Real estate crowdfunding allows multiple investors to pool funds online for property investments, offering lower entry barriers and diversified risk compared to traditional real estate development projects that require significant capital and hands-on management. Crowdfunding platforms provide access to residential and commercial properties, enabling passive income streams, whereas development projects focus on constructing or renovating buildings for long-term value appreciation and direct control. Explore the distinct advantages and challenges of each approach to optimize your real estate investment strategy.

Why it is important

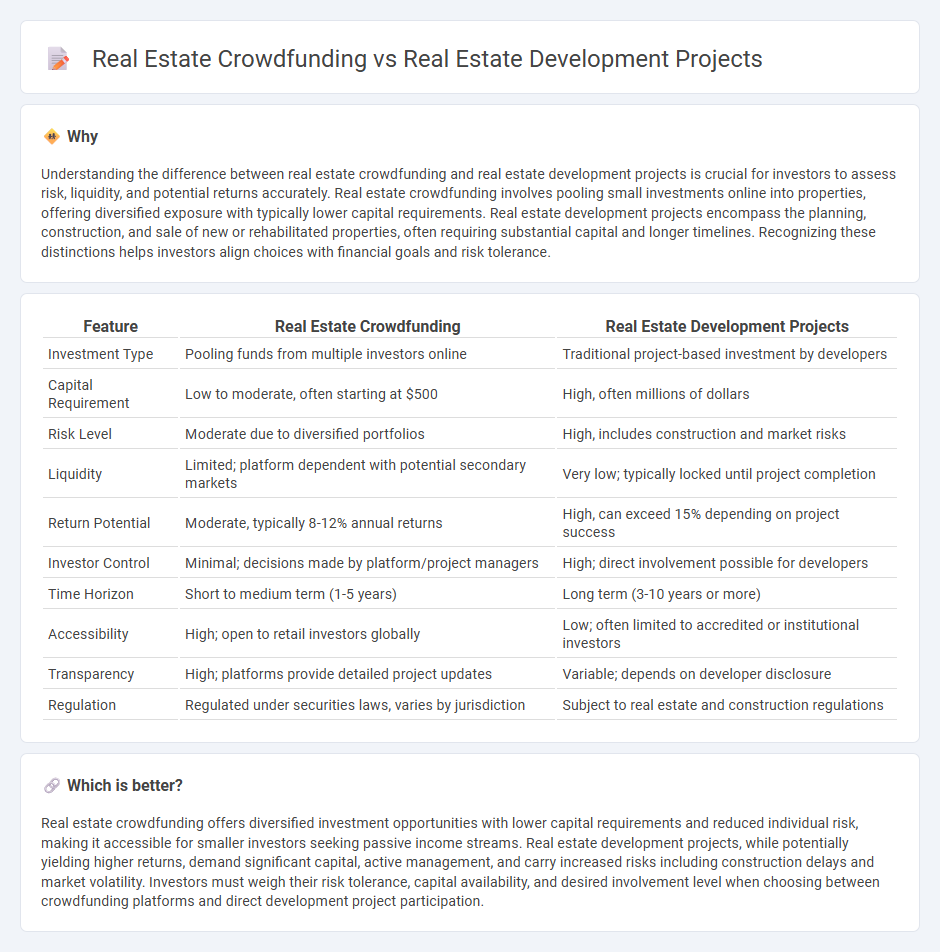

Understanding the difference between real estate crowdfunding and real estate development projects is crucial for investors to assess risk, liquidity, and potential returns accurately. Real estate crowdfunding involves pooling small investments online into properties, offering diversified exposure with typically lower capital requirements. Real estate development projects encompass the planning, construction, and sale of new or rehabilitated properties, often requiring substantial capital and longer timelines. Recognizing these distinctions helps investors align choices with financial goals and risk tolerance.

Comparison Table

| Feature | Real Estate Crowdfunding | Real Estate Development Projects |

|---|---|---|

| Investment Type | Pooling funds from multiple investors online | Traditional project-based investment by developers |

| Capital Requirement | Low to moderate, often starting at $500 | High, often millions of dollars |

| Risk Level | Moderate due to diversified portfolios | High, includes construction and market risks |

| Liquidity | Limited; platform dependent with potential secondary markets | Very low; typically locked until project completion |

| Return Potential | Moderate, typically 8-12% annual returns | High, can exceed 15% depending on project success |

| Investor Control | Minimal; decisions made by platform/project managers | High; direct involvement possible for developers |

| Time Horizon | Short to medium term (1-5 years) | Long term (3-10 years or more) |

| Accessibility | High; open to retail investors globally | Low; often limited to accredited or institutional investors |

| Transparency | High; platforms provide detailed project updates | Variable; depends on developer disclosure |

| Regulation | Regulated under securities laws, varies by jurisdiction | Subject to real estate and construction regulations |

Which is better?

Real estate crowdfunding offers diversified investment opportunities with lower capital requirements and reduced individual risk, making it accessible for smaller investors seeking passive income streams. Real estate development projects, while potentially yielding higher returns, demand significant capital, active management, and carry increased risks including construction delays and market volatility. Investors must weigh their risk tolerance, capital availability, and desired involvement level when choosing between crowdfunding platforms and direct development project participation.

Connection

Real estate crowdfunding accelerates real estate development projects by pooling capital from multiple investors, enabling developers to access funding without relying solely on traditional financing methods. This collaborative investment model diversifies risk and increases liquidity, making it easier to launch and complete large-scale development projects. Enhanced by online platforms, real estate crowdfunding democratizes participation, fostering innovation and growth within the real estate development sector.

Key Terms

**Real estate development projects:**

Real estate development projects involve the acquisition, construction, and sale or lease of properties, typically requiring substantial capital investment and expert project management to maximize returns. These projects often include residential, commercial, or mixed-use developments, with risks and timelines influenced by regulations, market demand, and construction challenges. Discover how real estate development projects can offer long-term value and impact local economies by exploring detailed strategies and case studies.

Zoning

Real estate development projects often require comprehensive zoning approvals to ensure compliance with local land use regulations, which can significantly impact project timelines and design flexibility. Real estate crowdfunding platforms enable investors to participate in developments already aligned with zoning laws, reducing regulatory risks while diversifying investment portfolios. Explore the intricate relationship between zoning regulations and investment strategies to optimize your real estate ventures.

Entitlements

Entitlements in real estate development projects involve obtaining government approvals such as zoning variances, environmental permits, and building permits crucial for project viability and timeline adherence. Real estate crowdfunding platforms typically rely on pre-entitled or partially entitled projects, reducing risk exposure for investors by ensuring necessary legal clearances and facilitating quicker capital deployment. Explore how mastering entitlements can optimize investment strategies and project success in both traditional development and crowdfunding contexts.

Source and External Links

Real Estate Development Guide - This webpage provides insights into the process of real estate development, including types such as brownfield, greenfield, and infill development projects.

Building Better - Discusses how real estate developers can create more inclusive and catalytic development projects, focusing on examples like Aggie Square and Centennial Yards.

Orlando Real Estate 2025 - Highlights four major real estate development projects in Orlando for 2025, including new community developments and infrastructure updates.

dowidth.com

dowidth.com