Opportunity Zones provide tax incentives for investments in designated low-income areas, fostering economic growth through real estate development and business expansion. The Community Reinvestment Act (CRA) encourages banks to meet the credit needs of all community segments, promoting affordable housing and neighborhood revitalization. Explore the distinctions and benefits of each program to maximize your real estate investment strategy.

Why it is important

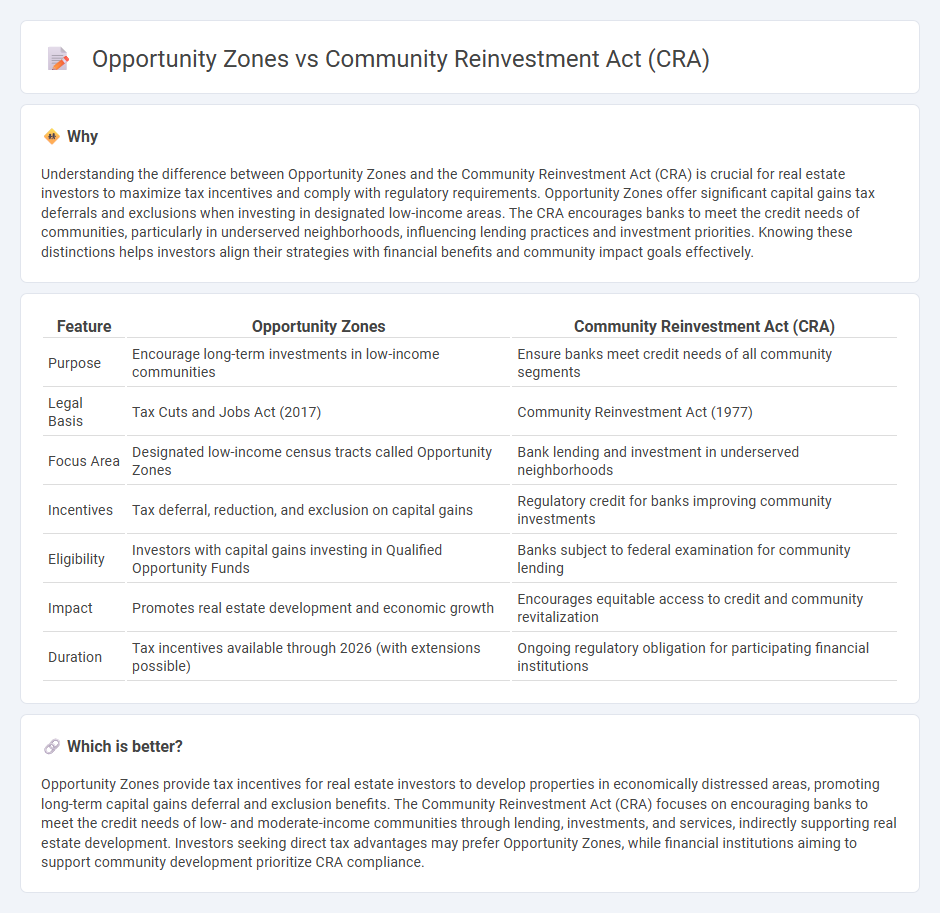

Understanding the difference between Opportunity Zones and the Community Reinvestment Act (CRA) is crucial for real estate investors to maximize tax incentives and comply with regulatory requirements. Opportunity Zones offer significant capital gains tax deferrals and exclusions when investing in designated low-income areas. The CRA encourages banks to meet the credit needs of communities, particularly in underserved neighborhoods, influencing lending practices and investment priorities. Knowing these distinctions helps investors align their strategies with financial benefits and community impact goals effectively.

Comparison Table

| Feature | Opportunity Zones | Community Reinvestment Act (CRA) |

|---|---|---|

| Purpose | Encourage long-term investments in low-income communities | Ensure banks meet credit needs of all community segments |

| Legal Basis | Tax Cuts and Jobs Act (2017) | Community Reinvestment Act (1977) |

| Focus Area | Designated low-income census tracts called Opportunity Zones | Bank lending and investment in underserved neighborhoods |

| Incentives | Tax deferral, reduction, and exclusion on capital gains | Regulatory credit for banks improving community investments |

| Eligibility | Investors with capital gains investing in Qualified Opportunity Funds | Banks subject to federal examination for community lending |

| Impact | Promotes real estate development and economic growth | Encourages equitable access to credit and community revitalization |

| Duration | Tax incentives available through 2026 (with extensions possible) | Ongoing regulatory obligation for participating financial institutions |

Which is better?

Opportunity Zones provide tax incentives for real estate investors to develop properties in economically distressed areas, promoting long-term capital gains deferral and exclusion benefits. The Community Reinvestment Act (CRA) focuses on encouraging banks to meet the credit needs of low- and moderate-income communities through lending, investments, and services, indirectly supporting real estate development. Investors seeking direct tax advantages may prefer Opportunity Zones, while financial institutions aiming to support community development prioritize CRA compliance.

Connection

Opportunity Zones and the Community Reinvestment Act (CRA) intersect by incentivizing investments in underserved real estate markets to stimulate economic growth and community development. Investments in Opportunity Zones can qualify for CRA credit, encouraging banks to direct capital towards revitalizing low-income neighborhoods while benefiting from tax advantages. This synergy enhances affordable housing projects and commercial real estate improvements, aligning with CRA's mission to reduce lending disparities.

Key Terms

Redlining

The Community Reinvestment Act (CRA) targets alleviating redlining by encouraging banks to meet the credit needs of underserved communities, while Opportunity Zones offer tax incentives to spur private investment in designated economically distressed areas. CRA emphasizes equitable lending practices to combat historical discrimination, whereas Opportunity Zones leverage capital gains tax deferrals to attract investment and economic growth in marginalized neighborhoods. Discover how these policies intersect to address redlining and promote community development.

Tax Incentives

The Community Reinvestment Act (CRA) encourages banks to meet the credit needs of underserved communities by providing regulatory benefits rather than direct tax incentives, emphasizing improved lending and investment activities. Opportunity Zones offer significant tax deferrals and capital gains tax reductions to investors who deploy capital into designated economically distressed areas, driving private investment via tax advantages. Explore detailed comparisons to understand how each program leverages financial incentives to stimulate community development.

Low- to Moderate-Income (LMI)

The Community Reinvestment Act (CRA) mandates banks to meet the credit needs of Low- to Moderate-Income (LMI) communities, promoting affordable housing, small business loans, and community development, while Opportunity Zones provide tax incentives for private investments in economically distressed LMI areas to spur long-term growth. CRA emphasizes regulatory compliance and direct community benefits, whereas Opportunity Zones leverage market-driven capital to stimulate economic revitalization in targeted LMI neighborhoods. Explore how these complementary tools can accelerate investment and development in underserved communities.

Source and External Links

Community Reinvestment Act - Wikipedia - The Community Reinvestment Act is a U.S. law enacted in 1977 to encourage banks to meet the credit needs of all community segments, including low- and moderate-income neighborhoods.

Community Reinvestment Act (CRA) - Federal Reserve Board - This webpage provides information on the CRA, including its purpose and the role of federal banking regulators in enforcing it.

Community Reinvestment Act | American Bankers Association - The CRA requires banks to invest in their communities, and the American Bankers Association provides insights into its implementation and recent changes.

dowidth.com

dowidth.com