Investing in wine cask aging offers potential for high returns as rare vintages appreciate in value due to limited supply and historical demand trends. Classic cars also present a unique alternative investment, often gaining worth based on rarity, condition, and provenance within the vintage automobile market. Explore deeper insights to understand which asset aligns best with your investment strategy.

Why it is important

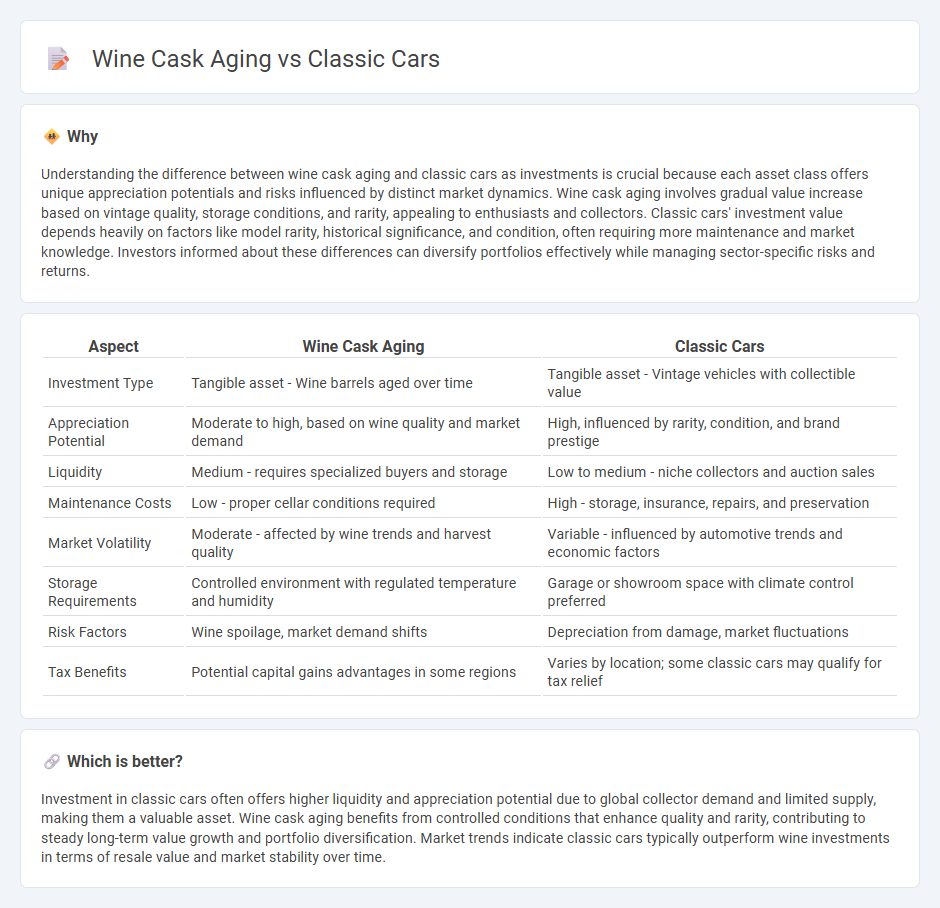

Understanding the difference between wine cask aging and classic cars as investments is crucial because each asset class offers unique appreciation potentials and risks influenced by distinct market dynamics. Wine cask aging involves gradual value increase based on vintage quality, storage conditions, and rarity, appealing to enthusiasts and collectors. Classic cars' investment value depends heavily on factors like model rarity, historical significance, and condition, often requiring more maintenance and market knowledge. Investors informed about these differences can diversify portfolios effectively while managing sector-specific risks and returns.

Comparison Table

| Aspect | Wine Cask Aging | Classic Cars |

|---|---|---|

| Investment Type | Tangible asset - Wine barrels aged over time | Tangible asset - Vintage vehicles with collectible value |

| Appreciation Potential | Moderate to high, based on wine quality and market demand | High, influenced by rarity, condition, and brand prestige |

| Liquidity | Medium - requires specialized buyers and storage | Low to medium - niche collectors and auction sales |

| Maintenance Costs | Low - proper cellar conditions required | High - storage, insurance, repairs, and preservation |

| Market Volatility | Moderate - affected by wine trends and harvest quality | Variable - influenced by automotive trends and economic factors |

| Storage Requirements | Controlled environment with regulated temperature and humidity | Garage or showroom space with climate control preferred |

| Risk Factors | Wine spoilage, market demand shifts | Depreciation from damage, market fluctuations |

| Tax Benefits | Potential capital gains advantages in some regions | Varies by location; some classic cars may qualify for tax relief |

Which is better?

Investment in classic cars often offers higher liquidity and appreciation potential due to global collector demand and limited supply, making them a valuable asset. Wine cask aging benefits from controlled conditions that enhance quality and rarity, contributing to steady long-term value growth and portfolio diversification. Market trends indicate classic cars typically outperform wine investments in terms of resale value and market stability over time.

Connection

Investment in wine cask aging and classic cars intersects through their shared value appreciation over time due to rarity, craftsmanship, and historical significance. Both assets benefit from limited availability and increasing demand among collectors and enthusiasts, driving substantial returns beyond traditional financial markets. Strategic investment in these tangible goods offers portfolio diversification with unique risk-reward profiles influenced by market trends and provenance.

Key Terms

Appreciation

Classic cars appreciate over time through rarity, historical value, and condition, making them prized collector's items. Wine cask aging enhances flavor complexity, aroma, and texture, increasing its market value and desirability among connoisseurs. Discover how these distinct forms of appreciation transform passion into valuable investments.

Provenance

Classic cars and wine cask aging both emphasize provenance as a key factor in value and quality. The history and origin of a classic car impact its authenticity and desirability, much like how the cask's previous contents and wood type influence the flavor profile of aged wine or spirits. Explore the significance of provenance in determining the unique character and worth of these timeless treasures.

Liquidity

Classic cars and wine cask aging both serve as alternative investments with unique liquidity profiles, where classic cars generally offer higher liquidity due to easier valuation and a more active market. Wine cask aging requires longer holding periods and specialized knowledge, impacting liquidity but also potentially offering significant appreciation tied to vintage quality and rarity. Explore detailed insights on liquidity management in alternative investments to optimize your portfolio strategy.

Source and External Links

Classic Cars and Trucks for Sale - Classics on Autotrader - Premier marketplace to buy & sell thousands of classic cars including Chevrolet Corvette, Ford Mustang, Porsche 911, and classic trucks nationwide.

Classic Cars for Sale - ClassicCars.com - Largest website with over 38,000 classic and collector vehicles including muscle cars, hot rods, street rods, and vintage trucks for sale nationwide.

Classic Cars for Sale - Collector Car Marketplace - Online marketplace offering muscle cars, convertibles, exotics, and vintage cars like Chevrolet Chevelle, Ford Model A, and Cadillac Eldorado from trusted sellers.

dowidth.com

dowidth.com