Laddered bond ETFs provide a structured investment approach by holding bonds with staggered maturities, reducing interest rate risk and offering predictable income streams. Actively managed bond ETFs rely on professional portfolio managers who adjust holdings based on market conditions to seek higher returns or mitigate risks. Explore the detailed differences and benefits to determine which bond ETF strategy aligns with your financial goals.

Why it is important

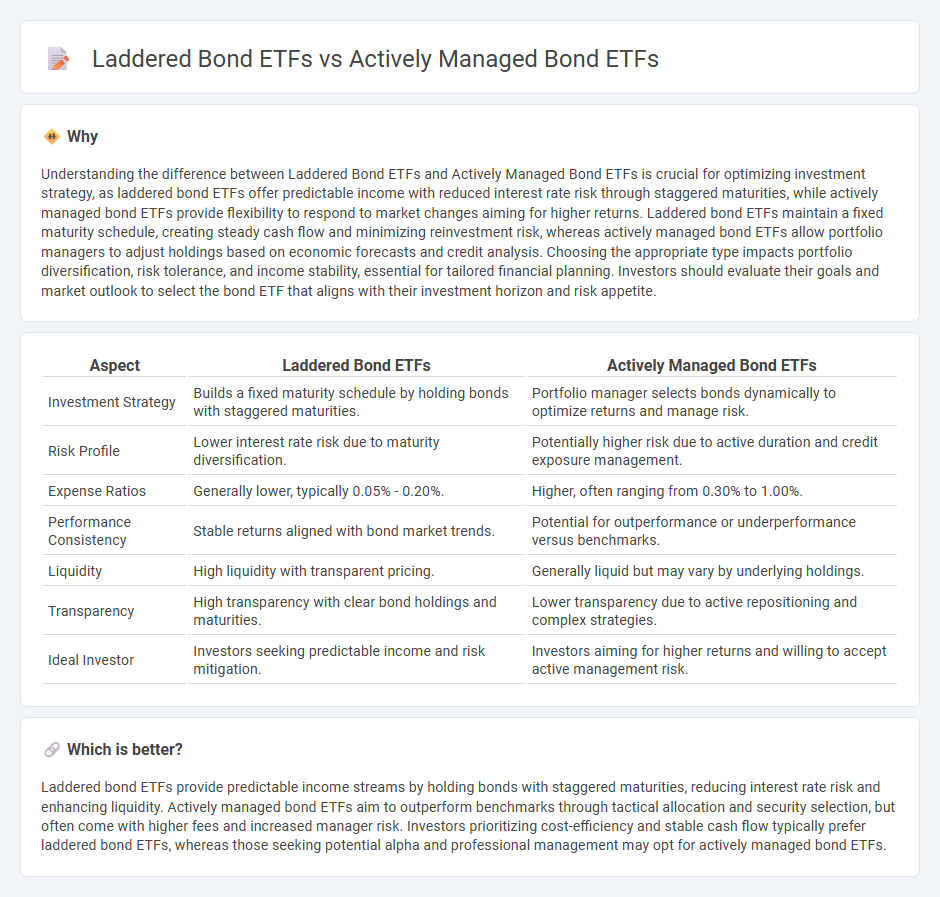

Understanding the difference between Laddered Bond ETFs and Actively Managed Bond ETFs is crucial for optimizing investment strategy, as laddered bond ETFs offer predictable income with reduced interest rate risk through staggered maturities, while actively managed bond ETFs provide flexibility to respond to market changes aiming for higher returns. Laddered bond ETFs maintain a fixed maturity schedule, creating steady cash flow and minimizing reinvestment risk, whereas actively managed bond ETFs allow portfolio managers to adjust holdings based on economic forecasts and credit analysis. Choosing the appropriate type impacts portfolio diversification, risk tolerance, and income stability, essential for tailored financial planning. Investors should evaluate their goals and market outlook to select the bond ETF that aligns with their investment horizon and risk appetite.

Comparison Table

| Aspect | Laddered Bond ETFs | Actively Managed Bond ETFs |

|---|---|---|

| Investment Strategy | Builds a fixed maturity schedule by holding bonds with staggered maturities. | Portfolio manager selects bonds dynamically to optimize returns and manage risk. |

| Risk Profile | Lower interest rate risk due to maturity diversification. | Potentially higher risk due to active duration and credit exposure management. |

| Expense Ratios | Generally lower, typically 0.05% - 0.20%. | Higher, often ranging from 0.30% to 1.00%. |

| Performance Consistency | Stable returns aligned with bond market trends. | Potential for outperformance or underperformance versus benchmarks. |

| Liquidity | High liquidity with transparent pricing. | Generally liquid but may vary by underlying holdings. |

| Transparency | High transparency with clear bond holdings and maturities. | Lower transparency due to active repositioning and complex strategies. |

| Ideal Investor | Investors seeking predictable income and risk mitigation. | Investors aiming for higher returns and willing to accept active management risk. |

Which is better?

Laddered bond ETFs provide predictable income streams by holding bonds with staggered maturities, reducing interest rate risk and enhancing liquidity. Actively managed bond ETFs aim to outperform benchmarks through tactical allocation and security selection, but often come with higher fees and increased manager risk. Investors prioritizing cost-efficiency and stable cash flow typically prefer laddered bond ETFs, whereas those seeking potential alpha and professional management may opt for actively managed bond ETFs.

Connection

Laddered bond ETFs and actively managed bond ETFs are connected through their shared focus on bond investments, but they differ in strategy and risk management. Laddered bond ETFs employ a fixed maturity schedule to reduce interest rate risk and provide predictable income streams, while actively managed bond ETFs rely on portfolio managers to adjust holdings based on market conditions and interest rate forecasts. Both types aim to diversify bond exposure but offer varying degrees of flexibility and potential returns depending on investor objectives.

Key Terms

Portfolio Management Style

Actively managed bond ETFs employ portfolio managers who continuously analyze market trends, interest rate movements, and credit risks to make dynamic adjustments, aiming to outperform benchmark indices. Laddered bond ETFs utilize a passive strategy by holding bonds with staggered maturities, providing consistent income streams and mitigating interest rate risk through a structured maturation schedule. Explore more about which portfolio management style aligns with your investment goals and risk tolerance.

Interest Rate Risk

Actively managed bond ETFs adjust portfolio holdings in response to changing interest rate environments, aiming to minimize interest rate risk and optimize returns. Laddered bond ETFs spread maturity dates across a range of bonds to reduce sensitivity to interest rate fluctuations by staggering principal repayments. Discover the best strategy to manage interest rate risk suited for your investment goals.

Liquidity

Actively managed bond ETFs offer enhanced liquidity through dynamic portfolio adjustments, enabling investors to respond swiftly to market changes. Laddered bond ETFs provide predictable cash flows and mitigate interest rate risk via staggered maturities but may face lower liquidity in secondary markets. Explore our detailed comparison to understand which strategy best suits your investment goals.

Source and External Links

Why active ETFs matter in fixed income investing - Actively managed bond ETFs can provide portfolio diversification, potential return enhancements, and regular income, especially valuable in complex and uncertain market environments where active bond selection can offset index limitations.

Investors Turn to Actively Managed Bond ETFs in March - JPMorgan offers actively managed bond ETFs like the Ultra-Short Income ETF and the Ultra-Short Municipal Income ETF that use professional insight to manage duration and credit exposures, offering diversification, income, and potentially favorable tax profiles within short-duration bonds.

Why you should consider active fixed income ETFs - Active fixed income ETFs provide advantages such as intraday trading, tax efficiency, portfolio transparency, enhanced liquidity, diversification beyond indexes, and the potential to outperform benchmarks through active professional oversight.

dowidth.com

dowidth.com