Dynamic pricing in real estate adjusts rental rates based on market demand, property features, and seasonal trends to maximize revenue efficiently. Rent-to-own pricing combines rental payments with an option to purchase the property later, offering tenants a pathway to homeownership while locking in price terms. Explore these innovative pricing strategies to discover the best fit for your investment or housing goals.

Why it is important

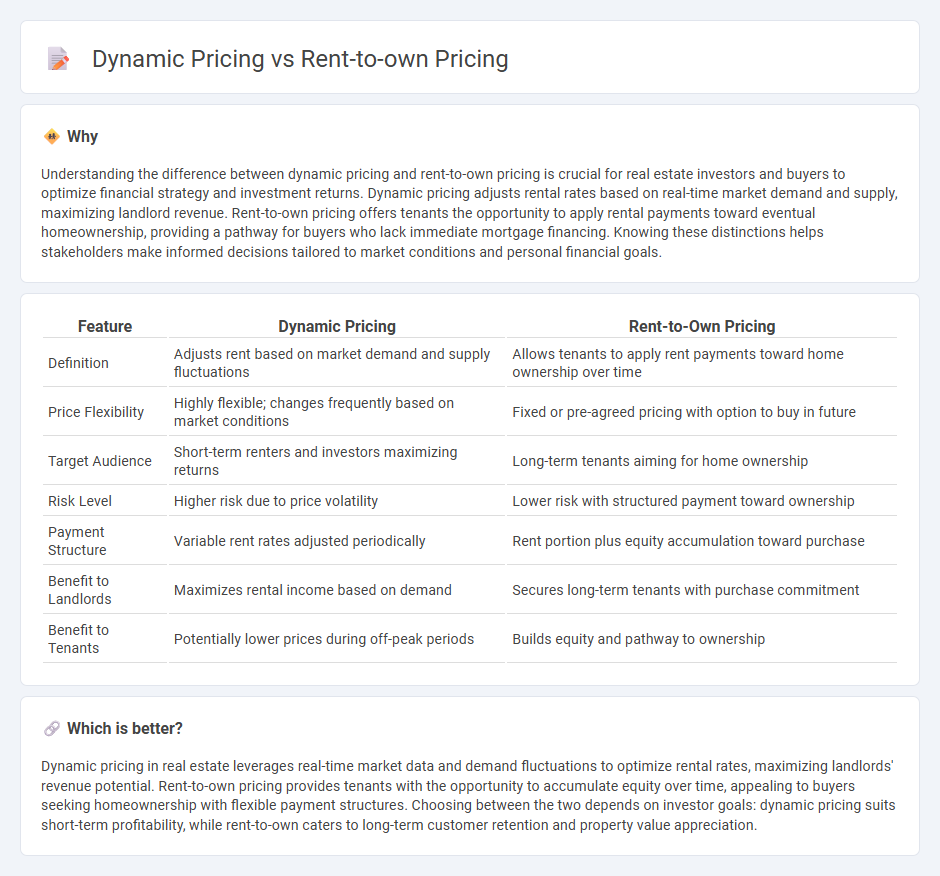

Understanding the difference between dynamic pricing and rent-to-own pricing is crucial for real estate investors and buyers to optimize financial strategy and investment returns. Dynamic pricing adjusts rental rates based on real-time market demand and supply, maximizing landlord revenue. Rent-to-own pricing offers tenants the opportunity to apply rental payments toward eventual homeownership, providing a pathway for buyers who lack immediate mortgage financing. Knowing these distinctions helps stakeholders make informed decisions tailored to market conditions and personal financial goals.

Comparison Table

| Feature | Dynamic Pricing | Rent-to-Own Pricing |

|---|---|---|

| Definition | Adjusts rent based on market demand and supply fluctuations | Allows tenants to apply rent payments toward home ownership over time |

| Price Flexibility | Highly flexible; changes frequently based on market conditions | Fixed or pre-agreed pricing with option to buy in future |

| Target Audience | Short-term renters and investors maximizing returns | Long-term tenants aiming for home ownership |

| Risk Level | Higher risk due to price volatility | Lower risk with structured payment toward ownership |

| Payment Structure | Variable rent rates adjusted periodically | Rent portion plus equity accumulation toward purchase |

| Benefit to Landlords | Maximizes rental income based on demand | Secures long-term tenants with purchase commitment |

| Benefit to Tenants | Potentially lower prices during off-peak periods | Builds equity and pathway to ownership |

Which is better?

Dynamic pricing in real estate leverages real-time market data and demand fluctuations to optimize rental rates, maximizing landlords' revenue potential. Rent-to-own pricing provides tenants with the opportunity to accumulate equity over time, appealing to buyers seeking homeownership with flexible payment structures. Choosing between the two depends on investor goals: dynamic pricing suits short-term profitability, while rent-to-own caters to long-term customer retention and property value appreciation.

Connection

Dynamic pricing in real estate uses market data and demand fluctuations to adjust rental rates, which directly influences rent-to-own pricing structures by reflecting current market conditions. Rent-to-own agreements leverage dynamic pricing models to set competitive monthly payments that account for property value changes over time. This connection enables both landlords and tenants to benefit from flexible pricing strategies adapting to market trends and investment risks.

Key Terms

Option Fee

The option fee in rent-to-own pricing acts as a non-refundable deposit securing future homeownership, typically ranging from 1% to 5% of the property's price, providing buyers with an equity stake. In contrast, dynamic pricing adjusts rental rates in real-time based on market demand, without any upfront option fee, prioritizing flexibility and maximizing landlord revenue. Explore the advantages and drawbacks of these pricing strategies to determine the best fit for your housing needs.

Market Fluctuation

Rent-to-own pricing provides stable, predictable payments unaffected by short-term market fluctuations, offering consumers financial certainty over time. Dynamic pricing adjusts costs in real-time based on market demand, supply, and competitor actions, capturing price variations that maximize revenue. Explore how each pricing model responds to market volatility to optimize your business strategy.

Purchase Price Adjustment

Rent-to-own pricing features a predetermined purchase price adjustment embedded in lease agreements, allowing consumers to apply rental payments toward ownership, offering price predictability and gradual equity building. Dynamic pricing adjusts the purchase price based on real-time market demand, inventory levels, and consumer behavior, creating fluctuating costs that reflect current market conditions and maximize seller revenue. Explore how these pricing strategies impact consumer affordability and seller profitability to make informed decisions.

Source and External Links

How does rent-to-own work? - Rocket Mortgage - Rent-to-own typically involves paying an option fee of 2% - 7% of the home's value and additional rent that may apply toward the purchase price.

Rent-To-Own Homes: How The Process Works - Bankrate - Rent-to-own involves an option fee, often 1% to 5% of the purchase price, and monthly rent payments that may partially apply to a future down payment.

How Does Rent-To-Own Work? - Zillow - Rent-to-own agreements typically include a lease with a portion of rent payments applied toward a down payment for purchasing the home later.

dowidth.com

dowidth.com