Tax lien certificates offer investors secured debt positions with fixed returns backed by property taxes, providing a lower-risk, income-generating investment. Private equity involves acquiring equity stakes in private companies, aiming for higher returns through business growth and operational improvements, but with increased risk and less liquidity. Explore the fundamental differences and benefits of tax lien certificates versus private equity to determine the best fit for your investment goals.

Why it is important

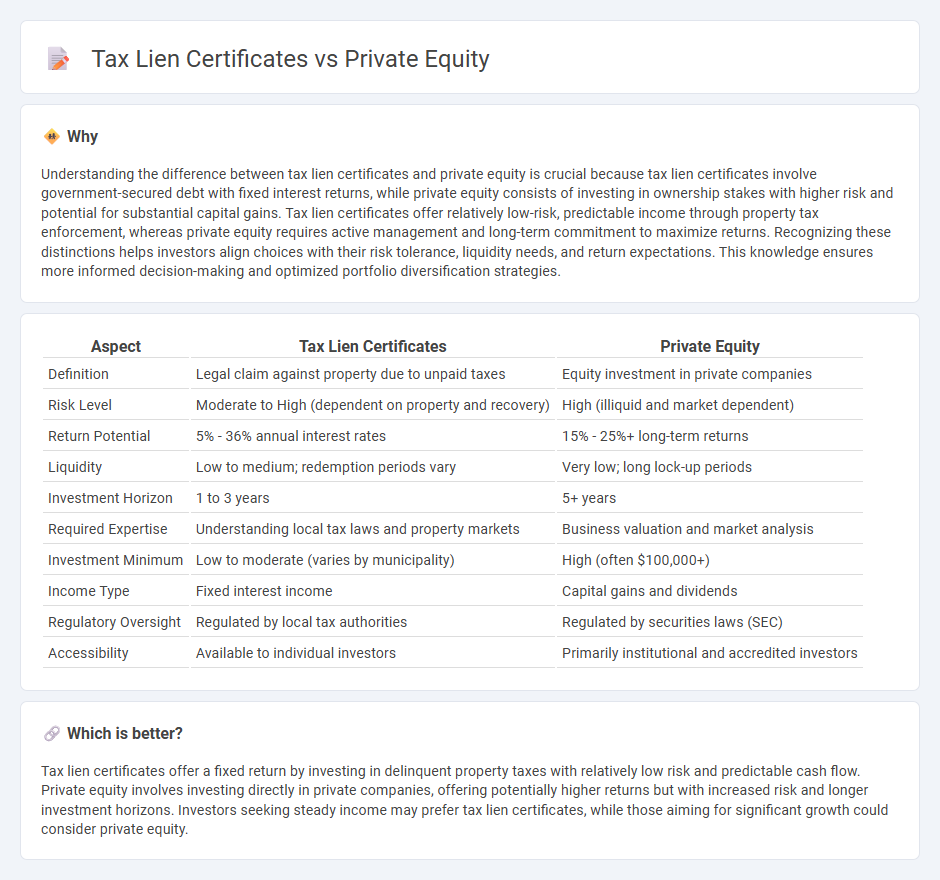

Understanding the difference between tax lien certificates and private equity is crucial because tax lien certificates involve government-secured debt with fixed interest returns, while private equity consists of investing in ownership stakes with higher risk and potential for substantial capital gains. Tax lien certificates offer relatively low-risk, predictable income through property tax enforcement, whereas private equity requires active management and long-term commitment to maximize returns. Recognizing these distinctions helps investors align choices with their risk tolerance, liquidity needs, and return expectations. This knowledge ensures more informed decision-making and optimized portfolio diversification strategies.

Comparison Table

| Aspect | Tax Lien Certificates | Private Equity |

|---|---|---|

| Definition | Legal claim against property due to unpaid taxes | Equity investment in private companies |

| Risk Level | Moderate to High (dependent on property and recovery) | High (illiquid and market dependent) |

| Return Potential | 5% - 36% annual interest rates | 15% - 25%+ long-term returns |

| Liquidity | Low to medium; redemption periods vary | Very low; long lock-up periods |

| Investment Horizon | 1 to 3 years | 5+ years |

| Required Expertise | Understanding local tax laws and property markets | Business valuation and market analysis |

| Investment Minimum | Low to moderate (varies by municipality) | High (often $100,000+) |

| Income Type | Fixed interest income | Capital gains and dividends |

| Regulatory Oversight | Regulated by local tax authorities | Regulated by securities laws (SEC) |

| Accessibility | Available to individual investors | Primarily institutional and accredited investors |

Which is better?

Tax lien certificates offer a fixed return by investing in delinquent property taxes with relatively low risk and predictable cash flow. Private equity involves investing directly in private companies, offering potentially higher returns but with increased risk and longer investment horizons. Investors seeking steady income may prefer tax lien certificates, while those aiming for significant growth could consider private equity.

Connection

Tax lien certificates provide private equity investors with alternative investment opportunities by offering secured interests in property tax debts. Private equity firms actively target tax lien certificates to diversify portfolios and generate high-yield returns through the foreclosure process or redemption payments. This strategy leverages the intersection of real estate and private debt markets, enhancing capital growth potential within private equity frameworks.

Key Terms

Ownership Stake

Private equity investments involve acquiring an ownership stake in a company, granting investors voting rights and potential profit sharing based on company performance. In contrast, tax lien certificates represent a secured claim against a property for unpaid taxes, without conferring any ownership or control over the property unless foreclosure occurs. Explore the nuanced differences and strategic implications between these investment types to enhance your portfolio understanding.

Asset-backed Security

Private equity investments involve acquiring ownership stakes in companies, often aiming for high returns through business growth or restructuring, while tax lien certificates are asset-backed securities representing claims on properties with unpaid taxes, providing secured income through interest and potential property acquisition. Tax lien certificates offer a more secured investment profile backed by real estate assets, whereas private equity carries higher risk tied to company performance and market conditions. Explore the nuances of asset-backed securities in both strategies to optimize your investment portfolio.

Risk Profile

Private equity investments typically involve higher risk due to market volatility and the long-term commitment required, with returns dependent on company performance and economic conditions. Tax lien certificates offer a different risk profile, being secured by property and potentially providing steady interest payments, but carry the risk of property redemption or foreclosure processes. Explore more about the comparative risk profiles of private equity and tax lien certificates to make informed investment decisions.

Source and External Links

What is Private Equity? - BVCA - Private equity involves medium- to long-term investments in unquoted companies, usually supporting management buyouts or buy-ins, with investors working closely alongside management to drive growth, improve operations, and maximize value before exiting their stake after several years.

Private equity - Wikipedia - Private equity refers to equity investments in companies not publicly traded, typically held by specialized investment funds that use a combination of debt and equity to acquire stakes, aiming to enhance performance and returns through operational improvements, revenue growth, margin expansion, and eventual exit strategies.

Private Equity: What You Need to Know - KKR - Private equity funds invest in private companies, actively engaging in management to strengthen teams, optimize operations, expand into new markets, and refine business strategies, seeking to outperform public markets and diversify investment portfolios.

dowidth.com

dowidth.com