Sale leaseback transfers property ownership to investors while allowing the original owner to continue using the space through lease agreements, optimizing cash flow and balance sheets. Equity partnerships involve shared ownership and profit distribution, aligning interests between investors and operators for mutual growth potential in real estate projects. Explore these strategies further to determine which best suits your investment goals.

Why it is important

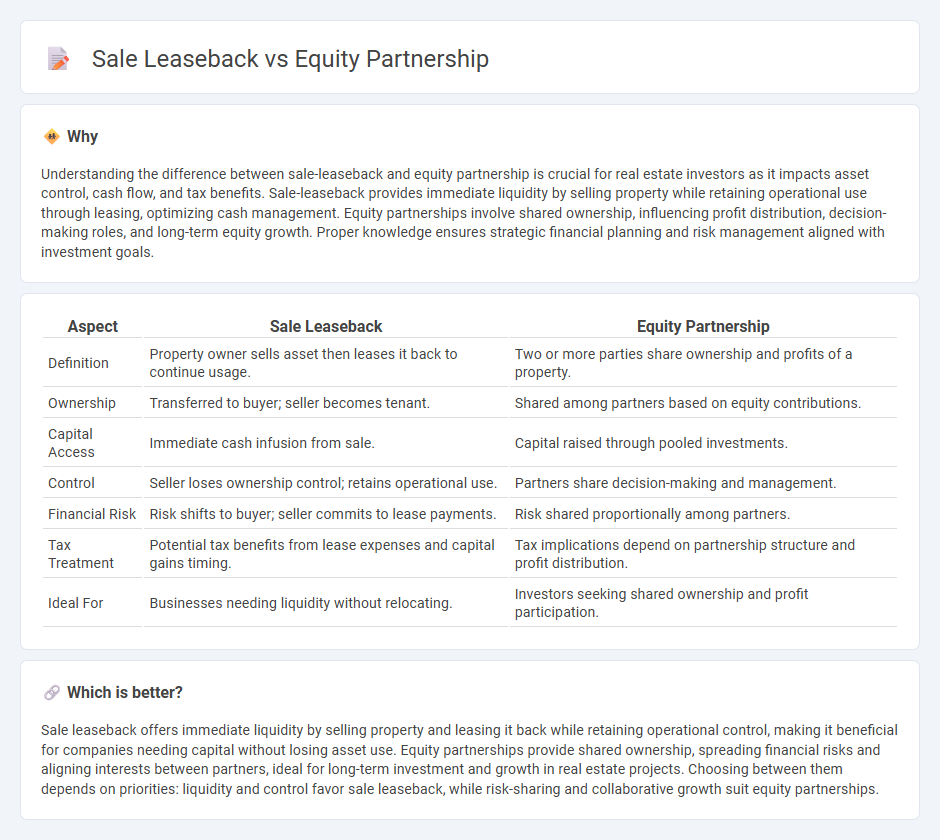

Understanding the difference between sale-leaseback and equity partnership is crucial for real estate investors as it impacts asset control, cash flow, and tax benefits. Sale-leaseback provides immediate liquidity by selling property while retaining operational use through leasing, optimizing cash management. Equity partnerships involve shared ownership, influencing profit distribution, decision-making roles, and long-term equity growth. Proper knowledge ensures strategic financial planning and risk management aligned with investment goals.

Comparison Table

| Aspect | Sale Leaseback | Equity Partnership |

|---|---|---|

| Definition | Property owner sells asset then leases it back to continue usage. | Two or more parties share ownership and profits of a property. |

| Ownership | Transferred to buyer; seller becomes tenant. | Shared among partners based on equity contributions. |

| Capital Access | Immediate cash infusion from sale. | Capital raised through pooled investments. |

| Control | Seller loses ownership control; retains operational use. | Partners share decision-making and management. |

| Financial Risk | Risk shifts to buyer; seller commits to lease payments. | Risk shared proportionally among partners. |

| Tax Treatment | Potential tax benefits from lease expenses and capital gains timing. | Tax implications depend on partnership structure and profit distribution. |

| Ideal For | Businesses needing liquidity without relocating. | Investors seeking shared ownership and profit participation. |

Which is better?

Sale leaseback offers immediate liquidity by selling property and leasing it back while retaining operational control, making it beneficial for companies needing capital without losing asset use. Equity partnerships provide shared ownership, spreading financial risks and aligning interests between partners, ideal for long-term investment and growth in real estate projects. Choosing between them depends on priorities: liquidity and control favor sale leaseback, while risk-sharing and collaborative growth suit equity partnerships.

Connection

Sale leaseback transactions enable property owners to convert real estate assets into liquidity by selling the property and leasing it back, preserving operational control. Equity partnerships often complement this strategy by attracting investors who provide capital in exchange for ownership stakes, facilitating property acquisition or refinancing. Integrating both methods enhances financial flexibility and optimizes asset management within commercial real estate portfolios.

Key Terms

Ownership Structure

Equity partnership involves multiple parties sharing ownership, risks, and returns based on their investment stake, fostering collaborative control and long-term alignment in asset management. Sale-leaseback transfers ownership from the seller to the buyer while the original owner becomes a lessee, enabling capital generation without relinquishing operational control but altering the asset's ownership structure. Explore detailed comparisons to understand which ownership structure aligns best with your financial and strategic objectives.

Capital Deployment

Equity partnership allows businesses to share ownership and risks, leveraging invested capital for growth without immediate debt impacts; sale-leaseback converts owned assets into cash by selling property and leasing it back, freeing capital tied in real estate to fund operations or investments. Capital deployment in equity partnerships emphasizes long-term value creation through shared equity, while sale-leaseback offers immediate liquidity with ongoing lease commitments. Explore detailed comparisons to determine which strategy best aligns with your financial goals and capital management needs.

Lease Agreement

In an equity partnership, the lease agreement typically outlines terms for shared property use and profit distribution between investors, focusing on long-term collaboration and asset appreciation. Sale-leaseback agreements transfer property ownership to the buyer while the seller retains operational control through a lease, emphasizing fixed rental payments and lease duration under strict terms. Explore deeper insights into how lease agreements impact financial strategies and property management decisions.

Source and External Links

Equity Partnership Agreements: Roles, Rights & Risks - An equity partnership agreement outlines the rights and obligations of partners, including ownership, profit sharing, and decision-making protocols.

What Defines Being an Equity Partner? - An equity partner owns a partial share of a business, participating in its profits and losses, and is involved in decision-making.

Equity Partner Definition - An equity partner holds an ownership stake in a business, contributes assets, and shares in profits and losses, often participating in management.

dowidth.com

dowidth.com