Opportunity Zones and Qualified Census Tracts are two key designations in real estate that influence investment and development incentives. Opportunity Zones provide tax benefits to investors who put capital into economically distressed areas, promoting long-term growth. Explore more to understand how these zones impact property values and investment strategies.

Why it is important

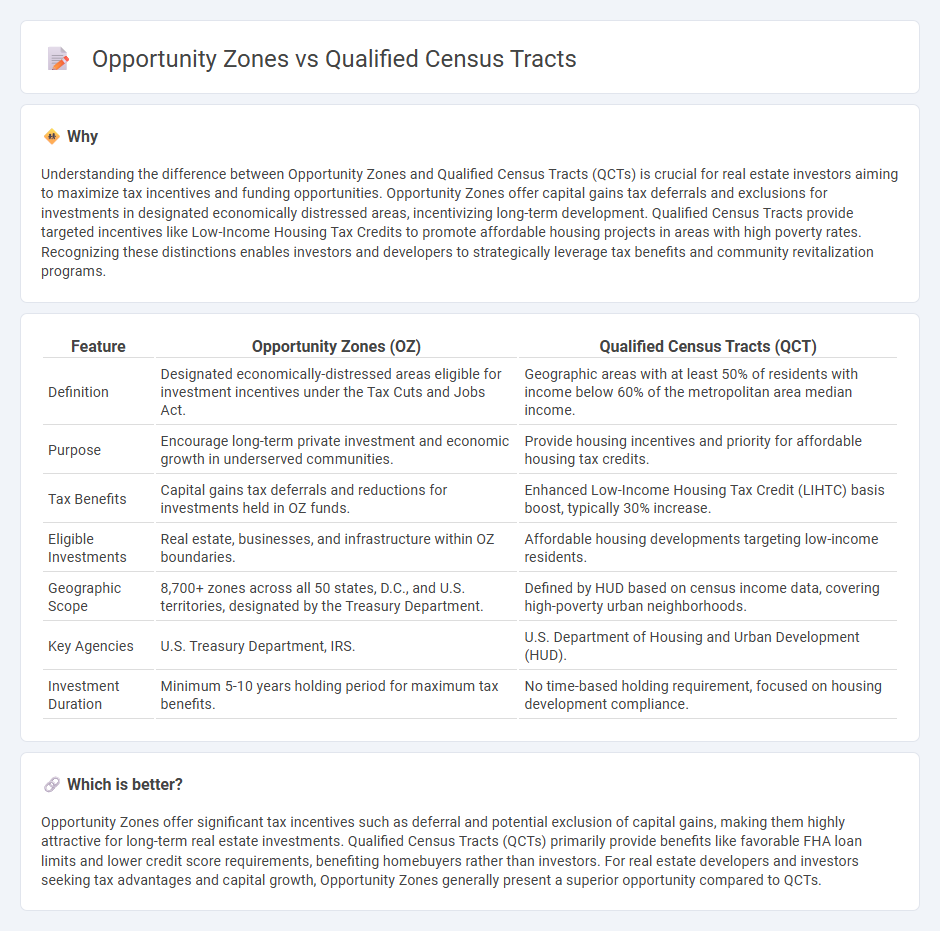

Understanding the difference between Opportunity Zones and Qualified Census Tracts (QCTs) is crucial for real estate investors aiming to maximize tax incentives and funding opportunities. Opportunity Zones offer capital gains tax deferrals and exclusions for investments in designated economically distressed areas, incentivizing long-term development. Qualified Census Tracts provide targeted incentives like Low-Income Housing Tax Credits to promote affordable housing projects in areas with high poverty rates. Recognizing these distinctions enables investors and developers to strategically leverage tax benefits and community revitalization programs.

Comparison Table

| Feature | Opportunity Zones (OZ) | Qualified Census Tracts (QCT) |

|---|---|---|

| Definition | Designated economically-distressed areas eligible for investment incentives under the Tax Cuts and Jobs Act. | Geographic areas with at least 50% of residents with income below 60% of the metropolitan area median income. |

| Purpose | Encourage long-term private investment and economic growth in underserved communities. | Provide housing incentives and priority for affordable housing tax credits. |

| Tax Benefits | Capital gains tax deferrals and reductions for investments held in OZ funds. | Enhanced Low-Income Housing Tax Credit (LIHTC) basis boost, typically 30% increase. |

| Eligible Investments | Real estate, businesses, and infrastructure within OZ boundaries. | Affordable housing developments targeting low-income residents. |

| Geographic Scope | 8,700+ zones across all 50 states, D.C., and U.S. territories, designated by the Treasury Department. | Defined by HUD based on census income data, covering high-poverty urban neighborhoods. |

| Key Agencies | U.S. Treasury Department, IRS. | U.S. Department of Housing and Urban Development (HUD). |

| Investment Duration | Minimum 5-10 years holding period for maximum tax benefits. | No time-based holding requirement, focused on housing development compliance. |

Which is better?

Opportunity Zones offer significant tax incentives such as deferral and potential exclusion of capital gains, making them highly attractive for long-term real estate investments. Qualified Census Tracts (QCTs) primarily provide benefits like favorable FHA loan limits and lower credit score requirements, benefiting homebuyers rather than investors. For real estate developers and investors seeking tax advantages and capital growth, Opportunity Zones generally present a superior opportunity compared to QCTs.

Connection

Opportunity Zones and Qualified Census Tracts (QCTs) are closely linked as most Opportunity Zones are designated within QCTs, targeting economically distressed areas for investment. Investors benefit from tax incentives when investing in these zones, fostering real estate development and community revitalization. The synergy between Opportunity Zones and QCTs drives capital flow into underserved neighborhoods, enhancing property values and economic growth.

Key Terms

Low-Income Community

Qualified Census Tracts (QCTs) and Opportunity Zones both target investments in economically distressed areas, but QCTs are specifically defined by the Department of Housing and Urban Development as areas where at least 50% of households have income below 80% of the area median. Opportunity Zones, established under the Tax Cuts and Jobs Act, offer tax incentives to investors for long-term investments in designated low-income communities identified by state governors and approved by the Treasury Department. Explore the differences and benefits of QCTs and Opportunity Zones to optimize your impact in low-income community investment.

Tax Incentives

Qualified Census Tracts (QCTs) designate areas with high poverty rates, enabling investors to claim higher Low-Income Housing Tax Credit (LIHTC) bonuses for affordable housing projects, incentivizing development in economically-challenged neighborhoods. Opportunity Zones, created under the Tax Cuts and Jobs Act of 2017, offer capital gains tax deferral and potential tax exclusions to investors funneling funds into designated economically-distressed communities, driving long-term investments and economic growth. Explore detailed tax benefits and eligibility criteria for both programs to optimize investment strategies and maximize impact.

Area Designation

Qualified Census Tracts (QCTs) are census tracts where at least 50% of households have incomes below 60% of the Area Median Gross Income, focusing on targeting economic distress through HUD programs. Opportunity Zones are economically-distressed communities designated by governors and certified by the Treasury Department to encourage long-term private investment via tax incentives. Explore how these area designations shape community development strategies and investment opportunities further.

Source and External Links

Maryland Housing Designated Areas - Qualified Census Tracts - Provides information on Qualified Census Tracts (QCTs) in Maryland, which must have a poverty rate of at least 25 percent or at least 50 percent of households with incomes below certain thresholds.

Qualifying Census Tracts (QCT) Map - Outlines census tracts designated by HUD as QCTs, where 50 percent or more of households have incomes below 60 percent of the Area Median Gross Income (AMGI) or have a poverty rate of 25 percent or more.

Equity and QCTs - Defines Qualified Census Tracts as areas where at least half of households have lower incomes than most of the surrounding region, emphasizing their role in addressing equity and supporting low-income communities.

dowidth.com

dowidth.com