Green leases integrate sustainability commitments into property agreements, promoting energy efficiency and environmental responsibility among tenants and landlords. Triple net leases require tenants to cover property taxes, insurance, and maintenance costs, shifting financial responsibilities away from landlords. Explore these leasing options further to determine which best aligns with your investment goals and sustainability priorities.

Why it is important

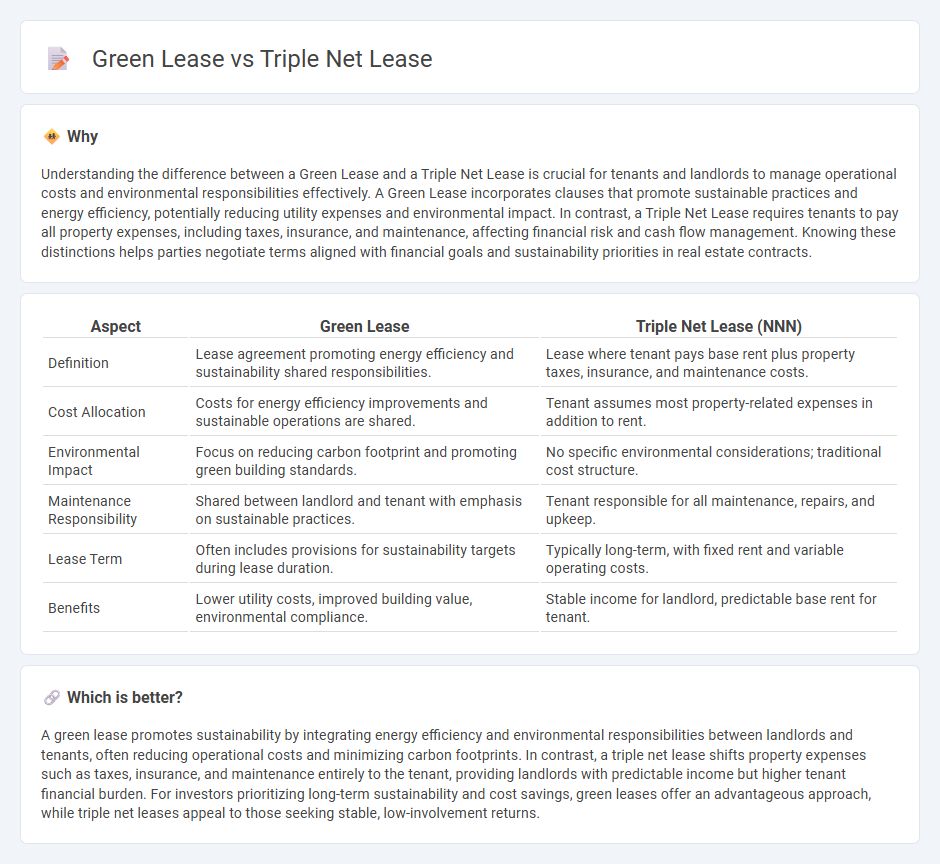

Understanding the difference between a Green Lease and a Triple Net Lease is crucial for tenants and landlords to manage operational costs and environmental responsibilities effectively. A Green Lease incorporates clauses that promote sustainable practices and energy efficiency, potentially reducing utility expenses and environmental impact. In contrast, a Triple Net Lease requires tenants to pay all property expenses, including taxes, insurance, and maintenance, affecting financial risk and cash flow management. Knowing these distinctions helps parties negotiate terms aligned with financial goals and sustainability priorities in real estate contracts.

Comparison Table

| Aspect | Green Lease | Triple Net Lease (NNN) |

|---|---|---|

| Definition | Lease agreement promoting energy efficiency and sustainability shared responsibilities. | Lease where tenant pays base rent plus property taxes, insurance, and maintenance costs. |

| Cost Allocation | Costs for energy efficiency improvements and sustainable operations are shared. | Tenant assumes most property-related expenses in addition to rent. |

| Environmental Impact | Focus on reducing carbon footprint and promoting green building standards. | No specific environmental considerations; traditional cost structure. |

| Maintenance Responsibility | Shared between landlord and tenant with emphasis on sustainable practices. | Tenant responsible for all maintenance, repairs, and upkeep. |

| Lease Term | Often includes provisions for sustainability targets during lease duration. | Typically long-term, with fixed rent and variable operating costs. |

| Benefits | Lower utility costs, improved building value, environmental compliance. | Stable income for landlord, predictable base rent for tenant. |

Which is better?

A green lease promotes sustainability by integrating energy efficiency and environmental responsibilities between landlords and tenants, often reducing operational costs and minimizing carbon footprints. In contrast, a triple net lease shifts property expenses such as taxes, insurance, and maintenance entirely to the tenant, providing landlords with predictable income but higher tenant financial burden. For investors prioritizing long-term sustainability and cost savings, green leases offer an advantageous approach, while triple net leases appeal to those seeking stable, low-involvement returns.

Connection

Green leases and triple net leases intersect through their impact on property operating expenses and sustainability goals. In a triple net lease, tenants cover property taxes, insurance, and maintenance costs, which can be aligned with green lease provisions that promote energy efficiency and reduced environmental impact. This connection incentivizes landlords and tenants to collaborate on sustainability improvements, driving long-term cost savings and enhanced building performance in commercial real estate.

Key Terms

Operating Expenses

A triple net lease requires tenants to cover all operating expenses including property taxes, insurance, and maintenance costs, providing landlords with predictable net income. In contrast, a green lease incorporates sustainability clauses that promote energy-efficient practices and often allocate operating expenses based on shared environmental goals, potentially lowering overall costs. Explore further to understand how each lease type impacts operating expenses and long-term financial benefits.

Sustainability Requirements

Triple net leases require tenants to cover property taxes, insurance, and maintenance costs, often leaving sustainability upgrades as landlord expenses with limited tenant incentive. Green leases integrate environmental performance standards, promoting energy efficiency, waste reduction, and sustainable building practices through shared responsibilities between landlords and tenants. Explore detailed comparisons to understand how lease structures impact sustainability goals and financial outcomes.

Maintenance Responsibility

Triple net leases require tenants to handle all maintenance, property taxes, and insurance expenses, shifting significant operational risks from landlords. Green leases incorporate sustainability clauses that promote shared responsibility for maintenance, emphasizing energy efficiency and environmental impact reductions. Discover how these lease structures influence maintenance responsibilities and sustainability goals in your commercial property agreements.

Source and External Links

What Is A Triple Net Lease (NNN) | Definition & Examples - A triple net lease is a commercial lease where the tenant pays not only rent but also all operating expenses, including insurance, taxes, and maintenance.

triple net lease | Wex | US Law | LII / Legal Information Institute - A triple net lease involves a tenant paying rent, utilities, and three other types of property expenses: insurance, maintenance, and taxes.

Benefits and Drawbacks of a Triple Net Lease (NNN) in Commercial Real Estate - A triple net lease requires the tenant to pay taxes, property insurance, and operating expenses in addition to the base rent and utilities.

dowidth.com

dowidth.com