Sale leaseback and joint venture represent two distinct real estate investment strategies, each offering unique financial structures and risk profiles. Sale leaseback allows property owners to unlock capital by selling assets and leasing them back, maintaining operational control while freeing up cash flow. Explore these approaches to determine which aligns best with your investment goals and portfolio diversification.

Why it is important

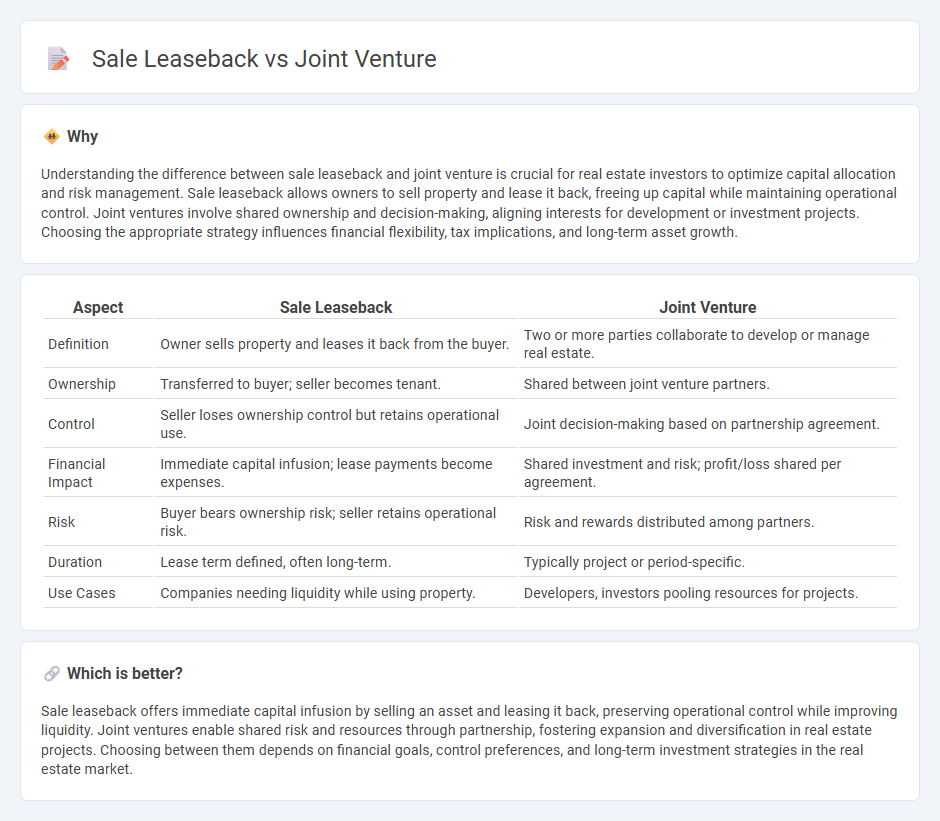

Understanding the difference between sale leaseback and joint venture is crucial for real estate investors to optimize capital allocation and risk management. Sale leaseback allows owners to sell property and lease it back, freeing up capital while maintaining operational control. Joint ventures involve shared ownership and decision-making, aligning interests for development or investment projects. Choosing the appropriate strategy influences financial flexibility, tax implications, and long-term asset growth.

Comparison Table

| Aspect | Sale Leaseback | Joint Venture |

|---|---|---|

| Definition | Owner sells property and leases it back from the buyer. | Two or more parties collaborate to develop or manage real estate. |

| Ownership | Transferred to buyer; seller becomes tenant. | Shared between joint venture partners. |

| Control | Seller loses ownership control but retains operational use. | Joint decision-making based on partnership agreement. |

| Financial Impact | Immediate capital infusion; lease payments become expenses. | Shared investment and risk; profit/loss shared per agreement. |

| Risk | Buyer bears ownership risk; seller retains operational risk. | Risk and rewards distributed among partners. |

| Duration | Lease term defined, often long-term. | Typically project or period-specific. |

| Use Cases | Companies needing liquidity while using property. | Developers, investors pooling resources for projects. |

Which is better?

Sale leaseback offers immediate capital infusion by selling an asset and leasing it back, preserving operational control while improving liquidity. Joint ventures enable shared risk and resources through partnership, fostering expansion and diversification in real estate projects. Choosing between them depends on financial goals, control preferences, and long-term investment strategies in the real estate market.

Connection

Sale leaseback and joint ventures are connected through their ability to optimize asset management and capital allocation in real estate. In a sale leaseback, a company sells property and leases it back, freeing up capital while maintaining operational control, a structure often used in joint ventures to combine resources and expertise. These strategies enable partners to share risk, increase liquidity, and leverage property assets for growth and development in commercial real estate projects.

Key Terms

Ownership Structure

Joint ventures involve shared ownership structure where two or more parties collaborate, pooling resources and risks to operate a business or project together. Sale leaseback transactions transfer ownership of an asset from the seller to the buyer while the seller leases the asset back, maintaining operational use but relinquishing ownership rights. Explore how different ownership models impact financial and operational strategies in property investments.

Risk Sharing

A joint venture involves shared risks and rewards between parties, with both entities collaborating on investment, management, and operational responsibilities. Sale leaseback transfers ownership risk to the buyer, while the seller retains usage rights and assumes lease payment obligations, minimizing operational risks but introducing financial lease risks. Explore further to understand which structure best aligns with your risk tolerance and business strategy.

Asset Control

Joint ventures offer shared asset control among partners, allowing collaborative decision-making and strategic oversight, while sale leasebacks transfer asset ownership to a buyer but retain operational control through lease agreements. This structure enables companies to unlock capital without relinquishing day-to-day management of key assets. Explore more to understand which option aligns best with your asset management goals.

Source and External Links

What Is a Joint Venture and How Does It Work? - NerdWallet - A joint venture is an agreement by two or more people or companies to accomplish a specific business goal together, sharing resources, risks, and rewards.

Joint Venture (JV) - Corporate Finance Institute - A joint venture is a commercial enterprise where two or more organizations combine their resources to gain a strategic or tactical advantage, often for a specific project or to enter new markets.

joint venture | Wex | US Law | LII / Legal Information Institute - A joint venture is a combination of two or more parties pursuing a single enterprise or project for profit, sharing both the risks and the control over the venture.

dowidth.com

dowidth.com