Single family rentals offer privacy, space, and strong appeal for long-term tenants seeking home-like environments, while apartment complexes provide higher density living with shared amenities and streamlined property management. Real estate investors weigh factors such as maintenance costs, tenant turnover, and rental income stability when choosing between these asset types. Explore the benefits and challenges of single family rentals versus apartment complexes to identify the best fit for your investment strategy.

Why it is important

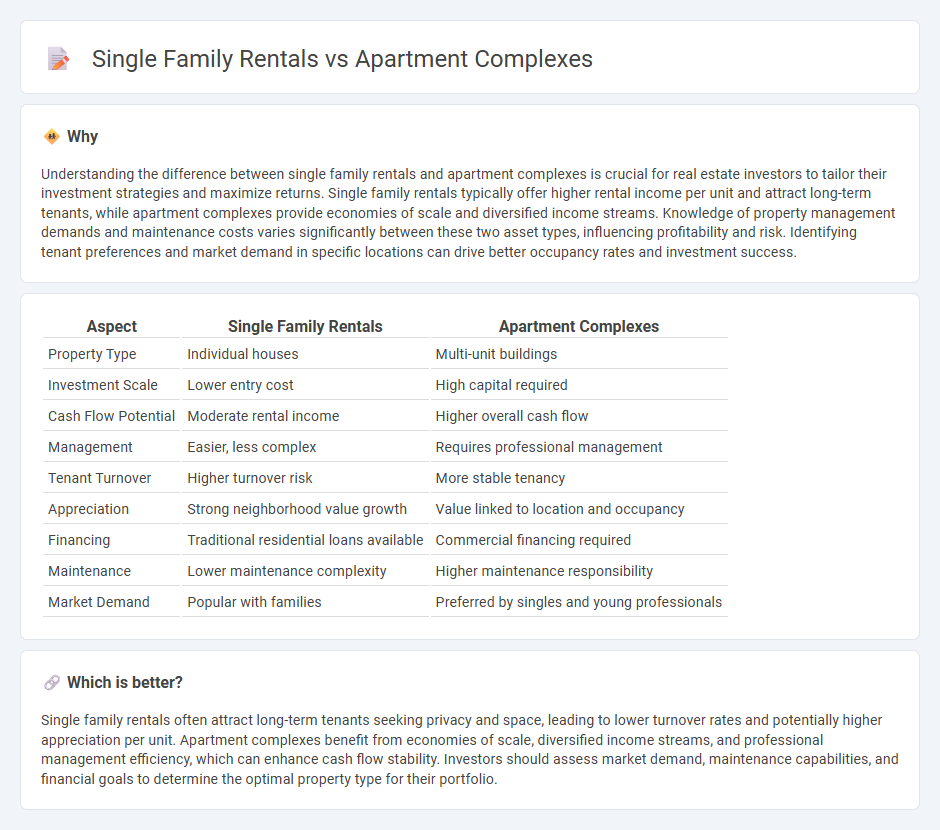

Understanding the difference between single family rentals and apartment complexes is crucial for real estate investors to tailor their investment strategies and maximize returns. Single family rentals typically offer higher rental income per unit and attract long-term tenants, while apartment complexes provide economies of scale and diversified income streams. Knowledge of property management demands and maintenance costs varies significantly between these two asset types, influencing profitability and risk. Identifying tenant preferences and market demand in specific locations can drive better occupancy rates and investment success.

Comparison Table

| Aspect | Single Family Rentals | Apartment Complexes |

|---|---|---|

| Property Type | Individual houses | Multi-unit buildings |

| Investment Scale | Lower entry cost | High capital required |

| Cash Flow Potential | Moderate rental income | Higher overall cash flow |

| Management | Easier, less complex | Requires professional management |

| Tenant Turnover | Higher turnover risk | More stable tenancy |

| Appreciation | Strong neighborhood value growth | Value linked to location and occupancy |

| Financing | Traditional residential loans available | Commercial financing required |

| Maintenance | Lower maintenance complexity | Higher maintenance responsibility |

| Market Demand | Popular with families | Preferred by singles and young professionals |

Which is better?

Single family rentals often attract long-term tenants seeking privacy and space, leading to lower turnover rates and potentially higher appreciation per unit. Apartment complexes benefit from economies of scale, diversified income streams, and professional management efficiency, which can enhance cash flow stability. Investors should assess market demand, maintenance capabilities, and financial goals to determine the optimal property type for their portfolio.

Connection

Single family rentals and apartment complexes are both key components of the residential real estate market, providing diverse housing options for renters. Investors often analyze rental income trends and occupancy rates across both property types to identify market demand and optimize portfolio returns. Their interconnected dynamics influence local housing supply, rental pricing strategies, and urban planning development.

Key Terms

Property Management

Apartment complexes offer streamlined property management through centralized maintenance, rent collection, and tenant communication, enhancing operational efficiency. Single family rentals require individualized management efforts for each property, often increasing time and resource investment. Explore detailed strategies to optimize property management for both asset types.

Occupancy Rates

Apartment complexes typically maintain higher occupancy rates, averaging around 95%, due to diversified tenant pools and streamlined management systems. Single family rentals often experience occupancy rates near 90%, influenced by variable tenant demand and longer vacancy periods between leases. Explore more insights to understand how these dynamics affect your real estate investment returns.

Investment Yield

Apartment complexes often deliver higher investment yields due to economies of scale, diversified tenant income, and reduced per-unit operating costs compared to single-family rentals. Single-family rentals generally provide more stable long-term appreciation and lower vacancy risks, but may require more intensive maintenance and property management per unit. Explore detailed comparisons on investment yield and risk profiles to determine the best option for your portfolio strategy.

Source and External Links

Apartments For Rent in Little Rock AR - 876 Rentals - Provides detailed listings of available apartments in Little Rock, AR, including pricing, sizes, and amenities for various complexes.

Apartments for Rent in Houston TX - Updated Today - Highlights diverse apartment options in Houston, TX, ranging from luxury downtown apartments to affordable suburban homes, with neighborhood descriptions.

Apartment Communities For Rent in New York, NY - Features extensive apartment communities for rent in New York City, showcasing various units, pricing, and amenities in multiple neighborhoods.

dowidth.com

dowidth.com