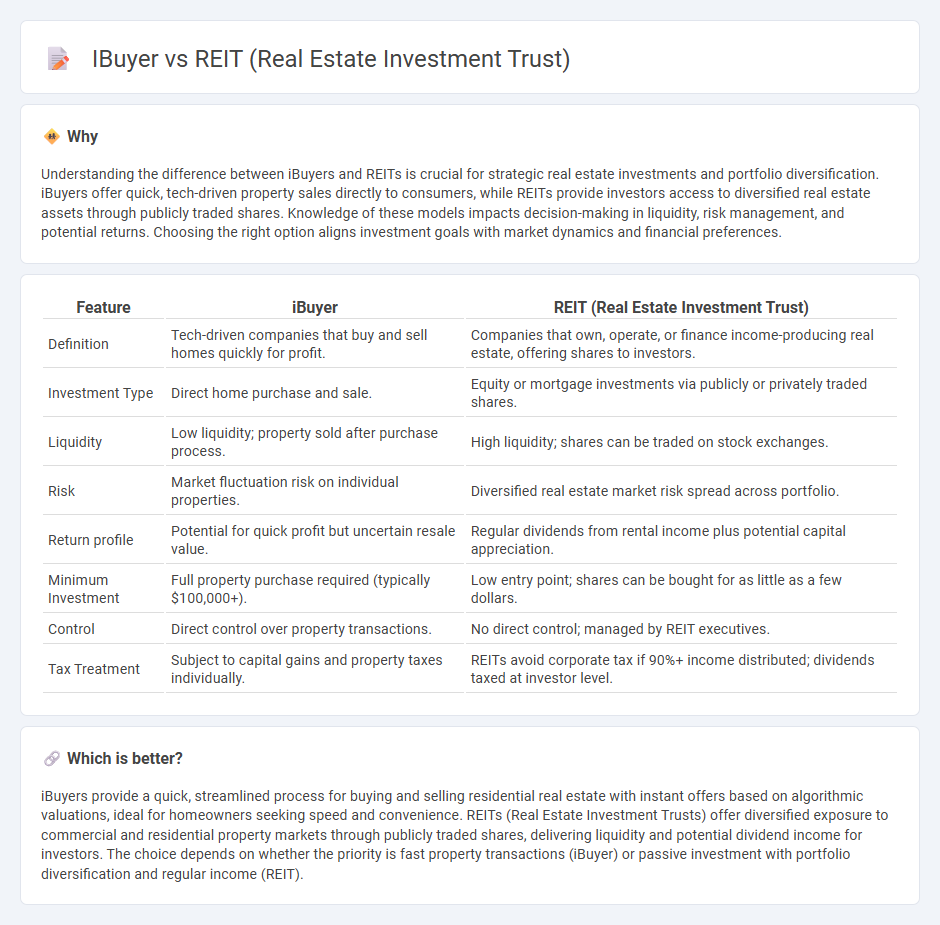

Understanding the difference between iBuyers and REITs is crucial for strategic real estate investments and portfolio diversification. iBuyers offer quick, tech-driven property sales directly to consumers, while REITs provide investors access to diversified real estate assets through publicly traded shares. Knowledge of these models impacts decision-making in liquidity, risk management, and potential returns. Choosing the right option aligns investment goals with market dynamics and financial preferences.

Comparison Table

| Feature | iBuyer | REIT (Real Estate Investment Trust) |

|---|---|---|

| Definition | Tech-driven companies that buy and sell homes quickly for profit. | Companies that own, operate, or finance income-producing real estate, offering shares to investors. |

| Investment Type | Direct home purchase and sale. | Equity or mortgage investments via publicly or privately traded shares. |

| Liquidity | Low liquidity; property sold after purchase process. | High liquidity; shares can be traded on stock exchanges. |

| Risk | Market fluctuation risk on individual properties. | Diversified real estate market risk spread across portfolio. |

| Return profile | Potential for quick profit but uncertain resale value. | Regular dividends from rental income plus potential capital appreciation. |

| Minimum Investment | Full property purchase required (typically $100,000+). | Low entry point; shares can be bought for as little as a few dollars. |

| Control | Direct control over property transactions. | No direct control; managed by REIT executives. |

| Tax Treatment | Subject to capital gains and property taxes individually. | REITs avoid corporate tax if 90%+ income distributed; dividends taxed at investor level. |

Which is better?

iBuyers provide a quick, streamlined process for buying and selling residential real estate with instant offers based on algorithmic valuations, ideal for homeowners seeking speed and convenience. REITs (Real Estate Investment Trusts) offer diversified exposure to commercial and residential property markets through publicly traded shares, delivering liquidity and potential dividend income for investors. The choice depends on whether the priority is fast property transactions (iBuyer) or passive investment with portfolio diversification and regular income (REIT).

Connection

iBuyers and Real Estate Investment Trusts (REITs) connect through their shared interest in streamlining real estate transactions and maximizing property portfolio returns. iBuyers use advanced algorithms to quickly purchase and resell homes, providing liquidity and market efficiency that REITs leverage to acquire high-quality, income-generating properties. This synergy enhances market accessibility and supports REITs' investment strategies by integrating technology-driven property acquisition and management processes.

Key Terms

Ownership Structure

REITs (Real Estate Investment Trusts) own, operate, or finance income-producing real estate, allowing investors to purchase shares and earn dividends without direct property management. iBuyers are technology-driven companies that purchase homes directly from sellers, providing quick sales but holding ownership temporarily before reselling. Explore the distinct ownership models and investment opportunities to determine which aligns best with your real estate goals.

Liquidity

REITs offer high liquidity through public trading on stock exchanges, allowing investors to buy and sell shares easily with minimal time delay. In contrast, iBuyer transactions involve direct property sales, which typically take days or weeks, resulting in lower liquidity for individual investors. Explore the nuances between REITs and iBuyers to better understand liquidity implications in real estate investing.

Transaction Model

REITs operate by pooling investor capital to acquire, manage, and profit from income-generating real estate, emphasizing long-term ownership and rental income. iBuyers use an instant-offer transaction model, leveraging technology and algorithms to quickly buy and resell homes, focusing on speed and convenience over prolonged investment. Explore the distinct benefits and operational methods of REITs and iBuyers to determine which suits your real estate investment goals.

Source and External Links

Real Estate Investment Trust - A company that owns and operates income-producing real estate, offering investors a way to capitalize on real estate without direct property management.

What's a REIT? - A type of company that owns or finances income-producing real estate, providing regular income streams and diversification benefits to investors.

What is a REIT? - Companies that invest in real estate, offering individuals an accessible way to invest without needing to manage properties themselves.

dowidth.com

dowidth.com