Properties in walkable neighborhoods often enjoy a walkability premium, reflecting higher values due to easy access to amenities, public transit, and pedestrian-friendly infrastructure. Conversely, properties in less walkable areas tend to face depreciation risks as buyers prioritize convenience and sustainable living options. Discover how walkability impacts property values and investment decisions in more detail.

Why it is important

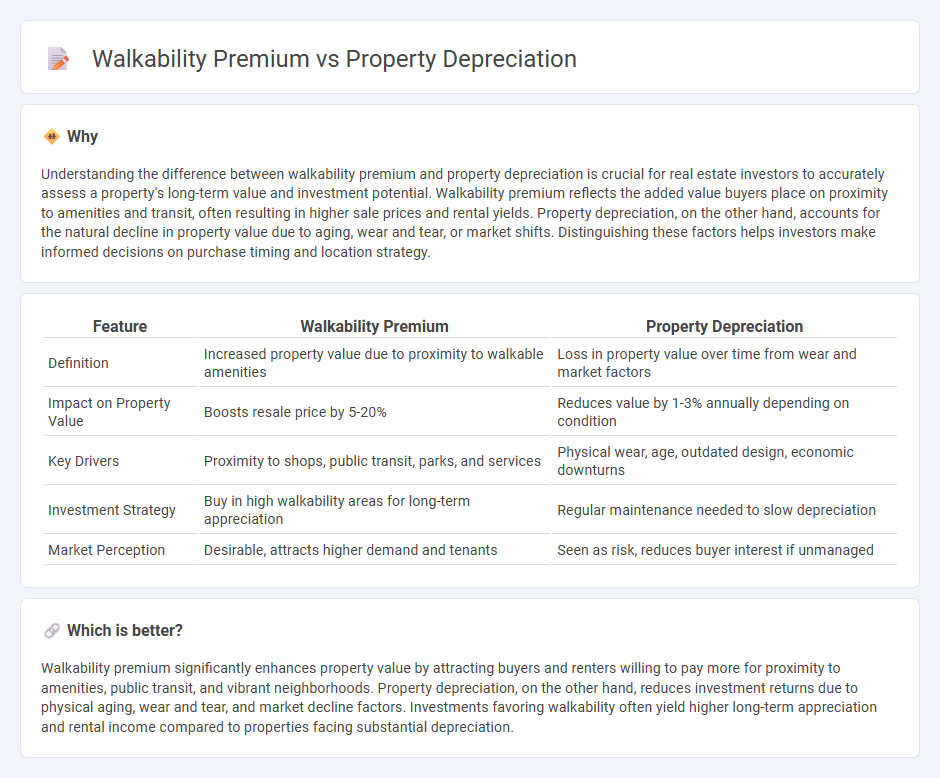

Understanding the difference between walkability premium and property depreciation is crucial for real estate investors to accurately assess a property's long-term value and investment potential. Walkability premium reflects the added value buyers place on proximity to amenities and transit, often resulting in higher sale prices and rental yields. Property depreciation, on the other hand, accounts for the natural decline in property value due to aging, wear and tear, or market shifts. Distinguishing these factors helps investors make informed decisions on purchase timing and location strategy.

Comparison Table

| Feature | Walkability Premium | Property Depreciation |

|---|---|---|

| Definition | Increased property value due to proximity to walkable amenities | Loss in property value over time from wear and market factors |

| Impact on Property Value | Boosts resale price by 5-20% | Reduces value by 1-3% annually depending on condition |

| Key Drivers | Proximity to shops, public transit, parks, and services | Physical wear, age, outdated design, economic downturns |

| Investment Strategy | Buy in high walkability areas for long-term appreciation | Regular maintenance needed to slow depreciation |

| Market Perception | Desirable, attracts higher demand and tenants | Seen as risk, reduces buyer interest if unmanaged |

Which is better?

Walkability premium significantly enhances property value by attracting buyers and renters willing to pay more for proximity to amenities, public transit, and vibrant neighborhoods. Property depreciation, on the other hand, reduces investment returns due to physical aging, wear and tear, and market decline factors. Investments favoring walkability often yield higher long-term appreciation and rental income compared to properties facing substantial depreciation.

Connection

Walkability premium significantly enhances property values by attracting buyers seeking convenient access to amenities, public transit, and recreational areas. Properties in highly walkable neighborhoods tend to experience slower depreciation rates compared to those in car-dependent locations, where reduced accessibility can lead to faster value decline. Studies show that walkability scores correlate directly with increased property appreciation, highlighting the inverse relationship between walkability and depreciation in real estate markets.

Key Terms

Asset Value

Property depreciation directly reduces asset value over time due to wear, aging, and market factors, whereas a walkability premium boosts asset value by enhancing location appeal and accessibility. High walkability scores typically attract buyers willing to pay more, offsetting potential depreciation and stabilizing long-term investment returns. Discover how balancing depreciation impacts with walkability benefits can maximize property asset value effectively.

Location Accessibility

Property depreciation often results from factors such as aging infrastructure, neighborhood decline, or environmental issues, which reduce an asset's overall value despite physical maintenance. Walkability premium reflects increased property values attributed to proximity to amenities, transit options, and pedestrian-friendly urban design, enhancing location accessibility and quality of life. Explore how optimizing location accessibility can balance depreciation effects and maximize real estate investment returns.

Market Demand

Property depreciation impacts market value by reflecting the gradual loss of asset worth due to wear and aging, while walkability premium enhances demand by attracting buyers seeking accessible, vibrant neighborhoods. Market demand intensifies for properties with high walkability scores, as convenience to amenities, transit, and social hubs boosts resale potential and rental income. Explore detailed data on how walkability premiums offset depreciation effects to maximize real estate investment returns.

Source and External Links

Rental Property Tax Depreciation FAQs - This webpage explains how rental property depreciation allows owners to recover costs through yearly tax deductions, outlining requirements and calculations for depreciation.

Rental Property Depreciation - This article discusses the concept of rental property depreciation, including how it works and how it can be calculated over a 27.5-year period.

Depreciation | Internal Revenue Service - The IRS provides information on depreciation, including how it is used to recover the cost of property over several years, with specific rules for different types of property.

dowidth.com

dowidth.com