Wine investing offers tangible assets with potential for appreciation based on vintage rarity, provenance, and storage conditions, appealing to enthusiasts and collectors. Antique investing involves acquiring historically significant artifacts whose value appreciates due to age, craftsmanship, and cultural relevance. Explore the nuances of each investment to determine which aligns best with your financial goals and interests.

Why it is important

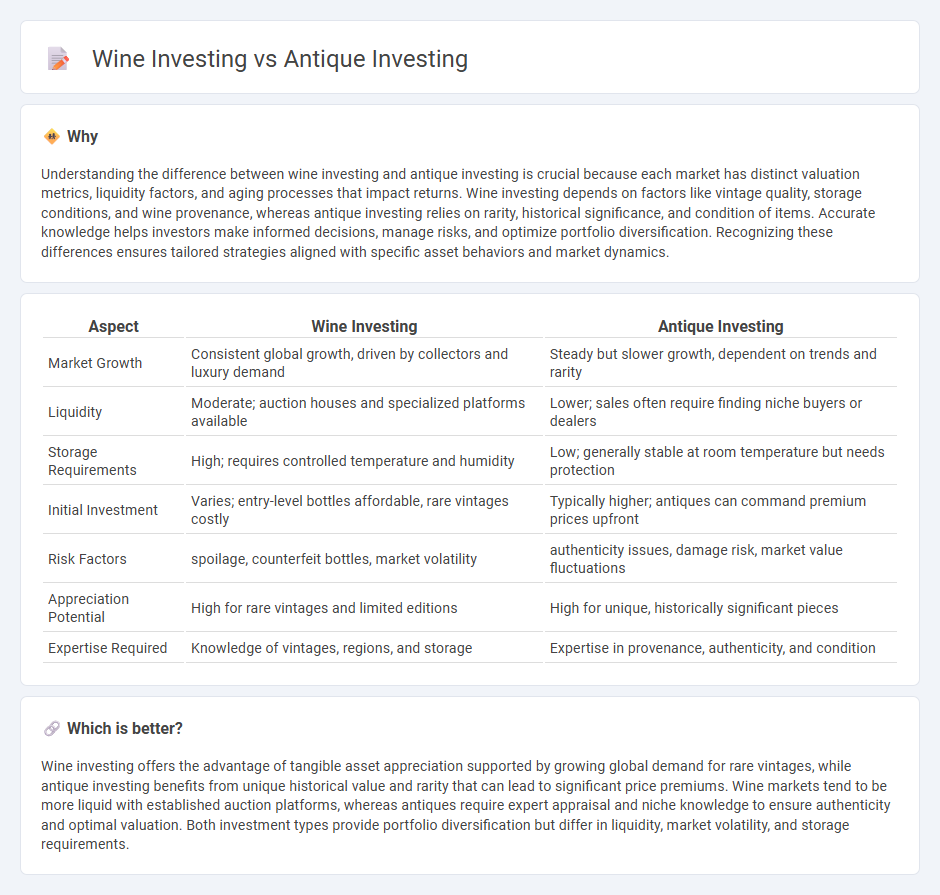

Understanding the difference between wine investing and antique investing is crucial because each market has distinct valuation metrics, liquidity factors, and aging processes that impact returns. Wine investing depends on factors like vintage quality, storage conditions, and wine provenance, whereas antique investing relies on rarity, historical significance, and condition of items. Accurate knowledge helps investors make informed decisions, manage risks, and optimize portfolio diversification. Recognizing these differences ensures tailored strategies aligned with specific asset behaviors and market dynamics.

Comparison Table

| Aspect | Wine Investing | Antique Investing |

|---|---|---|

| Market Growth | Consistent global growth, driven by collectors and luxury demand | Steady but slower growth, dependent on trends and rarity |

| Liquidity | Moderate; auction houses and specialized platforms available | Lower; sales often require finding niche buyers or dealers |

| Storage Requirements | High; requires controlled temperature and humidity | Low; generally stable at room temperature but needs protection |

| Initial Investment | Varies; entry-level bottles affordable, rare vintages costly | Typically higher; antiques can command premium prices upfront |

| Risk Factors | spoilage, counterfeit bottles, market volatility | authenticity issues, damage risk, market value fluctuations |

| Appreciation Potential | High for rare vintages and limited editions | High for unique, historically significant pieces |

| Expertise Required | Knowledge of vintages, regions, and storage | Expertise in provenance, authenticity, and condition |

Which is better?

Wine investing offers the advantage of tangible asset appreciation supported by growing global demand for rare vintages, while antique investing benefits from unique historical value and rarity that can lead to significant price premiums. Wine markets tend to be more liquid with established auction platforms, whereas antiques require expert appraisal and niche knowledge to ensure authenticity and optimal valuation. Both investment types provide portfolio diversification but differ in liquidity, market volatility, and storage requirements.

Connection

Wine investing and antique investing both capitalize on the increasing value of rare and historically significant assets, driven by scarcity and cultural appreciation. Collectors and investors benefit from market trends where provenance, condition, and age significantly influence valuation, creating parallel investment strategies in these tangible assets. Both markets require expertise in authentication and long-term preservation to maximize returns and mitigate risks.

Key Terms

**Antique investing:**

Antique investing offers long-term value appreciation due to rarity, historical significance, and craftsmanship, often outperforming traditional assets during market volatility. High-demand categories include vintage furniture, collectible ceramics, and rare artworks, with provenance playing a crucial role in valuation. Explore how antiques can diversify your portfolio and preserve wealth by diving deeper into this unique investment avenue.

Provenance

Provenance plays a critical role in both antique and wine investing, as documented history significantly enhances the value and authenticity of these assets. Antique investors prioritize detailed ownership records, restoration history, and exhibition provenance to verify originality and increase market desirability. Explore these provenance factors further to make informed decisions in antique and wine investment portfolios.

Rarity

Antique investing capitalizes on the rarity of unique historical artifacts and limited-edition pieces that appreciate over time due to their scarcity and cultural significance. Wine investing focuses on rare vintages from prestigious vineyards, where limited production and exceptional terroir create valuable, collectible bottles. Explore the intricacies of rarity in antique and wine investments to optimize your portfolio growth.

Source and External Links

Complete Guide to Antique Investing: Expert Strategies for 2025 - Investing in high-quality antiques such as fine silver, designer jewelry, and rare decorative objects can provide long-term appreciation and a unique, tangible asset to enjoy in your home, with the antiques market showing consistent resilience and outperforming many traditional investments over time.

10 Types of Antiques to Consider for an Investment - SmartAsset - Popular antique investment categories include furniture, jewelry, and coins, with emphasis on quality, historical significance, and market demand to maximize appreciation and diversification, and financial advisors can help tailor these investments to your portfolio and risk tolerance.

ANTIQUES AS AN ASSET: THE RISE OF THE VINTAGE INVESTMENT - Antiques are increasingly valued not only for their aesthetics but also as tangible, physical assets offering diversification from volatile financial markets, combining cultural significance and rarity with potential financial returns, making them an appealing investment option for a broader range of investors.

dowidth.com

dowidth.com