Royalty streaming grants investors a percentage of revenue from an asset, often in mining or entertainment industries, enabling income without ownership risks. Asset-backed lending involves loans secured by tangible assets, providing lenders collateral to minimize default risk while offering borrowers capital. Explore these investment strategies to discover which aligns best with your financial goals.

Why it is important

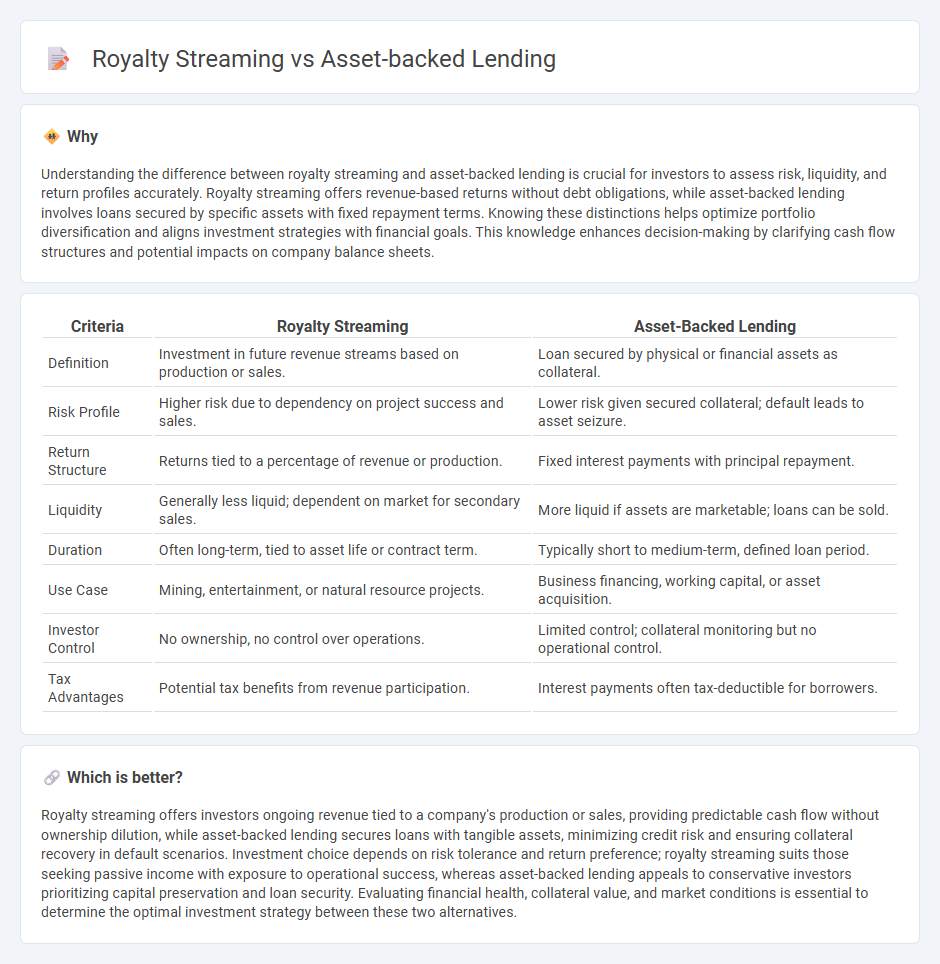

Understanding the difference between royalty streaming and asset-backed lending is crucial for investors to assess risk, liquidity, and return profiles accurately. Royalty streaming offers revenue-based returns without debt obligations, while asset-backed lending involves loans secured by specific assets with fixed repayment terms. Knowing these distinctions helps optimize portfolio diversification and aligns investment strategies with financial goals. This knowledge enhances decision-making by clarifying cash flow structures and potential impacts on company balance sheets.

Comparison Table

| Criteria | Royalty Streaming | Asset-Backed Lending |

|---|---|---|

| Definition | Investment in future revenue streams based on production or sales. | Loan secured by physical or financial assets as collateral. |

| Risk Profile | Higher risk due to dependency on project success and sales. | Lower risk given secured collateral; default leads to asset seizure. |

| Return Structure | Returns tied to a percentage of revenue or production. | Fixed interest payments with principal repayment. |

| Liquidity | Generally less liquid; dependent on market for secondary sales. | More liquid if assets are marketable; loans can be sold. |

| Duration | Often long-term, tied to asset life or contract term. | Typically short to medium-term, defined loan period. |

| Use Case | Mining, entertainment, or natural resource projects. | Business financing, working capital, or asset acquisition. |

| Investor Control | No ownership, no control over operations. | Limited control; collateral monitoring but no operational control. |

| Tax Advantages | Potential tax benefits from revenue participation. | Interest payments often tax-deductible for borrowers. |

Which is better?

Royalty streaming offers investors ongoing revenue tied to a company's production or sales, providing predictable cash flow without ownership dilution, while asset-backed lending secures loans with tangible assets, minimizing credit risk and ensuring collateral recovery in default scenarios. Investment choice depends on risk tolerance and return preference; royalty streaming suits those seeking passive income with exposure to operational success, whereas asset-backed lending appeals to conservative investors prioritizing capital preservation and loan security. Evaluating financial health, collateral value, and market conditions is essential to determine the optimal investment strategy between these two alternatives.

Connection

Royalty streaming and asset-backed lending intersect through their reliance on underlying assets to generate cash flow, with royalty streaming providing investors rights to future revenue from intellectual property or natural resources, while asset-backed lending involves loans secured by tangible or intangible assets. Both methods enhance liquidity for asset holders without traditional equity dilution, leveraging predictable revenue streams to mitigate risk for investors and lenders. This connection allows diversification of financing options in sectors like mining, entertainment, and technology, optimizing capital structure and investment returns.

Key Terms

Collateral

Asset-backed lending uses specific collateral such as real estate, inventory, or equipment to secure a loan, minimizing lender risk by providing tangible assets that can be liquidated if the borrower defaults. Royalty streaming involves investors providing upfront capital in exchange for a percentage of future revenue streams from intellectual property or natural resources without traditional collateral, making the investment reliant on consistent income generation rather than physical assets. Explore the nuanced differences in collateral structures to better understand which financing method aligns with your investment goals.

Royalty payments

Royalty streaming involves the purchase of future royalty payments generated by intellectual property or natural resources, providing investors with a steady revenue stream without ownership of the underlying asset. Asset-backed lending uses physical or financial assets as collateral to secure loans, with repayments tied to the borrower's creditworthiness rather than future income flows. Explore the nuances and strategic advantages of royalty payments in investment portfolios to understand their unique benefits.

Loan-to-value ratio

Asset-backed lending typically features a loan-to-value (LTV) ratio ranging from 50% to 80%, depending on the quality and liquidity of the underlying assets, providing lenders with substantial collateral security. Royalty streaming, on the other hand, does not rely on traditional collateral but bases valuation and financing terms on projected future revenue streams, often resulting in a variable effective LTV influenced by royalty contract terms and earnings stability. To explore the nuanced financial impacts and strategic considerations of these financing methods, delve deeper into comparative analyses of asset-backed lending and royalty streaming.

Source and External Links

Asset-Based Lending | ABL Finance - First Citizens Bank - Asset-based lending (ABL) is a type of secured loan where businesses leverage accounts receivable, inventory, or fixed assets as collateral, providing flexible, often lower-cost financing with typical advance rates from 50% to 90% of asset value depending on asset type.

The growth of asset-based finance in private credit markets - Asset-based lending (a subset of asset-based finance) involves loans to businesses secured by tangible or financial assets instead of cash flow, with advances generally ranging from 20% to 90% depending on asset type and recovery risk considerations.

Asset-based lending - Wikipedia - Asset-based lending involves loans secured by company assets, typically accounts receivable and inventory, featuring revolving credit limits linked to collateral value and allowing lenders to seize assets if the company defaults.

dowidth.com

dowidth.com