Green leases promote sustainability by integrating energy efficiency and environmental standards into rental agreements, reducing operational costs and carbon footprints for tenants and landlords. Sale-leaseback transactions allow property owners to sell their real estate while retaining use through leasing, improving liquidity and balance sheet management. Explore the benefits and considerations of green lease versus sale-leaseback strategies to optimize real estate investments.

Why it is important

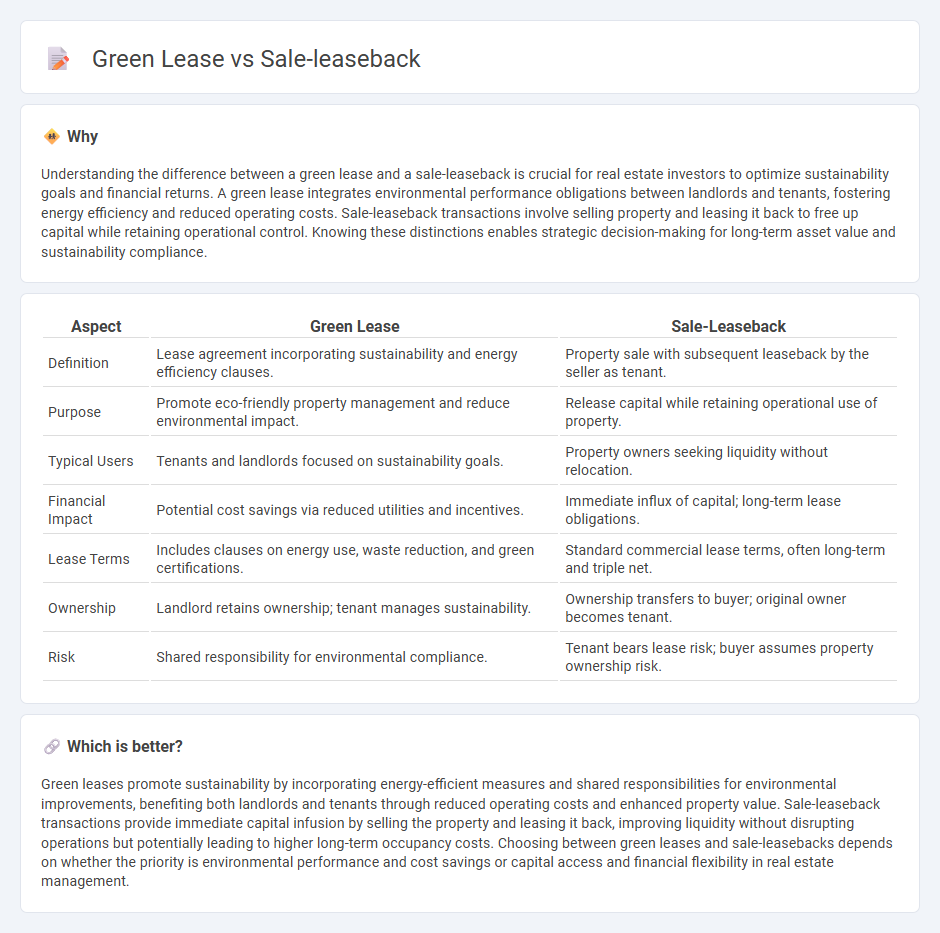

Understanding the difference between a green lease and a sale-leaseback is crucial for real estate investors to optimize sustainability goals and financial returns. A green lease integrates environmental performance obligations between landlords and tenants, fostering energy efficiency and reduced operating costs. Sale-leaseback transactions involve selling property and leasing it back to free up capital while retaining operational control. Knowing these distinctions enables strategic decision-making for long-term asset value and sustainability compliance.

Comparison Table

| Aspect | Green Lease | Sale-Leaseback |

|---|---|---|

| Definition | Lease agreement incorporating sustainability and energy efficiency clauses. | Property sale with subsequent leaseback by the seller as tenant. |

| Purpose | Promote eco-friendly property management and reduce environmental impact. | Release capital while retaining operational use of property. |

| Typical Users | Tenants and landlords focused on sustainability goals. | Property owners seeking liquidity without relocation. |

| Financial Impact | Potential cost savings via reduced utilities and incentives. | Immediate influx of capital; long-term lease obligations. |

| Lease Terms | Includes clauses on energy use, waste reduction, and green certifications. | Standard commercial lease terms, often long-term and triple net. |

| Ownership | Landlord retains ownership; tenant manages sustainability. | Ownership transfers to buyer; original owner becomes tenant. |

| Risk | Shared responsibility for environmental compliance. | Tenant bears lease risk; buyer assumes property ownership risk. |

Which is better?

Green leases promote sustainability by incorporating energy-efficient measures and shared responsibilities for environmental improvements, benefiting both landlords and tenants through reduced operating costs and enhanced property value. Sale-leaseback transactions provide immediate capital infusion by selling the property and leasing it back, improving liquidity without disrupting operations but potentially leading to higher long-term occupancy costs. Choosing between green leases and sale-leasebacks depends on whether the priority is environmental performance and cost savings or capital access and financial flexibility in real estate management.

Connection

Green leases integrate environmental sustainability clauses into property rental agreements, promoting energy efficiency and reduced carbon footprints. Sale-leaseback transactions enable property owners to sell assets and lease them back, often incorporating green lease terms to meet sustainability goals while maintaining operational control. Combining these strategies supports both financial flexibility and long-term environmental performance in commercial real estate.

Key Terms

Ownership Transfer

Sale-leaseback involves the transfer of property ownership from the seller to the buyer, who then leases the asset back to the original owner, enabling capital release while maintaining operational control. Green leases prioritize environmental performance by embedding sustainability clauses into lease agreements, typically without transferring ownership but ensuring energy efficiency and reduced carbon footprint commitments between landlords and tenants. Explore deeper insights into how ownership transfer impacts financial strategies and sustainability goals in commercial real estate.

Sustainability Clauses

Sale-leaseback agreements offer businesses immediate capital while transferring property ownership to a buyer, often integrating sustainability clauses that require energy efficiency upgrades and renewable energy usage. Green leases go further by embedding comprehensive environmental obligations into lease contracts, including performance benchmarks for reducing carbon footprints and waste management practices. Explore how these forward-thinking leasing strategies can align real estate management with corporate sustainability goals.

Leaseback Agreement

A Sale-Leaseback Agreement involves the property owner selling an asset and immediately leasing it back, providing liquidity while retaining operational control. Green Lease Agreements focus on incorporating sustainability clauses that improve energy efficiency and reduce environmental impact within the lease terms. Explore more about how Sale-Leaseback and Green Leases balance financial strategy and environmental responsibility in leaseback agreements.

Source and External Links

Sale-Leasebacks: A Tool for the Times | Publications - Cleary Gottlieb - A sale-leaseback is an arrangement where a company sells an asset and immediately leases it back, receiving a lump sum while retaining use of the asset, often resulting in attractive financing costs and operational flexibility compared to traditional borrowing.

Sale-Leaseback Transaction: An Attractive Option in Today's Market? - Sale-leasebacks enable sellers to convert long-term assets into working capital while continuing to use the asset, providing benefits such as tax-deductible rental payments and increased leverage in lease negotiations, which is increasingly popular in a high interest rate environment.

Understanding sale-leaseback transactions | Insights - Elliott Davis - Sale-leasebacks help businesses raise immediate cash without losing use of essential assets, typically offering lower financing costs than traditional loans, though they must meet specific accounting criteria to qualify as a sale instead of a loan.

dowidth.com

dowidth.com