Opportunity zones provide investors with tax deferrals and potential gains exclusions by investing in designated low-income areas, while Historic Tax Credits offer financial incentives to restore and preserve certified historic buildings, promoting urban revitalization. Both programs stimulate local economic growth and attract capital but target different types of properties and investment goals. Explore how leveraging Opportunity Zones and Historic Tax Credits can maximize returns and community impact in real estate ventures.

Why it is important

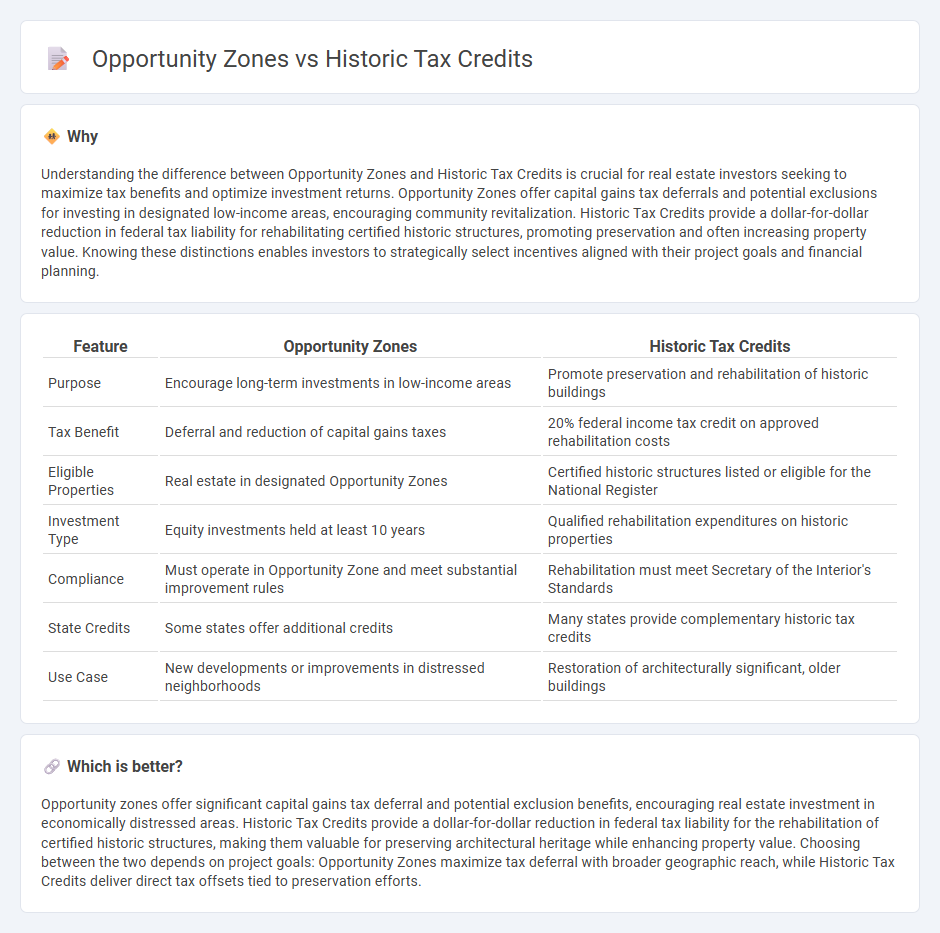

Understanding the difference between Opportunity Zones and Historic Tax Credits is crucial for real estate investors seeking to maximize tax benefits and optimize investment returns. Opportunity Zones offer capital gains tax deferrals and potential exclusions for investing in designated low-income areas, encouraging community revitalization. Historic Tax Credits provide a dollar-for-dollar reduction in federal tax liability for rehabilitating certified historic structures, promoting preservation and often increasing property value. Knowing these distinctions enables investors to strategically select incentives aligned with their project goals and financial planning.

Comparison Table

| Feature | Opportunity Zones | Historic Tax Credits |

|---|---|---|

| Purpose | Encourage long-term investments in low-income areas | Promote preservation and rehabilitation of historic buildings |

| Tax Benefit | Deferral and reduction of capital gains taxes | 20% federal income tax credit on approved rehabilitation costs |

| Eligible Properties | Real estate in designated Opportunity Zones | Certified historic structures listed or eligible for the National Register |

| Investment Type | Equity investments held at least 10 years | Qualified rehabilitation expenditures on historic properties |

| Compliance | Must operate in Opportunity Zone and meet substantial improvement rules | Rehabilitation must meet Secretary of the Interior's Standards |

| State Credits | Some states offer additional credits | Many states provide complementary historic tax credits |

| Use Case | New developments or improvements in distressed neighborhoods | Restoration of architecturally significant, older buildings |

Which is better?

Opportunity zones offer significant capital gains tax deferral and potential exclusion benefits, encouraging real estate investment in economically distressed areas. Historic Tax Credits provide a dollar-for-dollar reduction in federal tax liability for the rehabilitation of certified historic structures, making them valuable for preserving architectural heritage while enhancing property value. Choosing between the two depends on project goals: Opportunity Zones maximize tax deferral with broader geographic reach, while Historic Tax Credits deliver direct tax offsets tied to preservation efforts.

Connection

Opportunity Zones and Historic Tax Credits are connected through their complementary roles in revitalizing economically distressed areas while preserving cultural heritage. Opportunity Zones offer tax incentives to investors who reinvest capital gains into underserved communities, and Historic Tax Credits provide financial benefits for rehabilitating certified historic buildings within these zones. Leveraging both incentives can maximize investment impact, promoting sustainable development and heritage conservation in targeted urban and rural locations.

Key Terms

Rehabilitation Costs

Historic Tax Credits (HTCs) offer a federal credit of 20% for certified rehabilitation expenditures on qualified historic buildings, reducing the financial burden of preserving architectural heritage. Opportunity Zones provide tax deferral and potential exclusion benefits on capital gains for investments in economically distressed areas but do not directly offset rehabilitation costs. Explore the nuances between these incentives to maximize your project's financial viability and impact.

Capital Gains Tax Deferral

Historic Tax Credits offer dollar-for-dollar reductions in federal tax liability for the rehabilitation of certified historic structures, promoting preservation and providing significant tax savings. Opportunity Zones provide capital gains tax deferral and potential exclusion on new investments in designated economically-distressed areas, encouraging long-term economic growth. Explore how these incentives compare in maximizing capital gains tax deferral and boosting your investment portfolio.

Substantial Improvement

Historic Tax Credits (HTCs) require substantial improvement, defined as rehabilitation costs exceeding the building's adjusted basis, ensuring significant preservation of historic structures. Opportunity Zones allow investors to defer capital gains taxes by investing in underserved areas, but substantial improvement thresholds vary by state and project scope, typically encouraging new development rather than strict rehabilitation. Explore the nuances of substantial improvement criteria to maximize tax benefits in historic preservation or Opportunity Zone investments.

Source and External Links

About the Historic Tax Credit - This webpage provides an overview of the federal historic rehabilitation tax credit, a 20% tax credit for qualified expenditures on historic buildings.

Historic Rehabilitation Tax Credits - This program offers state tax credits to property owners for rehabilitating historic buildings in Virginia, with credits available from both state and federal governments.

Ohio Historic Preservation Tax Credit Program - This program provides a state tax credit up to 25% of qualified rehabilitation expenditures for historic buildings in Ohio, supporting private redevelopment.

dowidth.com

dowidth.com