Art flipping involves purchasing artworks with the intent to resell at a profit, often benefiting from market trends and artist reputation, while watch flipping focuses on acquiring luxury timepieces, leveraging brand exclusivity and limited editions to drive resale value. Both investment strategies require market knowledge, timing, and authenticity verification to maximize returns. Explore the nuances of art flipping and watch flipping to determine which aligns best with your investment goals.

Why it is important

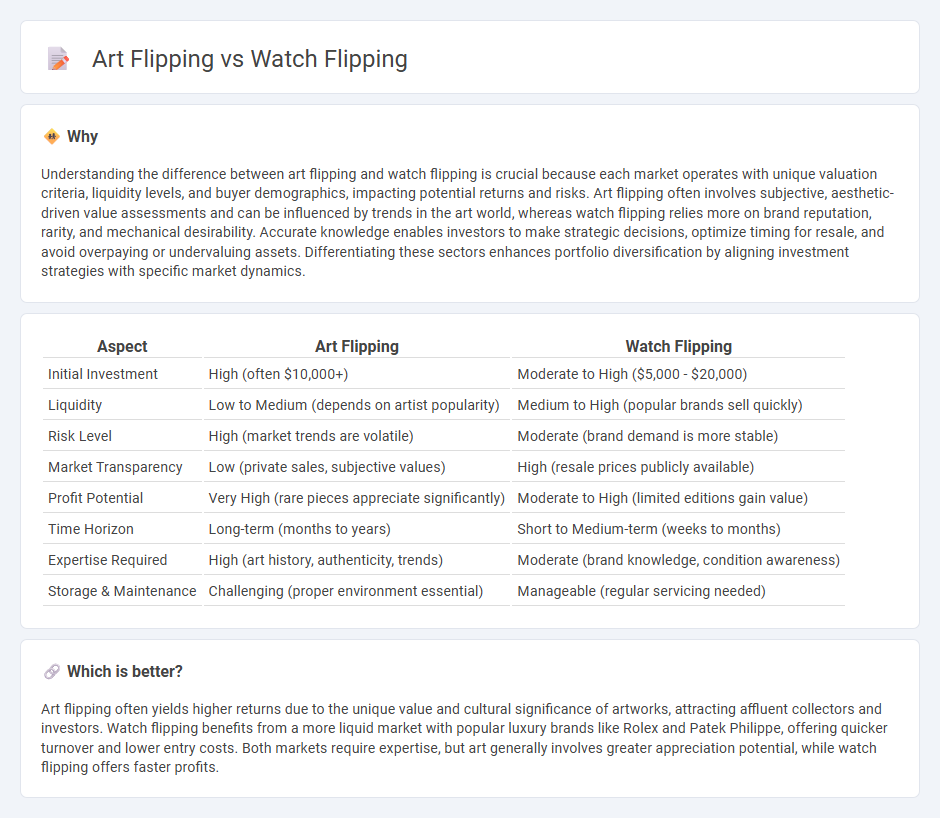

Understanding the difference between art flipping and watch flipping is crucial because each market operates with unique valuation criteria, liquidity levels, and buyer demographics, impacting potential returns and risks. Art flipping often involves subjective, aesthetic-driven value assessments and can be influenced by trends in the art world, whereas watch flipping relies more on brand reputation, rarity, and mechanical desirability. Accurate knowledge enables investors to make strategic decisions, optimize timing for resale, and avoid overpaying or undervaluing assets. Differentiating these sectors enhances portfolio diversification by aligning investment strategies with specific market dynamics.

Comparison Table

| Aspect | Art Flipping | Watch Flipping |

|---|---|---|

| Initial Investment | High (often $10,000+) | Moderate to High ($5,000 - $20,000) |

| Liquidity | Low to Medium (depends on artist popularity) | Medium to High (popular brands sell quickly) |

| Risk Level | High (market trends are volatile) | Moderate (brand demand is more stable) |

| Market Transparency | Low (private sales, subjective values) | High (resale prices publicly available) |

| Profit Potential | Very High (rare pieces appreciate significantly) | Moderate to High (limited editions gain value) |

| Time Horizon | Long-term (months to years) | Short to Medium-term (weeks to months) |

| Expertise Required | High (art history, authenticity, trends) | Moderate (brand knowledge, condition awareness) |

| Storage & Maintenance | Challenging (proper environment essential) | Manageable (regular servicing needed) |

Which is better?

Art flipping often yields higher returns due to the unique value and cultural significance of artworks, attracting affluent collectors and investors. Watch flipping benefits from a more liquid market with popular luxury brands like Rolex and Patek Philippe, offering quicker turnover and lower entry costs. Both markets require expertise, but art generally involves greater appreciation potential, while watch flipping offers faster profits.

Connection

Art flipping and watch flipping both capitalize on the appreciation of luxury assets in niche markets, leveraging trends and limited editions to generate profits. Investors analyze provenance, rarity, and market demand, using platforms like auction houses and online marketplaces to buy low and sell high. This speculative approach relies on deep market knowledge and timing to maximize returns within volatile yet lucrative investment sectors.

Key Terms

Liquidity

Watch flipping offers higher liquidity due to a globally active market with rapid transaction speeds and consistent demand for luxury timepieces, especially rare models from brands like Rolex and Patek Philippe. Art flipping, while potentially lucrative, faces lower liquidity because artworks often require longer sales cycles and depend on auction houses or private collectors, making transactions less frequent and more complex. Explore more about the liquidity dynamics in watch and art flipping to make informed investment choices.

Provenance

Watch flipping centers on acquiring timepieces with verified provenance, ensuring authenticity and potential value appreciation in resale markets. Art flipping leverages documented provenance to validate originality and establish historical significance, directly influencing market price and investor confidence. Explore deeper insights into how provenance shapes value in watch and art flipping markets.

Market volatility

Watch flipping involves buying and reselling luxury timepieces quickly to capitalize on market demand fluctuations, making it highly sensitive to short-term market volatility and trends. Art flipping, while also subject to market shifts, typically experiences slower volatility due to appraisal processes and auction cycles that affect artwork prices over longer periods. Explore the dynamics of these markets further to understand how volatility impacts investment strategies in watch and art flipping.

Source and External Links

eBay Watch Flipping Made Easy: Repair, List, Profit - A practical guide showing how to add profit by simple repairs like battery and band replacements before flipping watches on eBay, including how to properly close the watch after repair for selling.

How to flip watches for beginners: Turning timepieces into ... - Explains watch flipping as buying watches (often luxury or limited editions) at retail or below and reselling quickly for profit, emphasizing the importance of targeting high-demand brands and understanding the difference between flipping and reselling.

{GUIDE} How To Start Flipping Watches For Profit - A guide recommending starting with brands like Seiko, focusing on older limited editions and using sites like eBay and Chrono24 to analyze pricing and profit potential when flipping watches.

dowidth.com

dowidth.com