Opportunity Zones offer tax incentives to investors for rehabilitating properties in designated low-income areas, encouraging economic growth through capital gains deferral and exclusion. Renewal Communities focus on comprehensive urban revitalization by providing tax credits, commercial revitalization deductions, and employment credits to stimulate job creation and poverty reduction. Explore the distinct benefits and eligibility requirements of both programs to maximize your real estate investment potential.

Why it is important

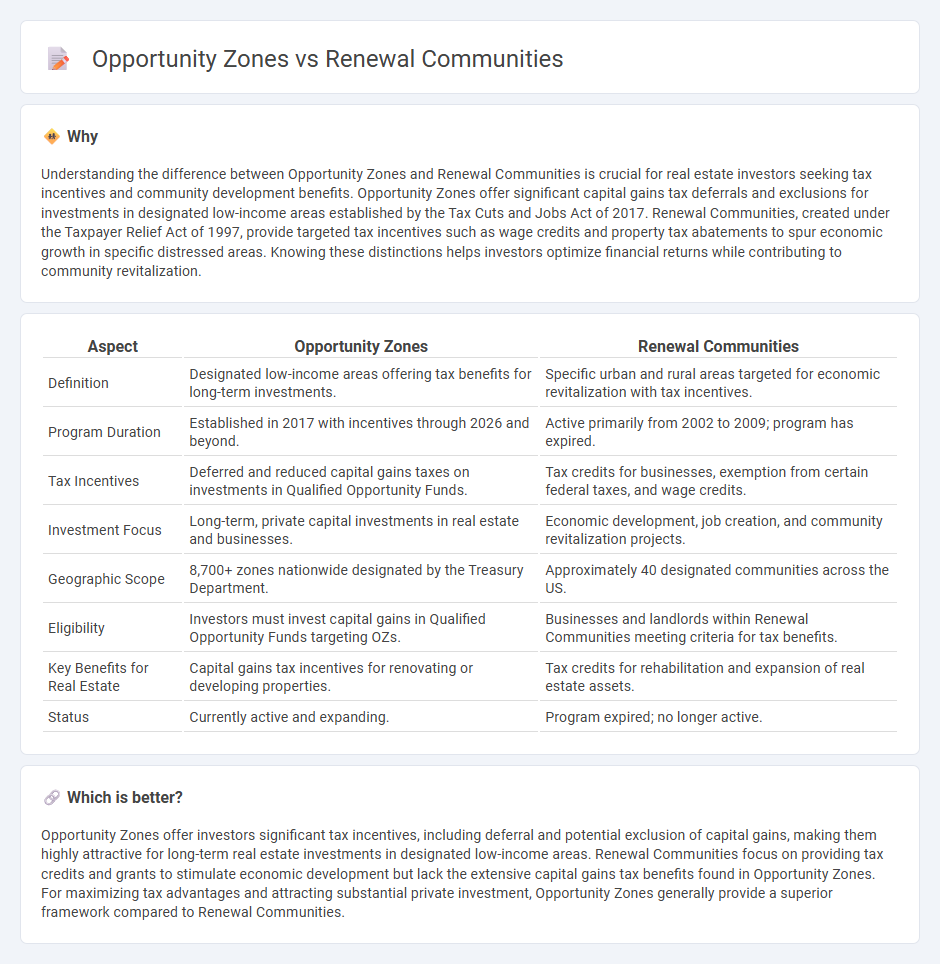

Understanding the difference between Opportunity Zones and Renewal Communities is crucial for real estate investors seeking tax incentives and community development benefits. Opportunity Zones offer significant capital gains tax deferrals and exclusions for investments in designated low-income areas established by the Tax Cuts and Jobs Act of 2017. Renewal Communities, created under the Taxpayer Relief Act of 1997, provide targeted tax incentives such as wage credits and property tax abatements to spur economic growth in specific distressed areas. Knowing these distinctions helps investors optimize financial returns while contributing to community revitalization.

Comparison Table

| Aspect | Opportunity Zones | Renewal Communities |

|---|---|---|

| Definition | Designated low-income areas offering tax benefits for long-term investments. | Specific urban and rural areas targeted for economic revitalization with tax incentives. |

| Program Duration | Established in 2017 with incentives through 2026 and beyond. | Active primarily from 2002 to 2009; program has expired. |

| Tax Incentives | Deferred and reduced capital gains taxes on investments in Qualified Opportunity Funds. | Tax credits for businesses, exemption from certain federal taxes, and wage credits. |

| Investment Focus | Long-term, private capital investments in real estate and businesses. | Economic development, job creation, and community revitalization projects. |

| Geographic Scope | 8,700+ zones nationwide designated by the Treasury Department. | Approximately 40 designated communities across the US. |

| Eligibility | Investors must invest capital gains in Qualified Opportunity Funds targeting OZs. | Businesses and landlords within Renewal Communities meeting criteria for tax benefits. |

| Key Benefits for Real Estate | Capital gains tax incentives for renovating or developing properties. | Tax credits for rehabilitation and expansion of real estate assets. |

| Status | Currently active and expanding. | Program expired; no longer active. |

Which is better?

Opportunity Zones offer investors significant tax incentives, including deferral and potential exclusion of capital gains, making them highly attractive for long-term real estate investments in designated low-income areas. Renewal Communities focus on providing tax credits and grants to stimulate economic development but lack the extensive capital gains tax benefits found in Opportunity Zones. For maximizing tax advantages and attracting substantial private investment, Opportunity Zones generally provide a superior framework compared to Renewal Communities.

Connection

Opportunity Zones and Renewal Communities both aim to stimulate economic growth and investment in underserved areas by offering tax incentives for real estate development. Opportunity Zones provide investors with capital gains tax deferrals when investing in designated low-income communities, while Renewal Communities offer tax credits and benefits to businesses operating in specific geographic zones. Together, these federal programs encourage revitalization and increased property values in economically distressed neighborhoods.

Key Terms

Tax Incentives

Renewal Communities and Opportunity Zones both offer tax incentives designed to stimulate economic growth in underserved areas, with Renewal Communities providing tax credits for businesses that invest and create jobs, and Opportunity Zones offering capital gains tax deferrals and potential exclusions for long-term investments. Opportunity Zones, established under the Tax Cuts and Jobs Act of 2017, emphasize deferred and reduced capital gains taxes to attract private investment, whereas Renewal Communities, created by the Community Renewal Tax Relief Act of 2000, focus on employment credits and commercial revitalization deductions. Explore the specific tax benefits and eligibility criteria of each to determine which program best suits your investment strategy.

Designated Areas

Renewal Communities are federally designated urban and rural areas targeting economic revitalization through tax incentives, primarily established under the Community Renewal Tax Relief Act of 2000. Opportunity Zones, created by the Tax Cuts and Jobs Act of 2017, designate specific census tracts across the U.S. for long-term investments aimed at spurring economic growth and job creation. Explore the distinct benefits and eligibility criteria of these designated areas to maximize your investment potential.

Economic Revitalization

Renewal Communities (RCs) and Opportunity Zones both drive economic revitalization by incentivizing investments in distressed areas through tax benefits and credits aimed at stimulating business growth and job creation. RCs, established under the Community Renewal Tax Relief Act of 2000, primarily focus on reducing unemployment and poverty in designated urban and rural zones, whereas Opportunity Zones, created by the Tax Cuts and Jobs Act of 2017, encourage long-term equity investments to foster sustainable development. Explore the distinctions between these programs to maximize community impact and economic growth potential.

Source and External Links

Renewal community - Renewal Communities are economically distressed urban and rural areas in the U.S. that offer tax incentives to stimulate business growth and job creation.

Questions and Answers on Renewal Community (RC) and Empowerment Zone (EZ) tax incentives - This document provides answers to questions about Renewal Communities and Empowerment Zones, including their designation criteria and tax incentive benefits.

Renew Communities - This organization aims to support under-resourced families through home ownership, business development, and community engagement initiatives.

dowidth.com

dowidth.com