Automated valuation models (AVMs) leverage algorithms and extensive datasets to estimate property values quickly and consistently. The sales comparison approach relies on analyzing recent sales of similar properties, providing context-specific market insights but requiring manual judgment. Explore the strengths and limitations of both methods to determine the best valuation strategy for your real estate needs.

Why it is important

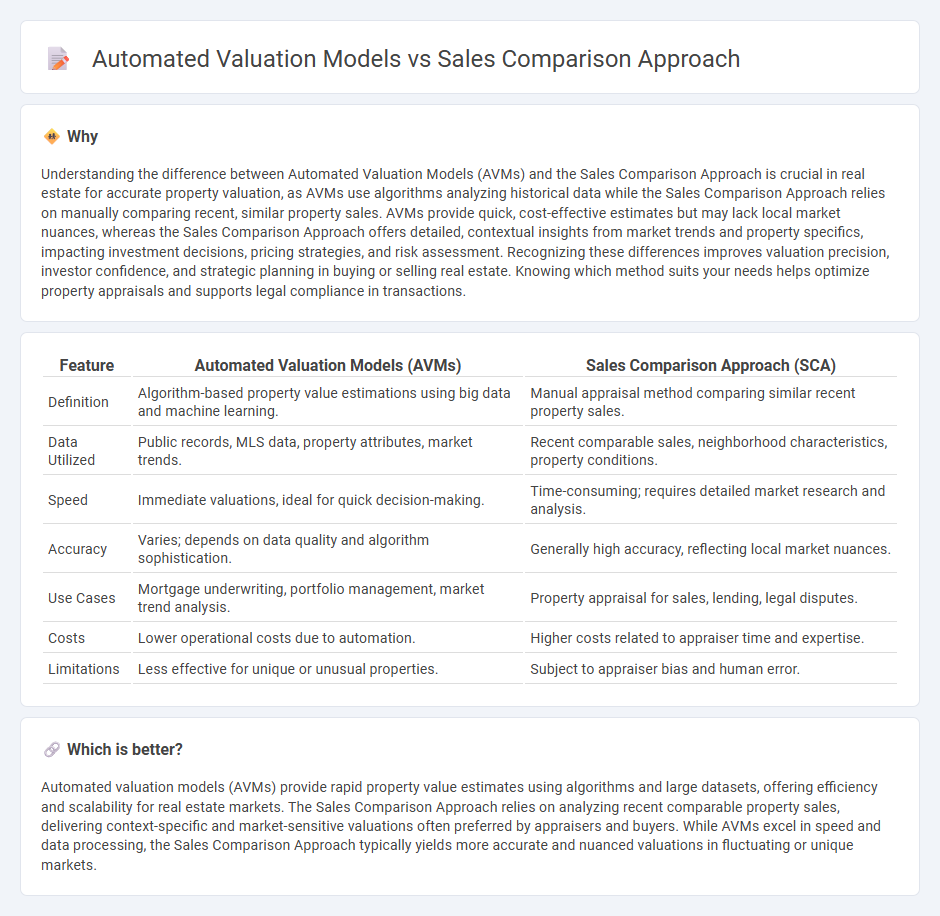

Understanding the difference between Automated Valuation Models (AVMs) and the Sales Comparison Approach is crucial in real estate for accurate property valuation, as AVMs use algorithms analyzing historical data while the Sales Comparison Approach relies on manually comparing recent, similar property sales. AVMs provide quick, cost-effective estimates but may lack local market nuances, whereas the Sales Comparison Approach offers detailed, contextual insights from market trends and property specifics, impacting investment decisions, pricing strategies, and risk assessment. Recognizing these differences improves valuation precision, investor confidence, and strategic planning in buying or selling real estate. Knowing which method suits your needs helps optimize property appraisals and supports legal compliance in transactions.

Comparison Table

| Feature | Automated Valuation Models (AVMs) | Sales Comparison Approach (SCA) |

|---|---|---|

| Definition | Algorithm-based property value estimations using big data and machine learning. | Manual appraisal method comparing similar recent property sales. |

| Data Utilized | Public records, MLS data, property attributes, market trends. | Recent comparable sales, neighborhood characteristics, property conditions. |

| Speed | Immediate valuations, ideal for quick decision-making. | Time-consuming; requires detailed market research and analysis. |

| Accuracy | Varies; depends on data quality and algorithm sophistication. | Generally high accuracy, reflecting local market nuances. |

| Use Cases | Mortgage underwriting, portfolio management, market trend analysis. | Property appraisal for sales, lending, legal disputes. |

| Costs | Lower operational costs due to automation. | Higher costs related to appraiser time and expertise. |

| Limitations | Less effective for unique or unusual properties. | Subject to appraiser bias and human error. |

Which is better?

Automated valuation models (AVMs) provide rapid property value estimates using algorithms and large datasets, offering efficiency and scalability for real estate markets. The Sales Comparison Approach relies on analyzing recent comparable property sales, delivering context-specific and market-sensitive valuations often preferred by appraisers and buyers. While AVMs excel in speed and data processing, the Sales Comparison Approach typically yields more accurate and nuanced valuations in fluctuating or unique markets.

Connection

Automated valuation models (AVMs) utilize the Sales Comparison Approach by analyzing recent sales data of comparable properties to estimate current market values efficiently. AVMs apply algorithms to adjust for differences in location, size, and features, enhancing accuracy in property valuations. This connection allows real estate professionals to leverage large datasets for faster, data-driven pricing decisions.

Key Terms

Comparable Sales (Comps)

The Sales Comparison Approach relies on analyzing recent, relevant Comparable Sales (Comps) within the same market to estimate property value through direct comparison of similar attributes such as location, size, and condition. Automated Valuation Models (AVMs) utilize algorithms and extensive databases of Comps combined with statistical modeling to provide rapid, data-driven property valuations, often incorporating broader market trends and adjustments. Explore more about how each method leverages Comparable Sales data to enhance accuracy and efficiency in property valuation.

Algorithm

The Sales Comparison Approach relies on analyzing recent comparable property sales to estimate market value, utilizing human judgment and qualitative adjustments in its algorithm. Automated Valuation Models (AVMs) employ advanced machine learning algorithms and large datasets to produce rapid, data-driven property valuations with minimal human intervention. Explore how algorithmic differences impact accuracy and efficiency in property appraisal by learning more about these valuation methods.

Adjustments

The Sales Comparison Approach relies heavily on manual adjustments to comparable property data, accounting for differences in features, location, and market conditions to arrive at a property's value. Automated Valuation Models (AVMs) use algorithms and large datasets to make real-time adjustments, often providing faster but less nuanced valuations. Explore more about how adjustments impact valuation accuracy and application in real estate.

Source and External Links

The Sales Comparison Approach - The sales comparison approach estimates property value by comparing prices of recently sold similar properties and making adjustments for differences, relying on the principle of substitution and contribution while considering current market conditions and specific property features.

Sales Comparison Approach (Real Estate) - Overview - This approach uses sales data of similar properties in the same locality and current use, adjusting for differing features to estimate market value, and is a key part of comparative market analysis for real estate valuation.

Sales Comparison Approach (SCA): A Complete Guide - The sales comparison approach factors in current market state, location, property features, square footage, and age/condition by comparing the subject property to similar recently sold homes nearby to determine value.

dowidth.com

dowidth.com