Smart contract leasing leverages blockchain technology to automate rental agreements, ensuring transparency, security, and real-time execution of lease terms without intermediaries. Leaseback arrangements involve a property owner selling their asset and simultaneously leasing it back, providing immediate capital while retaining property use and control. Explore the advantages and practical applications of both models to determine which suits your real estate investment strategy best.

Why it is important

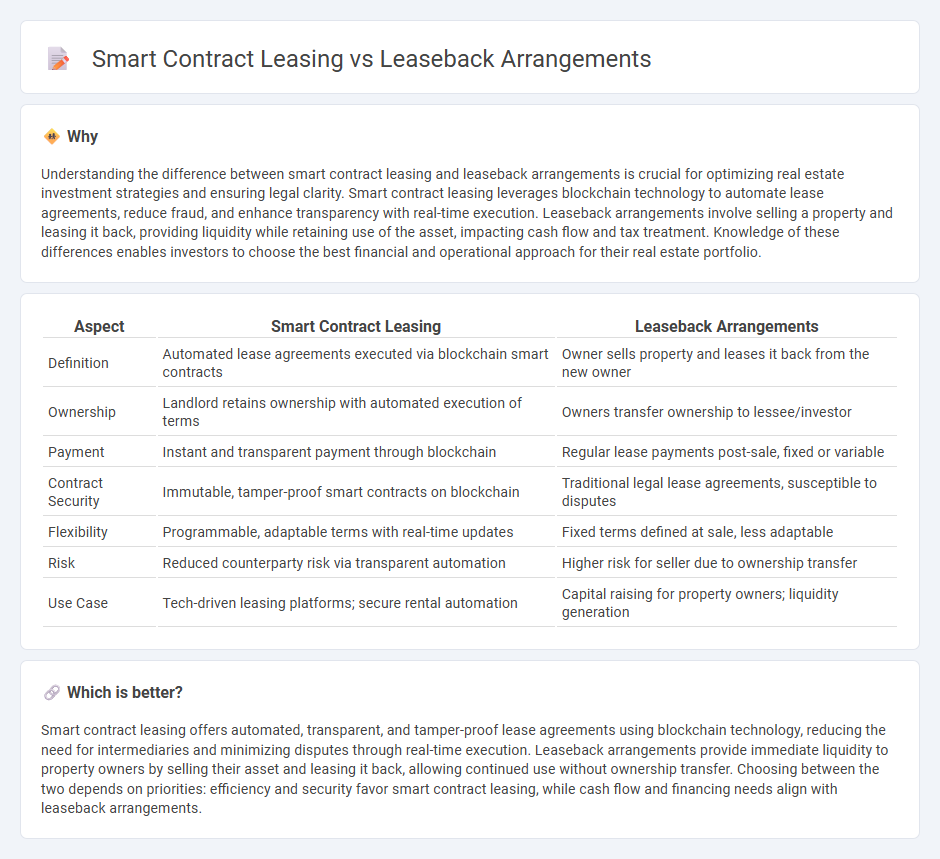

Understanding the difference between smart contract leasing and leaseback arrangements is crucial for optimizing real estate investment strategies and ensuring legal clarity. Smart contract leasing leverages blockchain technology to automate lease agreements, reduce fraud, and enhance transparency with real-time execution. Leaseback arrangements involve selling a property and leasing it back, providing liquidity while retaining use of the asset, impacting cash flow and tax treatment. Knowledge of these differences enables investors to choose the best financial and operational approach for their real estate portfolio.

Comparison Table

| Aspect | Smart Contract Leasing | Leaseback Arrangements |

|---|---|---|

| Definition | Automated lease agreements executed via blockchain smart contracts | Owner sells property and leases it back from the new owner |

| Ownership | Landlord retains ownership with automated execution of terms | Owners transfer ownership to lessee/investor |

| Payment | Instant and transparent payment through blockchain | Regular lease payments post-sale, fixed or variable |

| Contract Security | Immutable, tamper-proof smart contracts on blockchain | Traditional legal lease agreements, susceptible to disputes |

| Flexibility | Programmable, adaptable terms with real-time updates | Fixed terms defined at sale, less adaptable |

| Risk | Reduced counterparty risk via transparent automation | Higher risk for seller due to ownership transfer |

| Use Case | Tech-driven leasing platforms; secure rental automation | Capital raising for property owners; liquidity generation |

Which is better?

Smart contract leasing offers automated, transparent, and tamper-proof lease agreements using blockchain technology, reducing the need for intermediaries and minimizing disputes through real-time execution. Leaseback arrangements provide immediate liquidity to property owners by selling their asset and leasing it back, allowing continued use without ownership transfer. Choosing between the two depends on priorities: efficiency and security favor smart contract leasing, while cash flow and financing needs align with leaseback arrangements.

Connection

Smart contract leasing automates leaseback arrangements by executing terms through blockchain technology, ensuring transparency and reducing fraud. Leaseback agreements benefit from smart contracts by enabling real-time payments and immutable records, which streamline property ownership transfers while maintaining tenant rights. This convergence enhances efficiency in real estate transactions and fosters trust between lessors and lessees.

Key Terms

Ownership Transfer

Leaseback arrangements involve the original owner selling an asset and leasing it back, retaining use while transferring ownership to the buyer. Smart contract leasing automates ownership transfer via blockchain, enabling real-time, secure, and transparent asset management without intermediaries. Explore how smart contracts revolutionize ownership transfer in leasing for greater efficiency and trust.

Automated Execution

Leaseback arrangements enable property owners to sell assets and immediately lease them back, providing liquidity while retaining operational control. Smart contract leasing automates lease terms execution through blockchain technology, ensuring transparent, self-enforcing agreements with reduced administrative overhead. Explore how automated execution in smart contract leasing revolutionizes traditional leaseback models with enhanced efficiency and security.

Rental Income Rights

Leaseback arrangements involve selling an asset and simultaneously leasing it back to retain operational control while receiving immediate capital, with rental income rights typically defined in traditional contracts. Smart contract leasing automates rental income distribution through blockchain technology, ensuring transparency and real-time enforcement of payment terms without intermediaries. Explore the benefits and mechanisms of these rental income rights in modern leasing to optimize your financial strategy.

dowidth.com

dowidth.com