Escrow crowdfunding streamlines real estate investments by pooling funds from multiple investors into a single escrow account, enhancing transparency and accessibility compared to traditional escrow services that involve individual transactions. Traditional escrow typically requires a direct buyer-seller interaction with a third-party agent managing funds and documents, which can increase time and costs. Explore the advantages and drawbacks of escrow crowdfunding versus traditional escrow to determine the best fit for your real estate investment strategy.

Why it is important

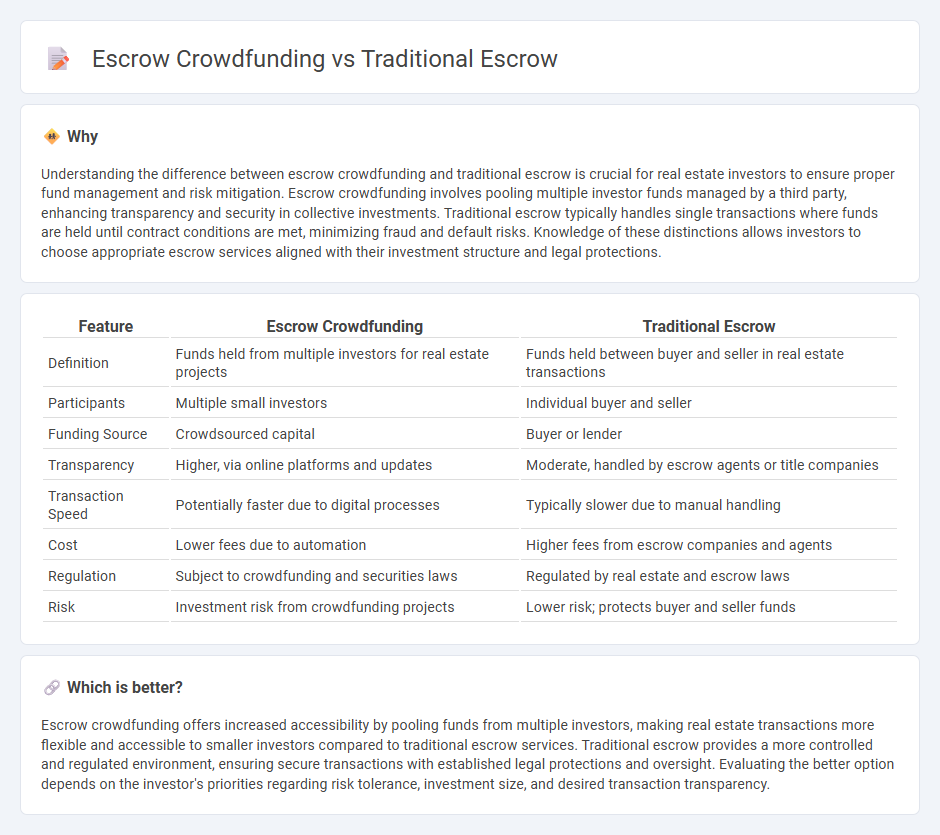

Understanding the difference between escrow crowdfunding and traditional escrow is crucial for real estate investors to ensure proper fund management and risk mitigation. Escrow crowdfunding involves pooling multiple investor funds managed by a third party, enhancing transparency and security in collective investments. Traditional escrow typically handles single transactions where funds are held until contract conditions are met, minimizing fraud and default risks. Knowledge of these distinctions allows investors to choose appropriate escrow services aligned with their investment structure and legal protections.

Comparison Table

| Feature | Escrow Crowdfunding | Traditional Escrow |

|---|---|---|

| Definition | Funds held from multiple investors for real estate projects | Funds held between buyer and seller in real estate transactions |

| Participants | Multiple small investors | Individual buyer and seller |

| Funding Source | Crowdsourced capital | Buyer or lender |

| Transparency | Higher, via online platforms and updates | Moderate, handled by escrow agents or title companies |

| Transaction Speed | Potentially faster due to digital processes | Typically slower due to manual handling |

| Cost | Lower fees due to automation | Higher fees from escrow companies and agents |

| Regulation | Subject to crowdfunding and securities laws | Regulated by real estate and escrow laws |

| Risk | Investment risk from crowdfunding projects | Lower risk; protects buyer and seller funds |

Which is better?

Escrow crowdfunding offers increased accessibility by pooling funds from multiple investors, making real estate transactions more flexible and accessible to smaller investors compared to traditional escrow services. Traditional escrow provides a more controlled and regulated environment, ensuring secure transactions with established legal protections and oversight. Evaluating the better option depends on the investor's priorities regarding risk tolerance, investment size, and desired transaction transparency.

Connection

Escrow crowdfunding and traditional escrow share the critical function of securely holding funds during real estate transactions to protect all parties involved. Both methods use third-party escrow agents to ensure that payments, such as down payments or investor contributions, are released only upon meeting predefined conditions, minimizing risk and fraud. In real estate, escrow crowdfunding expands investment access by pooling funds from multiple investors while maintaining the trusted escrow safeguards found in traditional real estate deals.

Key Terms

Third-Party Custodian

Traditional escrow involves a neutral third-party custodian who securely holds funds or assets until contractual conditions are met, ensuring trust and reducing risk for both buyers and sellers. Escrow crowdfunding adapts this model by integrating crowdfunding platforms as custodians, managing pooled contributions while safeguarding investor interests during fundraising campaigns. Explore the nuances between these custodial roles to better understand how escrow mechanisms protect stakeholders in diverse financial transactions.

Disbursement Structure

Traditional escrow disbursement follows a linear structure, releasing funds only upon the fulfillment of predefined conditions or milestones, ensuring strict control and protection for all parties involved. Escrow crowdfunding utilizes a more dynamic disbursement model, often allowing partial releases based on cumulative funding or incremental project progress, facilitating greater flexibility for multiple backers and project phases. Explore detailed comparisons and benefits to understand which disbursement structure aligns best with your funding needs.

Investor Pool

Traditional escrow typically involves a single investor or a small group, offering a controlled and secure transaction environment, while escrow crowdfunding pools funds from numerous investors, increasing capital access and diversifying risk. The investor pool in escrow crowdfunding is broader and more inclusive, enabling participation from individuals with varying investment capacities, unlike traditional escrow which is often limited to private or institutional investors. Explore more about how investor pool dynamics influence secured transactions and funding strategies.

Source and External Links

What is Escrow? We Explain in 6 Easy Steps - Explains traditional escrow accounts, which are managed by a neutral third-party company holding documents or money until a sale is complete.

Escrow - Wikipedia - Describes traditional escrow as a contractual arrangement where a third party manages funds or property based on conditions agreed upon by the transacting parties.

M&A Escrow Solutions vs. Traditional Bank Escrow Market Services - Discusses the use of traditional bank escrow accounts in mergers and acquisitions, highlighting their management and disbursement processes.

dowidth.com

dowidth.com