Watch investment communities focus on niche markets, leveraging specialized knowledge and enthusiasm to drive returns through acquiring rare and valuable timepieces. Pension funds manage large-scale, diversified portfolios to achieve steady long-term growth and meet future retirement obligations for millions of beneficiaries. Discover how these distinct investment approaches differ in strategy and risk by exploring their unique characteristics.

Why it is important

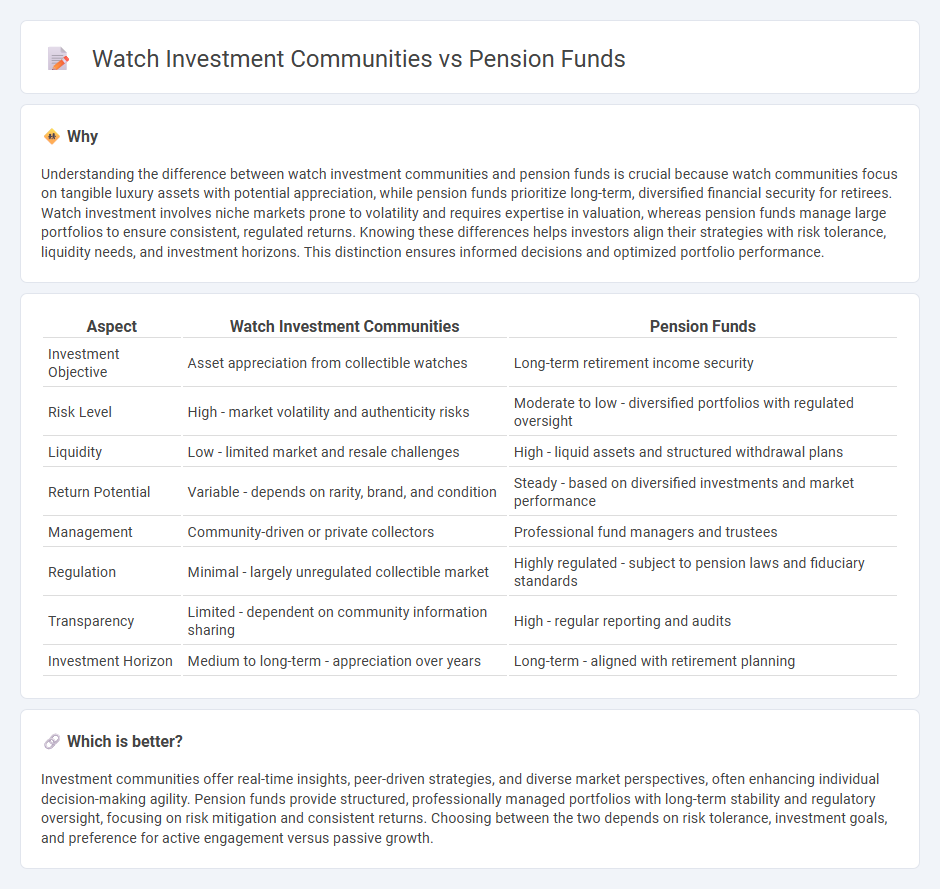

Understanding the difference between watch investment communities and pension funds is crucial because watch communities focus on tangible luxury assets with potential appreciation, while pension funds prioritize long-term, diversified financial security for retirees. Watch investment involves niche markets prone to volatility and requires expertise in valuation, whereas pension funds manage large portfolios to ensure consistent, regulated returns. Knowing these differences helps investors align their strategies with risk tolerance, liquidity needs, and investment horizons. This distinction ensures informed decisions and optimized portfolio performance.

Comparison Table

| Aspect | Watch Investment Communities | Pension Funds |

|---|---|---|

| Investment Objective | Asset appreciation from collectible watches | Long-term retirement income security |

| Risk Level | High - market volatility and authenticity risks | Moderate to low - diversified portfolios with regulated oversight |

| Liquidity | Low - limited market and resale challenges | High - liquid assets and structured withdrawal plans |

| Return Potential | Variable - depends on rarity, brand, and condition | Steady - based on diversified investments and market performance |

| Management | Community-driven or private collectors | Professional fund managers and trustees |

| Regulation | Minimal - largely unregulated collectible market | Highly regulated - subject to pension laws and fiduciary standards |

| Transparency | Limited - dependent on community information sharing | High - regular reporting and audits |

| Investment Horizon | Medium to long-term - appreciation over years | Long-term - aligned with retirement planning |

Which is better?

Investment communities offer real-time insights, peer-driven strategies, and diverse market perspectives, often enhancing individual decision-making agility. Pension funds provide structured, professionally managed portfolios with long-term stability and regulatory oversight, focusing on risk mitigation and consistent returns. Choosing between the two depends on risk tolerance, investment goals, and preference for active engagement versus passive growth.

Connection

Investment communities share critical insights and market trends that influence pension funds' asset allocation and risk management strategies. Pension funds leverage collective intelligence from these communities to optimize portfolio diversification and enhance long-term returns. This dynamic interaction supports informed decision-making and fosters financial stability for retirement planning.

Key Terms

Asset Allocation

Pension funds prioritize asset allocation strategies centered on long-term risk management and consistent returns, typically diversifying across equities, fixed income, real estate, and alternative assets. Watch investment communities focus their asset allocation on rare, high-value timepieces, emphasizing liquidity and market trends to maximize short- to mid-term gains. Explore these approaches in detail to understand distinct investment philosophies and methods.

Liquidity

Pension funds prioritize high liquidity to meet long-term obligations and manage risk, often favoring diversified portfolios with liquid assets such as stocks and bonds. Watch investment communities typically hold luxury timepieces as illiquid, collectible assets, valuing rarity and market appreciation over quick resale potential. Explore the distinct liquidity strategies shaping these investment approaches.

Risk Management

Pension funds prioritize risk management through diversified asset allocation and stringent regulatory compliance to ensure long-term financial stability for retirees. Watch investment communities tend to take higher risks by speculating on limited edition and vintage timepieces, with market volatility significantly impacting their returns. Explore comprehensive strategies used by both to optimize portfolio resilience and maximize returns in dynamic investment environments.

Source and External Links

Pension Fund - Overview, How It Works, Open vs Closed Funds - A pension fund is a capital pool accumulated to provide pension payments to employees upon retirement, investing mainly in capital markets to ensure sufficient future payouts, with common types including defined benefit plans and distinctions between open and closed pension funds.

Pension fund - Wikipedia - Pension funds provide retirement income by investing in stocks, bonds, real estate, and alternative assets, and are increasingly adopting passive investment strategies like index funds and ETFs, with major U.S. pension funds managing trillions in assets.

Pension funds' assets - OECD - Pension funds' assets are financial resources acquired exclusively from pension plan contributions, held independently to finance future pension benefits, with data showing large global asset pools managed by these funds as of 2023.

dowidth.com

dowidth.com