Short term rental arbitrage leverages leasing properties to profit from short-term rentals without property ownership, maximizing cash flow through market demand and dynamic pricing strategies. Buy and hold involves acquiring real estate assets to build equity and generate steady long-term rental income, benefiting from property appreciation and tax advantages. Explore key differences to determine which strategy aligns with your investment goals.

Why it is important

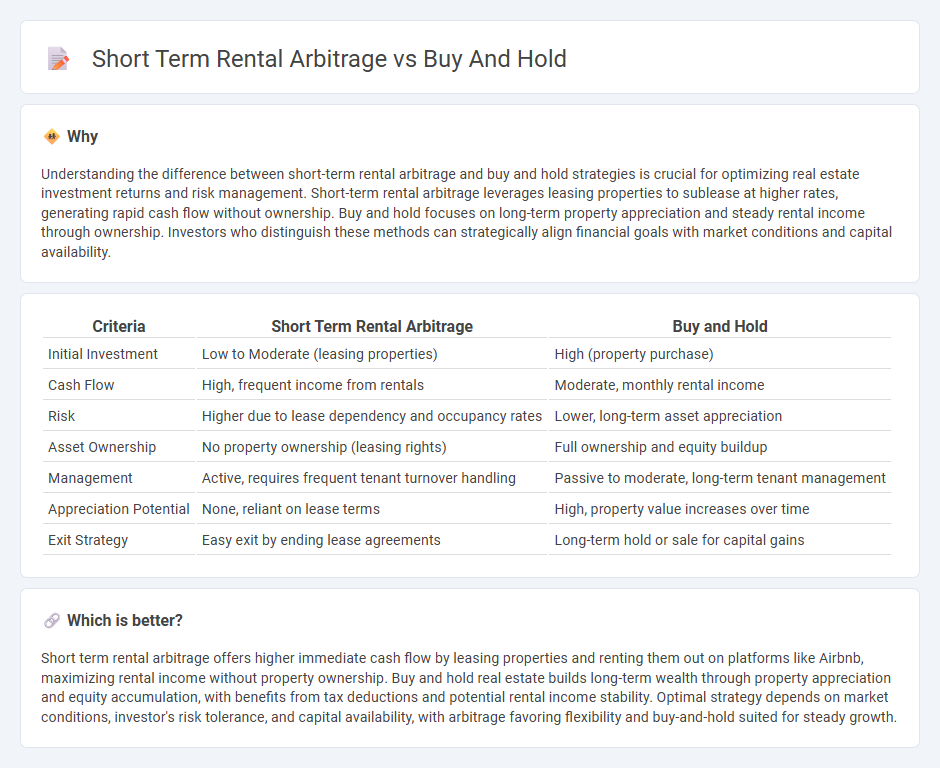

Understanding the difference between short-term rental arbitrage and buy and hold strategies is crucial for optimizing real estate investment returns and risk management. Short-term rental arbitrage leverages leasing properties to sublease at higher rates, generating rapid cash flow without ownership. Buy and hold focuses on long-term property appreciation and steady rental income through ownership. Investors who distinguish these methods can strategically align financial goals with market conditions and capital availability.

Comparison Table

| Criteria | Short Term Rental Arbitrage | Buy and Hold |

|---|---|---|

| Initial Investment | Low to Moderate (leasing properties) | High (property purchase) |

| Cash Flow | High, frequent income from rentals | Moderate, monthly rental income |

| Risk | Higher due to lease dependency and occupancy rates | Lower, long-term asset appreciation |

| Asset Ownership | No property ownership (leasing rights) | Full ownership and equity buildup |

| Management | Active, requires frequent tenant turnover handling | Passive to moderate, long-term tenant management |

| Appreciation Potential | None, reliant on lease terms | High, property value increases over time |

| Exit Strategy | Easy exit by ending lease agreements | Long-term hold or sale for capital gains |

Which is better?

Short term rental arbitrage offers higher immediate cash flow by leasing properties and renting them out on platforms like Airbnb, maximizing rental income without property ownership. Buy and hold real estate builds long-term wealth through property appreciation and equity accumulation, with benefits from tax deductions and potential rental income stability. Optimal strategy depends on market conditions, investor's risk tolerance, and capital availability, with arbitrage favoring flexibility and buy-and-hold suited for steady growth.

Connection

Short term rental arbitrage and Buy and Hold strategies are connected through their focus on generating rental income and long-term wealth accumulation in real estate. Both approaches leverage property assets to maximize cash flow, with arbitrage capitalizing on market demand fluctuations and Buy and Hold benefiting from property appreciation and steady rental returns. Investors often use short term rental arbitrage to generate immediate income, which can be reinvested into Buy and Hold properties for sustained growth and portfolio diversification.

Key Terms

Cash Flow

Buy and hold real estate investment generates consistent cash flow through long-term rental income, offering stability and property appreciation over time. Short-term rental arbitrage leverages high nightly rates on platforms like Airbnb to maximize immediate cash flow, though it involves increased management and market fluctuation risks. Explore detailed strategies and financial comparisons to determine which approach aligns best with your investment goals.

Appreciation

Buy and hold strategies benefit from long-term property appreciation, leveraging market value increases over years to build equity and wealth. Short term rental arbitrage focuses on maximizing rental income rather than property appreciation, often involving leased properties where long-term asset growth is less relevant. Explore the nuances of each approach to determine which aligns best with your investment goals.

Lease Agreement

Buy and hold strategies in real estate typically involve long-term lease agreements that provide stability and predictable cash flow, while short term rental arbitrage relies on short-term leases allowing for flexibility and higher rental yields. Lease agreements for buy and hold investors often include strict tenant protections and renewal options, contrasting with the frequent turnover and dynamic pricing models in short term rental contracts. Explore the nuances of lease agreements in both strategies to optimize investment returns and legal compliance.

Source and External Links

Buy and hold - Wikipedia - Buy and hold is an investment strategy where an investor purchases assets to hold long term, aiming for price appreciation despite market volatility, and avoiding market timing or emotional reactions to price changes, often associated with passive management and advocated by investors like Warren Buffett.

Buy-and-Hold Investing: Is It the Right Investment Strategy? - Buy-and-hold investing is a passive approach where investors buy stocks or financial assets and hold onto them for medium to long term, ignoring short-term market fluctuations with the expectation of capital appreciation and long-term income.

8-05 Buy and Hold - PersonalFinanceLab - This strategy advocates buying stocks of well-managed, profitable companies and holding them for decades to benefit from long-term growth, reducing stress linked to frequent trading and focusing on company fundamentals rather than market timing.

dowidth.com

dowidth.com