Institutional landlords typically manage large portfolios of commercial or residential properties, prioritizing long-term investment returns and portfolio diversification through professional asset management. Owner-occupiers purchase real estate primarily for personal or business use, focusing on location suitability, functionality, and long-term occupancy benefits rather than rental income. Explore the key differences and strategic advantages of institutional landlords versus owner-occupiers in the real estate market.

Why it is important

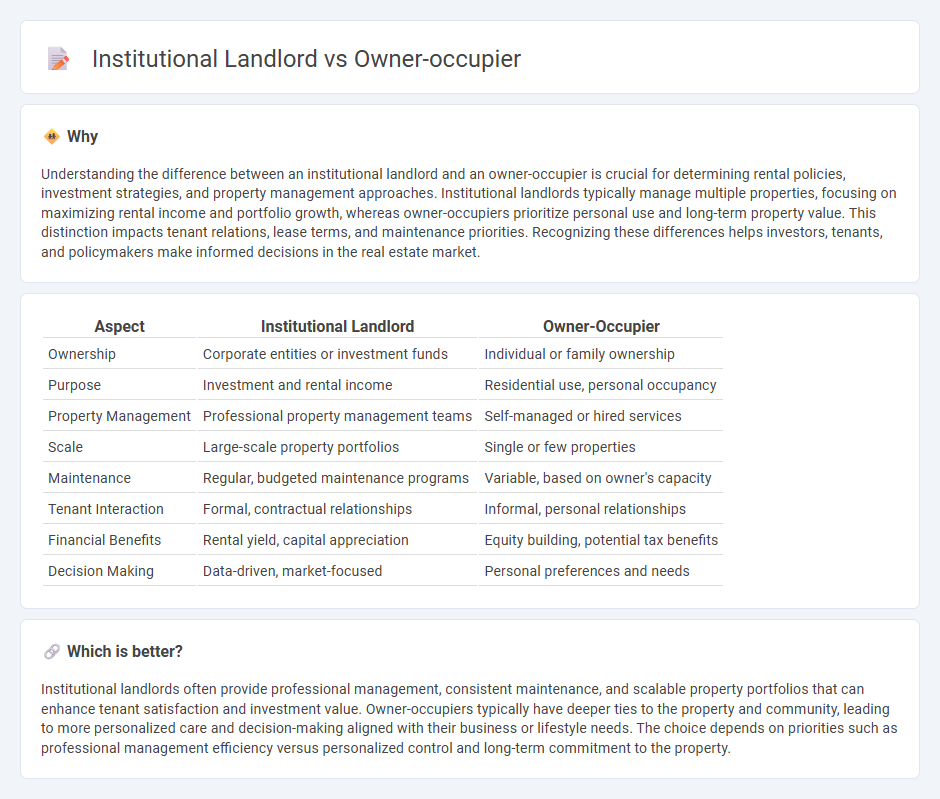

Understanding the difference between an institutional landlord and an owner-occupier is crucial for determining rental policies, investment strategies, and property management approaches. Institutional landlords typically manage multiple properties, focusing on maximizing rental income and portfolio growth, whereas owner-occupiers prioritize personal use and long-term property value. This distinction impacts tenant relations, lease terms, and maintenance priorities. Recognizing these differences helps investors, tenants, and policymakers make informed decisions in the real estate market.

Comparison Table

| Aspect | Institutional Landlord | Owner-Occupier |

|---|---|---|

| Ownership | Corporate entities or investment funds | Individual or family ownership |

| Purpose | Investment and rental income | Residential use, personal occupancy |

| Property Management | Professional property management teams | Self-managed or hired services |

| Scale | Large-scale property portfolios | Single or few properties |

| Maintenance | Regular, budgeted maintenance programs | Variable, based on owner's capacity |

| Tenant Interaction | Formal, contractual relationships | Informal, personal relationships |

| Financial Benefits | Rental yield, capital appreciation | Equity building, potential tax benefits |

| Decision Making | Data-driven, market-focused | Personal preferences and needs |

Which is better?

Institutional landlords often provide professional management, consistent maintenance, and scalable property portfolios that can enhance tenant satisfaction and investment value. Owner-occupiers typically have deeper ties to the property and community, leading to more personalized care and decision-making aligned with their business or lifestyle needs. The choice depends on priorities such as professional management efficiency versus personalized control and long-term commitment to the property.

Connection

Institutional landlords often invest in large-scale real estate properties that are leased to owner-occupiers, providing stable, long-term tenancy agreements. Owner-occupiers benefit from institutional landlords' professional management and maintenance services, enhancing property value and tenant satisfaction. This relationship creates a symbiotic connection where institutional landlords secure reliable income streams while owner-occupiers gain access to high-quality commercial and residential spaces.

Key Terms

Tenure

Owner-occupiers hold residential properties primarily for personal use, ensuring long-term stability and control over tenure without external interference. Institutional landlords, such as real estate investment trusts or pension funds, manage extensive portfolios with lease agreements structured for profitability and turnover, often resulting in more flexible but shorter tenancy durations. Explore the detailed differences in tenure dynamics and their impact on housing markets to better understand ownership implications.

Rental Yield

Owner-occupiers typically achieve lower rental yields compared to institutional landlords due to their primary focus on long-term property value and personal use rather than maximizing rental income. Institutional landlords leverage scale, property management expertise, and market data to optimize rental returns, often targeting yields above 5-7% depending on the location and asset type. Explore in-depth analyses and strategies to enhance rental yield performance between owner-occupier and institutional landlord models.

Property Management

Owner-occupiers typically manage properties with a hands-on approach, focusing on personalized maintenance and tenant relationships to ensure long-term asset value. Institutional landlords leverage advanced property management systems and economies of scale to optimize operational efficiency and maximize returns across large portfolios. Explore the key differences in property management strategies between these ownership types to enhance your investment approach.

Source and External Links

Owner occupancy: Everything you need to know - Owner-occupancy refers to owning a home and using it as your primary residence, offering benefits like tax advantages and full control over the property, in contrast to absentee ownership where the owner does not live in the home.

OWNER-OCCUPIER definition | Cambridge English Dictionary - An owner-occupier is someone who has bought the house or apartment that they live in, distinguishing them from landlords or investors who do not reside in their properties.

Understanding owner-occupied properties | Rocket Mortgage - Owner-occupied properties are those where the landlord both owns and lives in the home, which can serve as a gateway to real estate investing but comes with specific loan terms and occupancy requirements to consider.

dowidth.com

dowidth.com