Social token investment focuses on buying tokens that represent personal brands, communities, or influencers, offering direct engagement and potential rewards tied to social value. DAO investment involves purchasing tokens that grant governance rights in decentralized autonomous organizations, enabling holders to vote on decisions and share in collective profits. Explore the distinct benefits and risks of social token and DAO investments to make informed decisions.

Why it is important

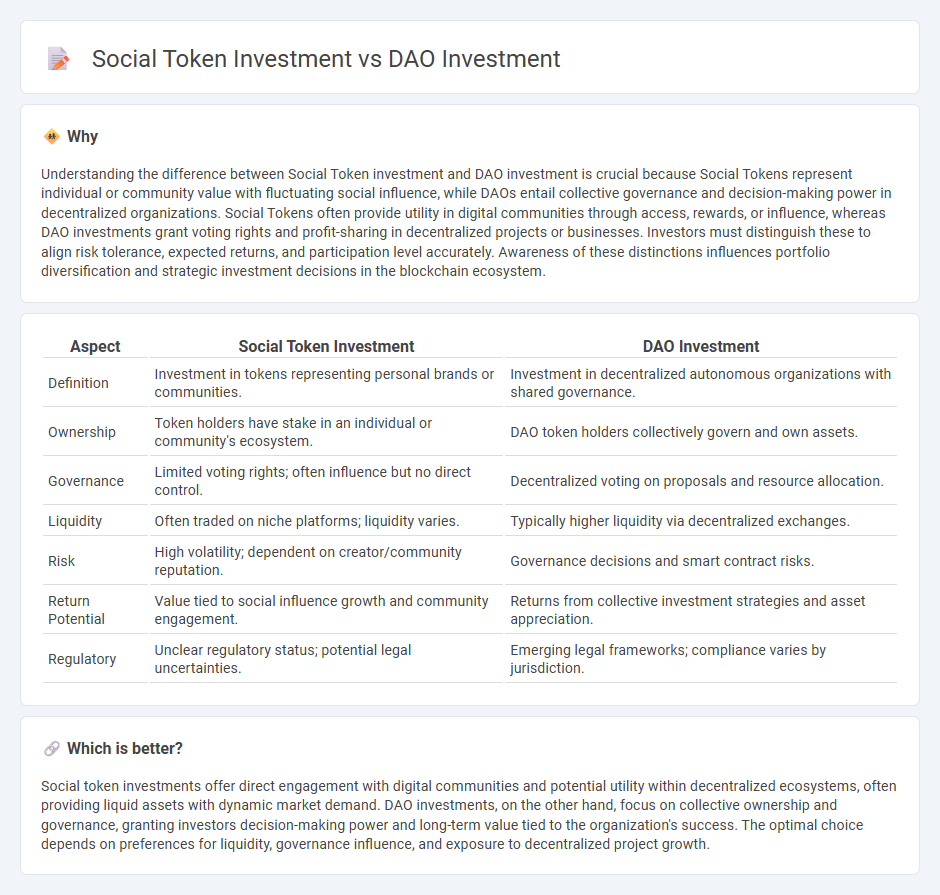

Understanding the difference between Social Token investment and DAO investment is crucial because Social Tokens represent individual or community value with fluctuating social influence, while DAOs entail collective governance and decision-making power in decentralized organizations. Social Tokens often provide utility in digital communities through access, rewards, or influence, whereas DAO investments grant voting rights and profit-sharing in decentralized projects or businesses. Investors must distinguish these to align risk tolerance, expected returns, and participation level accurately. Awareness of these distinctions influences portfolio diversification and strategic investment decisions in the blockchain ecosystem.

Comparison Table

| Aspect | Social Token Investment | DAO Investment |

|---|---|---|

| Definition | Investment in tokens representing personal brands or communities. | Investment in decentralized autonomous organizations with shared governance. |

| Ownership | Token holders have stake in an individual or community's ecosystem. | DAO token holders collectively govern and own assets. |

| Governance | Limited voting rights; often influence but no direct control. | Decentralized voting on proposals and resource allocation. |

| Liquidity | Often traded on niche platforms; liquidity varies. | Typically higher liquidity via decentralized exchanges. |

| Risk | High volatility; dependent on creator/community reputation. | Governance decisions and smart contract risks. |

| Return Potential | Value tied to social influence growth and community engagement. | Returns from collective investment strategies and asset appreciation. |

| Regulatory | Unclear regulatory status; potential legal uncertainties. | Emerging legal frameworks; compliance varies by jurisdiction. |

Which is better?

Social token investments offer direct engagement with digital communities and potential utility within decentralized ecosystems, often providing liquid assets with dynamic market demand. DAO investments, on the other hand, focus on collective ownership and governance, granting investors decision-making power and long-term value tied to the organization's success. The optimal choice depends on preferences for liquidity, governance influence, and exposure to decentralized project growth.

Connection

Social token investment and DAO investment intersect through decentralized finance mechanisms that empower community-driven value creation and governance. Social tokens, often issued by creators or communities, function as digital assets representing membership or influence, which can be integrated within DAOs to facilitate collective decision-making and resource allocation. This synergy enhances liquidity and engagement, enabling investors to participate actively in both the economic and managerial aspects of decentralized projects.

Key Terms

DAO investment:

DAO investment leverages decentralized autonomous organizations to provide collective decision-making and governance, allowing investors to participate directly in project development and profit-sharing. Unlike social token investment, which primarily centers on community engagement and influencer-driven value, DAO investment offers structured voting power and transparent asset management on blockchain platforms. Explore the intricacies of DAO investment to understand its potential impact on decentralized finance and beyond.

Governance

DAO investment prioritizes decentralized governance where token holders collectively make decisions, ensuring transparency and equal participation. Social token investment often blends governance with personal brand engagement, allowing communities to influence content and project evolution. Explore the key governance mechanisms to understand which investment aligns with your goals.

Treasury

DAO investment focuses on collective governance and transparent treasury management, enabling stakeholders to directly influence fund allocation through voting mechanisms. Social token investment revolves around utility within a community, where tokens often represent reputational value and provide access to exclusive experiences or rewards, with treasury roles varying widely between projects. Explore the differences in treasury functions and investment strategies to optimize your participation in decentralized ecosystems.

Source and External Links

Investment DAOs - Investment DAOs are decentralized autonomous organizations that raise and invest capital into various assets on behalf of their members, often using governance tokens and NFTs to facilitate participation and fundraising.

Best DAO Projects to Invest in 2025 - This resource highlights top DAO projects in 2025, including those involved in decentralized finance and governance, offering potential investment opportunities in a community-driven format.

Best Investment DAOs Rated - This list provides a full overview of investment DAOs, which are decentralized organizations that collaboratively research and decide on investment opportunities, distributing returns among members based on their contributions.

dowidth.com

dowidth.com