Value-add investments in real estate focus on acquiring properties with potential for enhancement through renovations, operational improvements, or repositioning to increase cash flow and property value. Development investments involve purchasing land or underdeveloped sites to construct new buildings or substantially redevelop existing structures, requiring substantial capital and longer timelines but offering higher returns upon project completion. Explore the key differences and strategic benefits of value-add versus development investments to optimize your real estate portfolio.

Why it is important

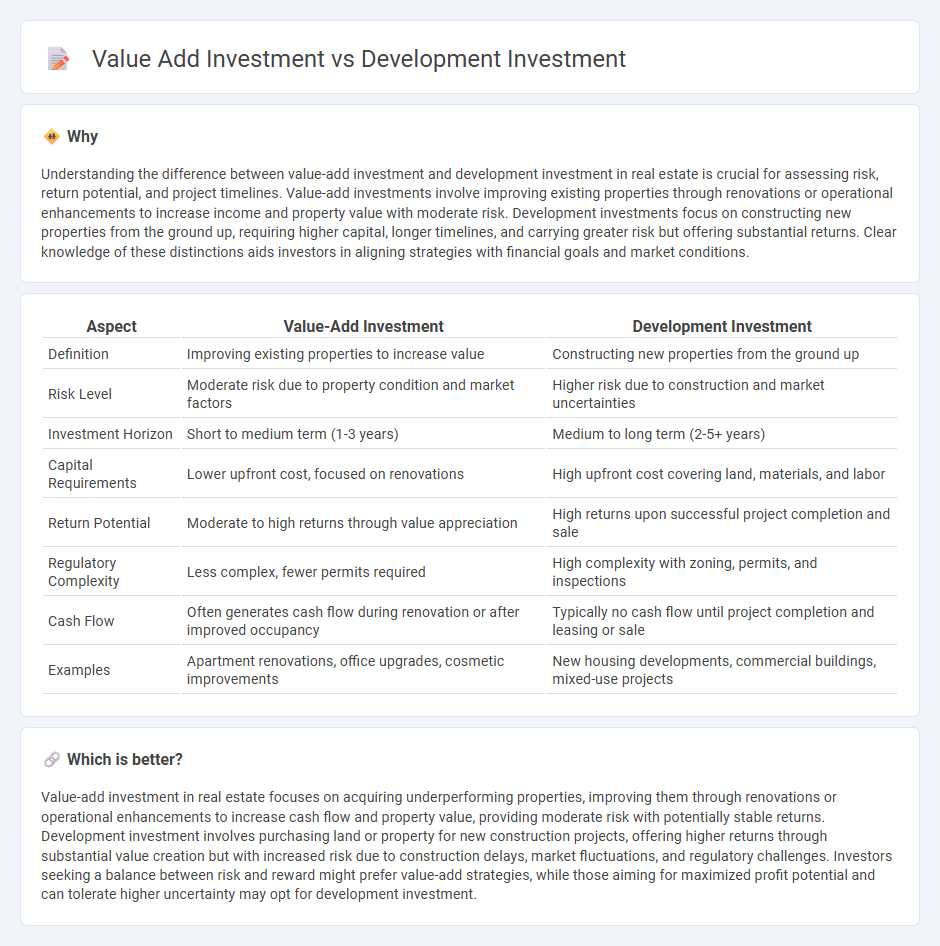

Understanding the difference between value-add investment and development investment in real estate is crucial for assessing risk, return potential, and project timelines. Value-add investments involve improving existing properties through renovations or operational enhancements to increase income and property value with moderate risk. Development investments focus on constructing new properties from the ground up, requiring higher capital, longer timelines, and carrying greater risk but offering substantial returns. Clear knowledge of these distinctions aids investors in aligning strategies with financial goals and market conditions.

Comparison Table

| Aspect | Value-Add Investment | Development Investment |

|---|---|---|

| Definition | Improving existing properties to increase value | Constructing new properties from the ground up |

| Risk Level | Moderate risk due to property condition and market factors | Higher risk due to construction and market uncertainties |

| Investment Horizon | Short to medium term (1-3 years) | Medium to long term (2-5+ years) |

| Capital Requirements | Lower upfront cost, focused on renovations | High upfront cost covering land, materials, and labor |

| Return Potential | Moderate to high returns through value appreciation | High returns upon successful project completion and sale |

| Regulatory Complexity | Less complex, fewer permits required | High complexity with zoning, permits, and inspections |

| Cash Flow | Often generates cash flow during renovation or after improved occupancy | Typically no cash flow until project completion and leasing or sale |

| Examples | Apartment renovations, office upgrades, cosmetic improvements | New housing developments, commercial buildings, mixed-use projects |

Which is better?

Value-add investment in real estate focuses on acquiring underperforming properties, improving them through renovations or operational enhancements to increase cash flow and property value, providing moderate risk with potentially stable returns. Development investment involves purchasing land or property for new construction projects, offering higher returns through substantial value creation but with increased risk due to construction delays, market fluctuations, and regulatory challenges. Investors seeking a balance between risk and reward might prefer value-add strategies, while those aiming for maximized profit potential and can tolerate higher uncertainty may opt for development investment.

Connection

Value-add investment in real estate involves purchasing underperforming properties and making strategic improvements to increase their market value and rental income. Development investment focuses on constructing new properties or redeveloping existing sites to maximize potential returns through enhanced design and functionality. Both investment strategies are connected by their goal to enhance asset value, boost cash flow, and achieve higher long-term capital appreciation.

Key Terms

Ground-up Construction

Development investment in ground-up construction involves financing new projects from the initial planning and building phases, targeting high returns through property creation. Value-add investment focuses on acquiring existing properties with potential for improvement through renovations or operational enhancements, increasing their market value and income potential. Explore deeper insights on optimizing returns in ground-up construction by understanding these investment strategies.

Rehabilitation

Development investment in rehabilitation targets comprehensive redevelopment projects, often involving constructing new structures or extensive rebuilding to enhance property value significantly. Value-add investment concentrates on strategic improvements such as upgrading finishes, systems, or amenities to increase operational efficiency and rental income without major structural changes. Explore detailed comparisons to understand which rehabilitation approach best suits your investment goals.

Entitlements

Development investment involves acquiring land or properties with the goal of obtaining entitlements such as zoning approvals, permits, and land-use rights that increase the project's potential value. Value-add investment focuses on properties already entitled but requiring improvements, renovations, or repositioning to enhance cash flow and asset value. Explore the intricacies of entitlements and their critical role in maximizing return on investment.

Source and External Links

Investment Priorities | U.S. Economic Development Administration - EDA's investment priorities guide competitive grants for projects that create jobs, leverage resources, and develop critical infrastructure, workforce, and innovation in regional economies.

How to Invest in Land Development (A Step-by-Step Guide) - Investing in land development involves market analysis, assessing economic viability, and navigating acquisition and contracting processes to maximize returns.

Community Development Financial Institutions Fund: Home - The CDFI Fund supports economic growth in distressed communities by providing federal resources to mission-driven financial institutions that increase access to capital.

dowidth.com

dowidth.com