Flash loan attacks exploit decentralized finance protocols by borrowing vast amounts instantly without collateral, enabling rapid price manipulation or asset draining. Whale manipulation involves influential investors leveraging large holdings to sway market prices, often triggering panic selling or buying. Explore detailed strategies and risks behind flash loan attacks and whale manipulation to safeguard your investments.

Why it is important

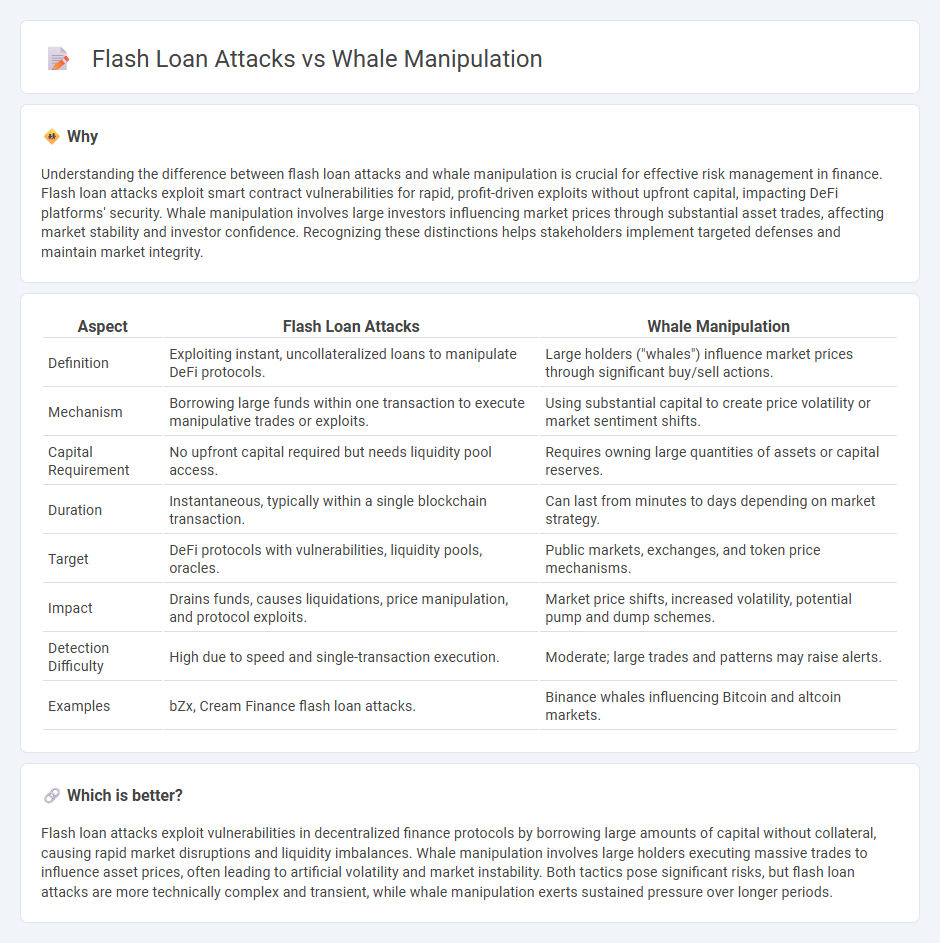

Understanding the difference between flash loan attacks and whale manipulation is crucial for effective risk management in finance. Flash loan attacks exploit smart contract vulnerabilities for rapid, profit-driven exploits without upfront capital, impacting DeFi platforms' security. Whale manipulation involves large investors influencing market prices through substantial asset trades, affecting market stability and investor confidence. Recognizing these distinctions helps stakeholders implement targeted defenses and maintain market integrity.

Comparison Table

| Aspect | Flash Loan Attacks | Whale Manipulation |

|---|---|---|

| Definition | Exploiting instant, uncollateralized loans to manipulate DeFi protocols. | Large holders ("whales") influence market prices through significant buy/sell actions. |

| Mechanism | Borrowing large funds within one transaction to execute manipulative trades or exploits. | Using substantial capital to create price volatility or market sentiment shifts. |

| Capital Requirement | No upfront capital required but needs liquidity pool access. | Requires owning large quantities of assets or capital reserves. |

| Duration | Instantaneous, typically within a single blockchain transaction. | Can last from minutes to days depending on market strategy. |

| Target | DeFi protocols with vulnerabilities, liquidity pools, oracles. | Public markets, exchanges, and token price mechanisms. |

| Impact | Drains funds, causes liquidations, price manipulation, and protocol exploits. | Market price shifts, increased volatility, potential pump and dump schemes. |

| Detection Difficulty | High due to speed and single-transaction execution. | Moderate; large trades and patterns may raise alerts. |

| Examples | bZx, Cream Finance flash loan attacks. | Binance whales influencing Bitcoin and altcoin markets. |

Which is better?

Flash loan attacks exploit vulnerabilities in decentralized finance protocols by borrowing large amounts of capital without collateral, causing rapid market disruptions and liquidity imbalances. Whale manipulation involves large holders executing massive trades to influence asset prices, often leading to artificial volatility and market instability. Both tactics pose significant risks, but flash loan attacks are more technically complex and transient, while whale manipulation exerts sustained pressure over longer periods.

Connection

Flash loan attacks exploit temporary, unsecured loans to manipulate asset prices within decentralized finance (DeFi) platforms, allowing attackers to trigger significant market shifts without upfront capital. Whale manipulation involves large holders using substantial cryptocurrency volumes to influence market prices, often amplifying volatility in affected assets. Both tactics leverage rapid liquidity movements to distort market dynamics, undermining price stability in blockchain-based financial ecosystems.

Key Terms

Liquidity

Whale manipulation exploits large cryptocurrency holders who influence market prices by executing substantial buy or sell orders, causing liquidity fluctuations and price volatility. Flash loan attacks leverage instant, uncollateralized loans to manipulate DeFi protocol liquidity pools, creating temporary imbalances for profit extraction. Explore detailed comparisons of whale manipulation and flash loan strategies to understand their impact on market liquidity dynamics.

Leverage

Whale manipulation exploits the market power of large holders to influence asset prices by executing substantial trades, while flash loan attacks leverage instant, uncollateralized borrowing to manipulate liquidity pools within a single transaction. Both tactics significantly affect decentralized finance (DeFi) markets, with leverage amplifying their impact by enabling massive position sizes relative to collateral. Explore detailed mechanisms and prevention strategies to better understand how leverage shapes these exploit methods.

Market impact

Whale manipulation involves large holders executing trades to influence asset prices, often causing significant market volatility and shifting liquidity dynamics. Flash loan attacks exploit smart contract vulnerabilities with instant, high-volume loans, leading to rapid price distortions and arbitrage opportunities within decentralized finance (DeFi) platforms. Explore the detailed impact and mitigation strategies of these market manipulation tactics to better safeguard your digital assets.

Source and External Links

Here's how whales manipulate the market and take your ... - Whales manipulate cryptocurrency markets through tactics like spoofing, stop-loss hunting, wash trading, and front-running to artificially inflate or crash prices for profit.

8 Ways Crypto Whales Manipulate Markets - Crypto whales use methods such as spoofing, pump-and-dump schemes, wash trading, and liquidity pulling to control market psychology and prices, often exploiting their large asset holdings.

Whales, Wash Trading & Fake Pumps: How Crypto Market ... - Whales impact crypto prices by executing massive trades and using strategies like spoofing and wash trading to create false market activity and profit from induced price swings.

dowidth.com

dowidth.com