Sale leaseback involves selling a property and leasing it back to retain operational control, freeing up capital while maintaining occupancy. Master lease agreements grant a lessee comprehensive control over multiple units or properties, often subletting to generate revenue without ownership. Explore the distinct advantages and strategic uses of sale leaseback versus master lease arrangements in real estate transactions.

Why it is important

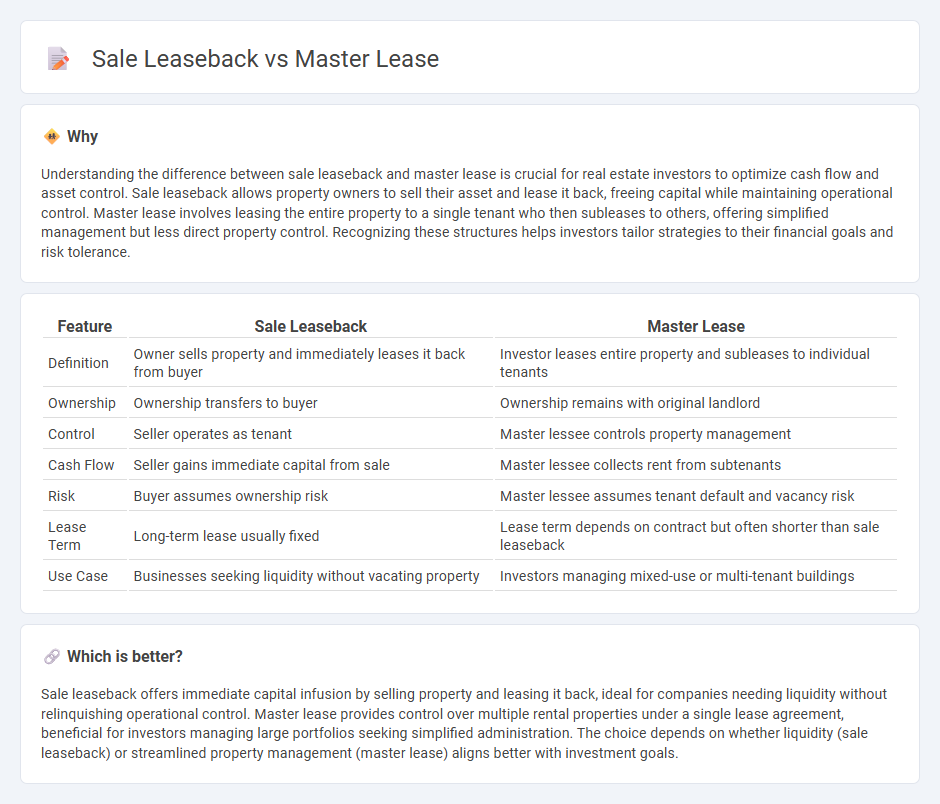

Understanding the difference between sale leaseback and master lease is crucial for real estate investors to optimize cash flow and asset control. Sale leaseback allows property owners to sell their asset and lease it back, freeing capital while maintaining operational control. Master lease involves leasing the entire property to a single tenant who then subleases to others, offering simplified management but less direct property control. Recognizing these structures helps investors tailor strategies to their financial goals and risk tolerance.

Comparison Table

| Feature | Sale Leaseback | Master Lease |

|---|---|---|

| Definition | Owner sells property and immediately leases it back from buyer | Investor leases entire property and subleases to individual tenants |

| Ownership | Ownership transfers to buyer | Ownership remains with original landlord |

| Control | Seller operates as tenant | Master lessee controls property management |

| Cash Flow | Seller gains immediate capital from sale | Master lessee collects rent from subtenants |

| Risk | Buyer assumes ownership risk | Master lessee assumes tenant default and vacancy risk |

| Lease Term | Long-term lease usually fixed | Lease term depends on contract but often shorter than sale leaseback |

| Use Case | Businesses seeking liquidity without vacating property | Investors managing mixed-use or multi-tenant buildings |

Which is better?

Sale leaseback offers immediate capital infusion by selling property and leasing it back, ideal for companies needing liquidity without relinquishing operational control. Master lease provides control over multiple rental properties under a single lease agreement, beneficial for investors managing large portfolios seeking simplified administration. The choice depends on whether liquidity (sale leaseback) or streamlined property management (master lease) aligns better with investment goals.

Connection

Sale leaseback and master lease are connected through their strategic use in real estate financing and management, where property ownership is transferred while the seller retains operational control by leasing the asset back. Sale leaseback involves the original owner selling the property and leasing it back, providing liquidity and continued use of the premises; master lease agreements, on the other hand, consolidate multiple leases under a single contract, enabling streamlined management and operational control over various tenants or subleases. Both mechanisms enhance cash flow optimization and asset utilization for investors and tenants within commercial real estate portfolios.

Key Terms

Control

A master lease provides the lessee with operational control over the property while the lessor retains ownership, allowing for long-term management flexibility. In a sale leaseback, the original owner sells the asset and leases it back, relinquishing ownership but maintaining use and control through lease terms. Explore the key differences in control structures to determine the best fit for your business strategy.

Ownership

Master lease agreements grant the lessee operational control without transferring ownership, allowing the lessor to retain asset title and responsibilities. Sale leaseback transactions involve the property owner selling the asset to an investor and immediately leasing it back, transferring ownership while maintaining operational use. Explore detailed distinctions and benefits of each arrangement to determine the best fit for your asset management strategy.

Liability

Master leases consolidate multiple lease agreements under one contract, typically limiting liability to the terms agreed within the lease framework, offering predictability in financial obligations. Sale leasebacks transfer ownership from the seller to the buyer while enabling the seller to remain as a lessee, often increasing liability exposure due to ongoing lease payments and potential asset obligations. Explore detailed comparisons to understand how these structures impact your financial liability and risk management.

Source and External Links

What is a Master Lease? - A master lease is a contract where a property owner leases to a master tenant, who then subleases parts or all of the property to sub-tenants, managing and assuming landlord responsibilities.

A guide to master leasing: the pros and cons you need to know - Master leasing lets the lessee control and sublease property, with various types like fixed, performance, and hybrid master leases defining payment structures and responsibilities.

Master Leasing for Bridge Housing FAQ - In master leasing, the master tenant manages subtenants and property duties while paying rent to the owner regardless of occupancy, shifting management responsibilities from owner to tenant.

dowidth.com

dowidth.com