Private credit involves direct lending to companies, often providing flexible financing without public market access, while venture debt targets startups with growth potential, offering debt that complements venture capital equity. Both financing options serve different risk profiles and stages of business development, catering to companies seeking alternatives to traditional bank loans or equity financing. Explore more to understand which option aligns with your business financing needs.

Why it is important

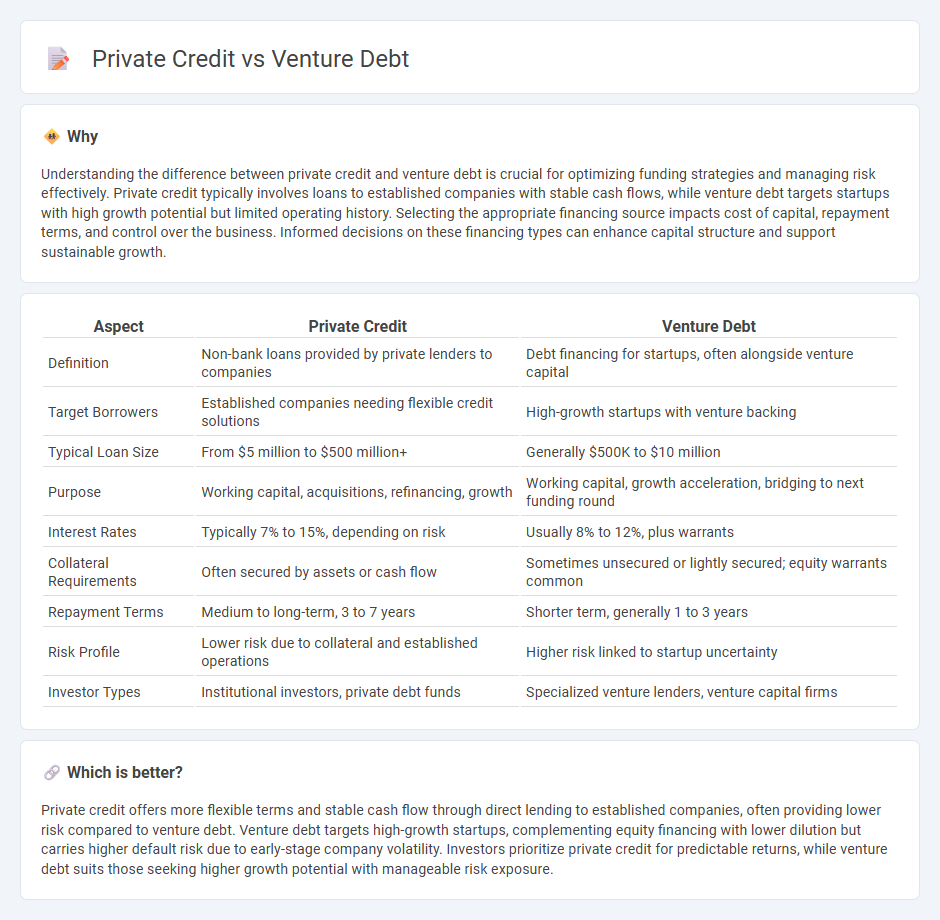

Understanding the difference between private credit and venture debt is crucial for optimizing funding strategies and managing risk effectively. Private credit typically involves loans to established companies with stable cash flows, while venture debt targets startups with high growth potential but limited operating history. Selecting the appropriate financing source impacts cost of capital, repayment terms, and control over the business. Informed decisions on these financing types can enhance capital structure and support sustainable growth.

Comparison Table

| Aspect | Private Credit | Venture Debt |

|---|---|---|

| Definition | Non-bank loans provided by private lenders to companies | Debt financing for startups, often alongside venture capital |

| Target Borrowers | Established companies needing flexible credit solutions | High-growth startups with venture backing |

| Typical Loan Size | From $5 million to $500 million+ | Generally $500K to $10 million |

| Purpose | Working capital, acquisitions, refinancing, growth | Working capital, growth acceleration, bridging to next funding round |

| Interest Rates | Typically 7% to 15%, depending on risk | Usually 8% to 12%, plus warrants |

| Collateral Requirements | Often secured by assets or cash flow | Sometimes unsecured or lightly secured; equity warrants common |

| Repayment Terms | Medium to long-term, 3 to 7 years | Shorter term, generally 1 to 3 years |

| Risk Profile | Lower risk due to collateral and established operations | Higher risk linked to startup uncertainty |

| Investor Types | Institutional investors, private debt funds | Specialized venture lenders, venture capital firms |

Which is better?

Private credit offers more flexible terms and stable cash flow through direct lending to established companies, often providing lower risk compared to venture debt. Venture debt targets high-growth startups, complementing equity financing with lower dilution but carries higher default risk due to early-stage company volatility. Investors prioritize private credit for predictable returns, while venture debt suits those seeking higher growth potential with manageable risk exposure.

Connection

Private credit and venture debt are interconnected as alternative financing solutions that provide capital to companies outside traditional bank loans and equity funding. Venture debt specifically serves startups and growth-stage companies, complementing venture capital by offering debt financing that minimizes equity dilution. Both private credit and venture debt support business expansion and cash flow needs while catering to different borrower risk profiles and capital structures.

Key Terms

Risk Profile

Venture debt typically carries higher risk due to its association with early-stage startups that may have limited revenue and higher failure rates, while private credit often involves more established companies with predictable cash flows, resulting in lower default risk. Venture debt lenders rely heavily on equity kickers and warrants as compensation for this elevated risk, contrasting with private credit's emphasis on secured loans and covenants. Explore detailed comparisons to understand how risk profiles influence investment strategies in these financing options.

Collateral

Venture debt typically requires minimal collateral, often relying on the startup's equity and future receivables, whereas private credit generally demands tangible assets or strong cash flow as collateral to mitigate lender risk. Collateral in venture debt is often intangible and less restrictive, providing startups flexibility to fuel growth without heavy asset encumbrance. Explore further to understand how collateral considerations impact financing structures between venture debt and private credit.

Borrower Type

Venture debt typically targets early-stage startups with high growth potential, providing non-dilutive capital to complement equity financing during expansion phases. Private credit funds focus on established companies requiring flexible financing solutions, often emphasizing cash flow and collateral over equity participation. Explore in-depth borrower profiles and financing structures to understand which option best suits your funding needs.

Source and External Links

Venture Debt Explained: Pros & Cons for Startups - Carta - Venture debt is a type of debt financing for early-stage startups, often raised alongside equity rounds to provide non-dilutive capital, typically between 20-35% of the equity amount raised, with terms including interest rates and covenants tied to company milestones.

Venture debt - Wikipedia - Venture debt is financing provided to venture-backed companies, often used to extend cash runway and complement venture capital without the need for positive cash flow or collateral, often including equity warrants to compensate lenders for higher risk.

When is Venture Debt right for your business? - SVB - Venture debt suits early-stage, fast-growing companies from Series A onwards who have typically raised $5 million+, providing additional capital with less dilution than equity but at higher cost, and lenders often evaluate the startup's existing investors before lending.

dowidth.com

dowidth.com