Dynamic pricing in real estate adjusts property prices based on real-time market demand, inventory levels, and buyer behavior, allowing sellers to maximize revenue by responding swiftly to market shifts. Tiered pricing structures properties into predefined categories with set price ranges, simplifying buyer decisions and creating clear value distinctions across different property tiers. Explore the advantages and applications of both strategies to optimize your real estate pricing approach.

Why it is important

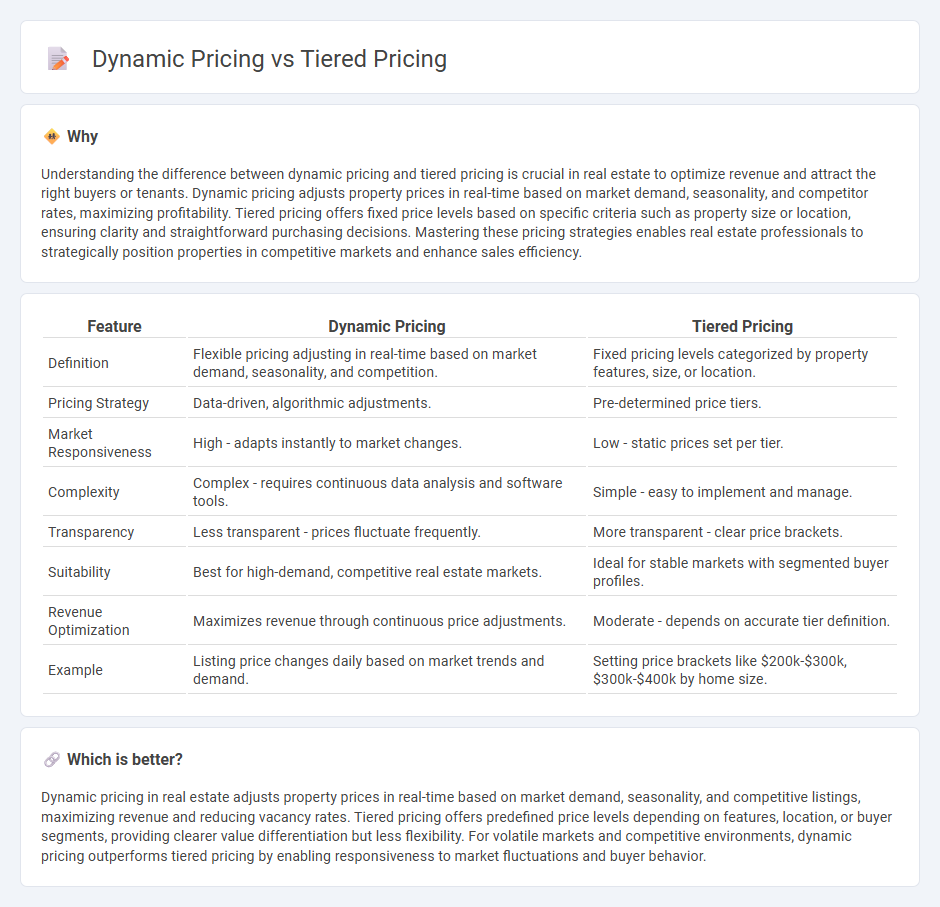

Understanding the difference between dynamic pricing and tiered pricing is crucial in real estate to optimize revenue and attract the right buyers or tenants. Dynamic pricing adjusts property prices in real-time based on market demand, seasonality, and competitor rates, maximizing profitability. Tiered pricing offers fixed price levels based on specific criteria such as property size or location, ensuring clarity and straightforward purchasing decisions. Mastering these pricing strategies enables real estate professionals to strategically position properties in competitive markets and enhance sales efficiency.

Comparison Table

| Feature | Dynamic Pricing | Tiered Pricing |

|---|---|---|

| Definition | Flexible pricing adjusting in real-time based on market demand, seasonality, and competition. | Fixed pricing levels categorized by property features, size, or location. |

| Pricing Strategy | Data-driven, algorithmic adjustments. | Pre-determined price tiers. |

| Market Responsiveness | High - adapts instantly to market changes. | Low - static prices set per tier. |

| Complexity | Complex - requires continuous data analysis and software tools. | Simple - easy to implement and manage. |

| Transparency | Less transparent - prices fluctuate frequently. | More transparent - clear price brackets. |

| Suitability | Best for high-demand, competitive real estate markets. | Ideal for stable markets with segmented buyer profiles. |

| Revenue Optimization | Maximizes revenue through continuous price adjustments. | Moderate - depends on accurate tier definition. |

| Example | Listing price changes daily based on market trends and demand. | Setting price brackets like $200k-$300k, $300k-$400k by home size. |

Which is better?

Dynamic pricing in real estate adjusts property prices in real-time based on market demand, seasonality, and competitive listings, maximizing revenue and reducing vacancy rates. Tiered pricing offers predefined price levels depending on features, location, or buyer segments, providing clearer value differentiation but less flexibility. For volatile markets and competitive environments, dynamic pricing outperforms tiered pricing by enabling responsiveness to market fluctuations and buyer behavior.

Connection

Dynamic pricing and tiered pricing in real estate are interconnected strategies that optimize property valuation by adjusting prices based on market demand and segmented customer profiles. Dynamic pricing uses real-time data and algorithms to modify property prices continuously, while tiered pricing categorizes properties into distinct price levels or segments, enhancing targeted marketing and maximizing revenue. The integration of these methods enables real estate investors and agents to respond efficiently to market fluctuations while appealing to diverse buyer groups.

Key Terms

Price Segmentation

Tiered pricing segments customers into predefined groups with fixed price levels based on volume or features, enabling predictable revenue streams and simplified purchasing decisions. Dynamic pricing adjusts prices in real-time according to demand, competition, and customer behavior, maximizing revenue through market-responsive segmentation. Explore how these distinct pricing models leverage segmentation to optimize profitability and customer satisfaction.

Demand Fluctuation

Tiered pricing segments products or services into distinct price levels based on quantity or usage, providing predictable cost brackets that cater to varying demand volumes. Dynamic pricing continuously adjusts prices in real-time according to demand fluctuations, market conditions, and competitor actions to maximize revenue. Explore how each pricing strategy adapts to changing demand patterns and determine which best suits your business model.

Revenue Optimization

Tiered pricing segments customers into distinct groups with fixed price levels based on usage or volume, maximizing revenue through clear, predictable cost structures. Dynamic pricing adjusts prices in real-time using algorithms and market data, optimizing revenue by responding to demand fluctuations and competitive conditions. Explore how leveraging these strategies can enhance your revenue optimization efforts.

Source and External Links

Mastering Tiered Pricing: Strategy for Revenue Maximization - This article explores tiered pricing as a flexible model that maximizes revenue by offering products or services at various price points based on different tiers or levels.

What is Tiered Pricing? - Tiered pricing is a complex strategy where companies offer different discounts or benefits based on the quantity of goods or services purchased.

Tiered Pricing Model vs Tier Pricing Strategy - This resource explains tiered pricing as a model used to sell products within a specific price range, typically by limiting or expanding features in each tier.

dowidth.com

dowidth.com