Flash loan attacks exploit unsecured, instant loans to manipulate decentralized finance (DeFi) protocols, causing significant financial losses by rapidly executing complex trades without upfront capital. Sandwich attacks target cryptocurrency traders by placing buy and sell orders around a victim's transaction to profit from price slippage, often harming the victim's trade execution. Explore more to understand the mechanics and defenses against these sophisticated DeFi exploits.

Why it is important

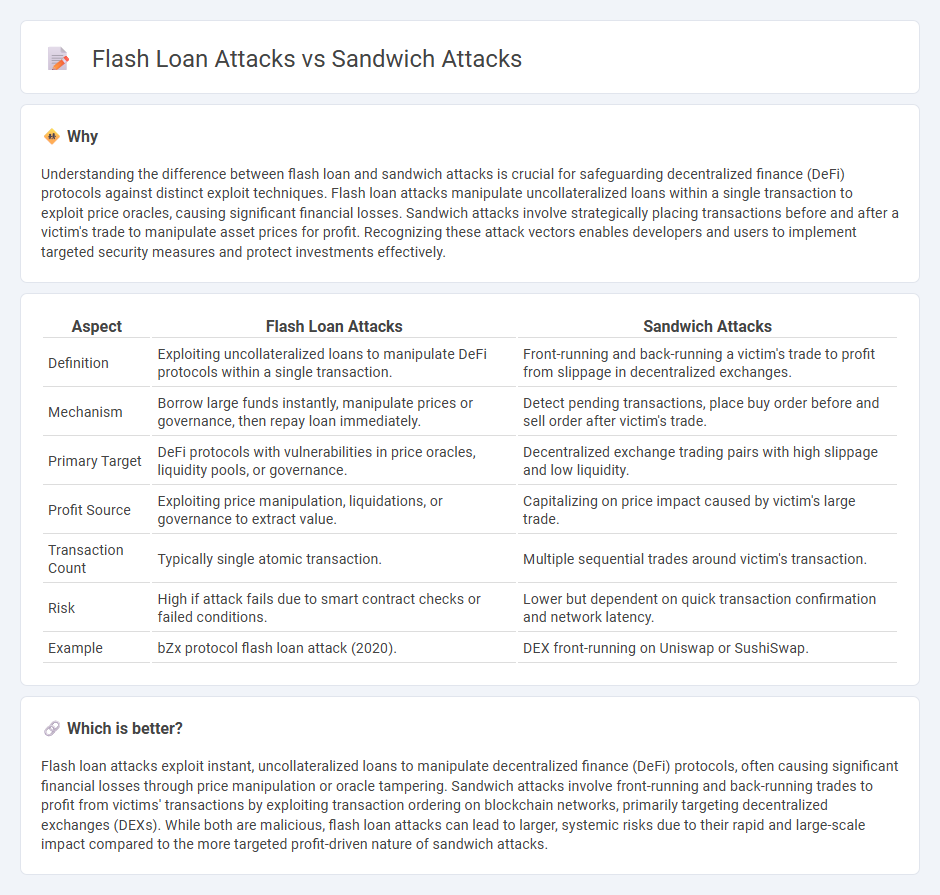

Understanding the difference between flash loan and sandwich attacks is crucial for safeguarding decentralized finance (DeFi) protocols against distinct exploit techniques. Flash loan attacks manipulate uncollateralized loans within a single transaction to exploit price oracles, causing significant financial losses. Sandwich attacks involve strategically placing transactions before and after a victim's trade to manipulate asset prices for profit. Recognizing these attack vectors enables developers and users to implement targeted security measures and protect investments effectively.

Comparison Table

| Aspect | Flash Loan Attacks | Sandwich Attacks |

|---|---|---|

| Definition | Exploiting uncollateralized loans to manipulate DeFi protocols within a single transaction. | Front-running and back-running a victim's trade to profit from slippage in decentralized exchanges. |

| Mechanism | Borrow large funds instantly, manipulate prices or governance, then repay loan immediately. | Detect pending transactions, place buy order before and sell order after victim's trade. |

| Primary Target | DeFi protocols with vulnerabilities in price oracles, liquidity pools, or governance. | Decentralized exchange trading pairs with high slippage and low liquidity. |

| Profit Source | Exploiting price manipulation, liquidations, or governance to extract value. | Capitalizing on price impact caused by victim's large trade. |

| Transaction Count | Typically single atomic transaction. | Multiple sequential trades around victim's transaction. |

| Risk | High if attack fails due to smart contract checks or failed conditions. | Lower but dependent on quick transaction confirmation and network latency. |

| Example | bZx protocol flash loan attack (2020). | DEX front-running on Uniswap or SushiSwap. |

Which is better?

Flash loan attacks exploit instant, uncollateralized loans to manipulate decentralized finance (DeFi) protocols, often causing significant financial losses through price manipulation or oracle tampering. Sandwich attacks involve front-running and back-running trades to profit from victims' transactions by exploiting transaction ordering on blockchain networks, primarily targeting decentralized exchanges (DEXs). While both are malicious, flash loan attacks can lead to larger, systemic risks due to their rapid and large-scale impact compared to the more targeted profit-driven nature of sandwich attacks.

Connection

Flash loan attacks exploit the instantaneous borrowing feature in decentralized finance (DeFi) to manipulate asset prices, enabling attackers to profit without upfront capital. Sandwich attacks involve front-running and back-running victim transactions in decentralized exchanges, often capitalizing on the price impact created by flash loan manipulations. Both attack types leverage DeFi's trustless and atomic transaction environment to execute complex arbitrage and market manipulation strategies within a single blockchain block.

Key Terms

Miner Extractable Value (MEV)

Miner Extractable Value (MEV) represents the profit miners can achieve by reordering, including, or censoring transactions within a blockchain block, with sandwich attacks exploiting MEV by placing buy and sell orders around a victim's transaction to capitalize on price slippage. Flash loan attacks utilize MEV by borrowing large, uncollateralized amounts instantly to manipulate the market or drain liquidity pools before repaying the loan within a single transaction, potentially destabilizing decentralized finance ecosystems. Explore how MEV-driven strategies like these impact blockchain security and DeFi protocols.

Slippage

Sandwich attacks manipulate transaction ordering in DeFi to exploit slippage by front-running and back-running victim trades, profiting from price differences caused by forced slippage. Flash loan attacks leverage instant, uncollateralized loans to manipulate market prices or exploit vulnerabilities within a single transaction, often amplifying slippage effects to maximize gains. Discover how understanding slippage intricacies can help mitigate risks in these types of DeFi attacks.

Liquidity

Sandwich attacks manipulate transaction ordering in decentralized finance to exploit liquidity pools by placing buy and sell orders around a victim's trade, profiting from price slippage. Flash loan attacks leverage uncollateralized loans to quickly drain or manipulate liquidity in DeFi protocols, often causing significant fund loss within a single transaction block. Explore how these attacks impact DeFi liquidity and the strategies to mitigate associated risks.

Source and External Links

What are Sandwich Attacks in DeFi? - Trust Wallet - Sandwich attacks in decentralized finance (DeFi) occur when an attacker places one transaction just before and one immediately after a victim's trade on a decentralized exchange, exploiting the victim's trade by causing price slippage and profiting from the price difference created; this leads to the victim receiving fewer tokens and causes market distortions.

What is a DeFi Sandwich Attack? - A DeFi sandwich attack exploits the publicly visible mempool of pending transactions by front-running a victim's trade with an increased gas fee to buy at a lower price before the victim's order executes, then back-running by selling the asset at a higher price after, profiting at the expense of the victim's slippage loss.

What is a Sandwich Attack? | CoW Protocol Documentation - Sandwich attacks trap a user's decentralized exchange transaction between two trader transactions, where the attacker buys before and sells after the victim's trade executes, capturing profits by pushing the asset price to the victim's slippage tolerance, resulting in the victim paying more for their purchase.

dowidth.com

dowidth.com