Luxury handbag investment offers tangible assets with strong brand recognition, limited editions, and resale value driven by high demand in fashion markets. Wine investment involves acquiring rare vintages that appreciate through aging, influenced by provenance, scarcity, and global auction trends. Explore detailed comparisons to understand which asset aligns best with your portfolio goals.

Why it is important

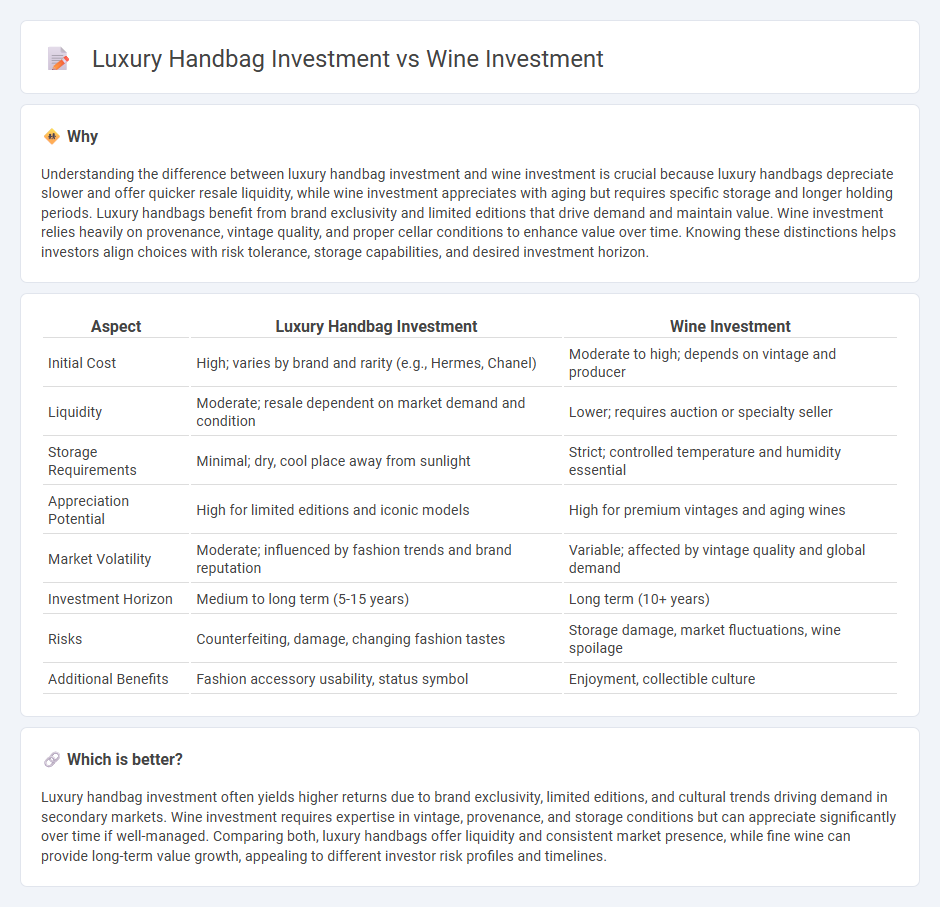

Understanding the difference between luxury handbag investment and wine investment is crucial because luxury handbags depreciate slower and offer quicker resale liquidity, while wine investment appreciates with aging but requires specific storage and longer holding periods. Luxury handbags benefit from brand exclusivity and limited editions that drive demand and maintain value. Wine investment relies heavily on provenance, vintage quality, and proper cellar conditions to enhance value over time. Knowing these distinctions helps investors align choices with risk tolerance, storage capabilities, and desired investment horizon.

Comparison Table

| Aspect | Luxury Handbag Investment | Wine Investment |

|---|---|---|

| Initial Cost | High; varies by brand and rarity (e.g., Hermes, Chanel) | Moderate to high; depends on vintage and producer |

| Liquidity | Moderate; resale dependent on market demand and condition | Lower; requires auction or specialty seller |

| Storage Requirements | Minimal; dry, cool place away from sunlight | Strict; controlled temperature and humidity essential |

| Appreciation Potential | High for limited editions and iconic models | High for premium vintages and aging wines |

| Market Volatility | Moderate; influenced by fashion trends and brand reputation | Variable; affected by vintage quality and global demand |

| Investment Horizon | Medium to long term (5-15 years) | Long term (10+ years) |

| Risks | Counterfeiting, damage, changing fashion tastes | Storage damage, market fluctuations, wine spoilage |

| Additional Benefits | Fashion accessory usability, status symbol | Enjoyment, collectible culture |

Which is better?

Luxury handbag investment often yields higher returns due to brand exclusivity, limited editions, and cultural trends driving demand in secondary markets. Wine investment requires expertise in vintage, provenance, and storage conditions but can appreciate significantly over time if well-managed. Comparing both, luxury handbags offer liquidity and consistent market presence, while fine wine can provide long-term value growth, appealing to different investor risk profiles and timelines.

Connection

Luxury handbag investment and wine investment both capitalize on rarity and provenance to drive value appreciation over time. Limited edition handbags from iconic brands and vintage wines from renowned vineyards share a strong secondary market where authenticity and condition significantly impact resale prices. Collectors in these markets benefit from expert knowledge, proper storage, and market trends to maximize returns on their investments.

Key Terms

Wine investment:

Investing in fine wine offers unique advantages such as tangibility, scarcity, and the potential for value appreciation due to vintage quality and aging potential. Unlike luxury handbags, wine investment markets are driven by critical reviews, auction prices, and global consumption trends, providing data-backed stability and diversification. Discover how wine investment can enhance your portfolio and appreciate over time by exploring market insights and expert guidance.

Provenance

Provenance plays a crucial role in both wine and luxury handbag investments, as the documented history significantly affects their value and authenticity. Wine investors rely on detailed records of vineyard origin, vintage, and storage conditions, while handbag collectors prioritize proof of purchase, limited edition status, and brand heritage. Discover the importance of provenance in securing your investment's future and maximizing returns.

Vintage

Vintage wine investment offers the potential for significant appreciation by leveraging factors such as rarity, provenance, and optimal storage conditions, with classic labels like Bordeaux or Burgundy commanding premium prices. Luxury handbag investment, particularly vintage pieces from brands like Hermes or Chanel, benefits from limited production runs, iconic designs, and proven resale value in secondary markets. Explore the distinct advantages and challenges of both investment types to make an informed decision.

Source and External Links

Getting Started with Wine Investments | Wine Folly - Investment wine should be age-worthy and in demand, with the most sought-after types being fine Bordeaux and Grand Cru Burgundy; investing typically involves buying by the case and ensuring provenance, with other notable options including Napa Cabernet and tete de cuvee Champagne.

Wine Investment | Investing in Fine Wines - Cru Wine - Fine wine is a stable, tangible asset providing long-term growth and portfolio diversification, supported by global demand, finite supply, and specialized management with insured bonded storage.

Evaluating the Investment Performance of Fine Wine: Returns and ... - Fine wine investment has averaged about 10% annual returns since 1988, with more consistent gains over 5+ years, and the market is increasingly diverse beyond Bordeaux, including Burgundy, Italy, Champagne, and others.

dowidth.com

dowidth.com