Opportunity zone investing offers significant tax incentives by allowing investors to defer and potentially reduce capital gains taxes when investing in designated economically distressed areas. Tax lien investing involves purchasing the legal claim on a property due to unpaid taxes, which can generate high returns through interest payments or property acquisition if liens are not settled. Explore the unique benefits and risks of these investment strategies to determine which aligns best with your financial goals.

Why it is important

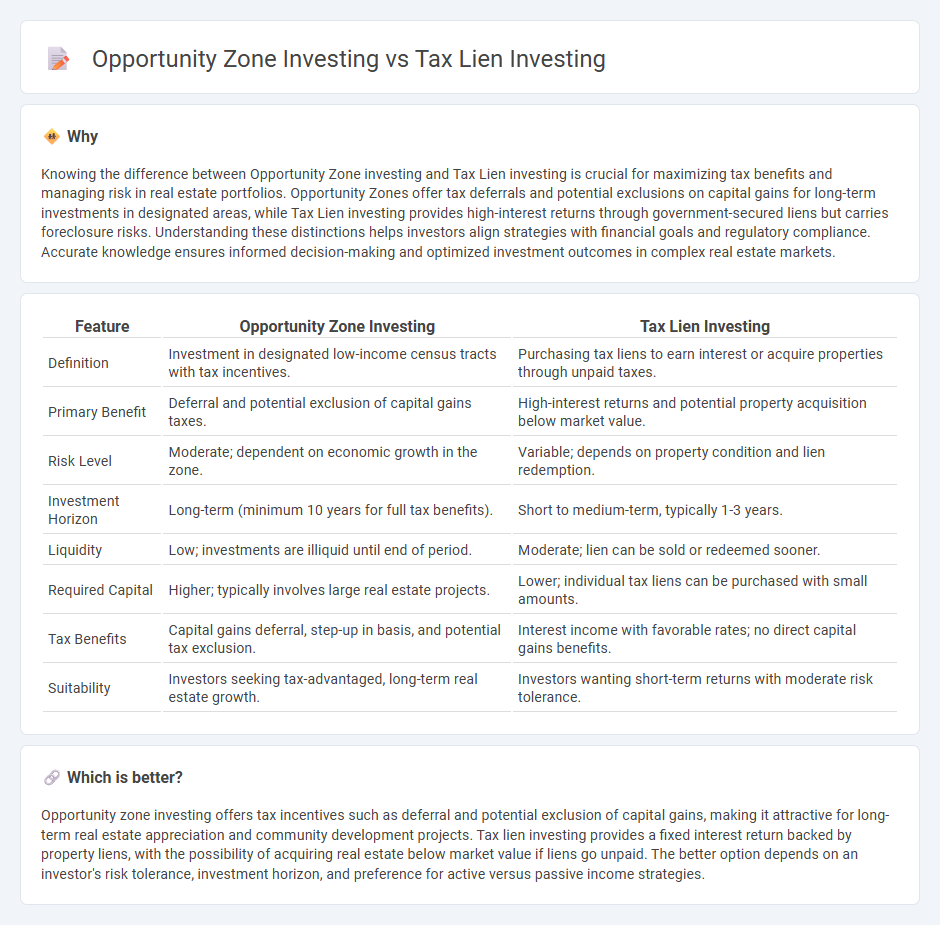

Knowing the difference between Opportunity Zone investing and Tax Lien investing is crucial for maximizing tax benefits and managing risk in real estate portfolios. Opportunity Zones offer tax deferrals and potential exclusions on capital gains for long-term investments in designated areas, while Tax Lien investing provides high-interest returns through government-secured liens but carries foreclosure risks. Understanding these distinctions helps investors align strategies with financial goals and regulatory compliance. Accurate knowledge ensures informed decision-making and optimized investment outcomes in complex real estate markets.

Comparison Table

| Feature | Opportunity Zone Investing | Tax Lien Investing |

|---|---|---|

| Definition | Investment in designated low-income census tracts with tax incentives. | Purchasing tax liens to earn interest or acquire properties through unpaid taxes. |

| Primary Benefit | Deferral and potential exclusion of capital gains taxes. | High-interest returns and potential property acquisition below market value. |

| Risk Level | Moderate; dependent on economic growth in the zone. | Variable; depends on property condition and lien redemption. |

| Investment Horizon | Long-term (minimum 10 years for full tax benefits). | Short to medium-term, typically 1-3 years. |

| Liquidity | Low; investments are illiquid until end of period. | Moderate; lien can be sold or redeemed sooner. |

| Required Capital | Higher; typically involves large real estate projects. | Lower; individual tax liens can be purchased with small amounts. |

| Tax Benefits | Capital gains deferral, step-up in basis, and potential tax exclusion. | Interest income with favorable rates; no direct capital gains benefits. |

| Suitability | Investors seeking tax-advantaged, long-term real estate growth. | Investors wanting short-term returns with moderate risk tolerance. |

Which is better?

Opportunity zone investing offers tax incentives such as deferral and potential exclusion of capital gains, making it attractive for long-term real estate appreciation and community development projects. Tax lien investing provides a fixed interest return backed by property liens, with the possibility of acquiring real estate below market value if liens go unpaid. The better option depends on an investor's risk tolerance, investment horizon, and preference for active versus passive income strategies.

Connection

Opportunity Zone investing and Tax Lien investing intersect in real estate through their potential for high returns and tax incentives. Opportunity Zones offer capital gains tax deferrals and exclusions for investments in designated low-income areas, while Tax Lien investing provides secured claims on properties with delinquent taxes, often resulting in interest income or property acquisition. Combining these strategies allows investors to leverage tax benefits in undervalued or distressed real estate markets, maximizing portfolio growth and diversification.

Key Terms

Tax Lien Certificate

Tax Lien Certificate investing involves purchasing delinquent property tax debts, allowing investors to earn interest and potentially acquire properties if liens remain unpaid. This strategy provides a secured investment with high interest rates set by local governments, often ranging between 8% and 36%. Explore the benefits and risks of Tax Lien Certificate investing to determine if it aligns with your financial goals.

Capital Gains Deferral

Tax lien investing offers investors fixed interest returns with immediate cash flow, but does not provide capital gains deferral benefits. Opportunity zone investing enables deferral and potential reduction of capital gains tax by reinvesting profits into designated low-income communities. Explore detailed strategies and tax advantages of each approach to optimize your investment portfolio.

Qualified Opportunity Fund

Tax Lien Investing offers high-yield returns through acquiring tax debt liens on properties, while Opportunity Zone Investing through a Qualified Opportunity Fund (QOF) provides significant tax incentives by channeling capital gains into designated economically distressed areas. A QOF enables investors to defer and potentially reduce capital gains taxes when reinvesting profits into qualified projects within Opportunity Zones, promoting community development and long-term appreciation. Explore more about how tax benefits and risk profiles vary between these strategies to optimize your investment portfolio.

Source and External Links

What is Tax Lien Investing? - Tax lien investing involves buying tax lien certificates at auctions, allowing investors to collect unpaid property taxes plus interest and penalties.

Tax Lien Investing: What You Need to Know - This article explains how tax lien investing works, including the process of buying certificates at auctions and the potential risks involved.

Tax Lien Investing vs. Tax Deed Investing - This webpage compares tax lien investing, where investors buy certificates to collect tax debts plus interest, with tax deed investing, which involves buying property rights.

dowidth.com

dowidth.com