ESG integration involves systematically incorporating environmental, social, and governance factors into investment analysis to enhance risk management and long-term returns, whereas Socially Responsible Investing (SRI) focuses on excluding or selecting investments based on ethical guidelines. ESG aims to identify financially material sustainability risks and opportunities, while SRI aligns portfolios with specific values or social causes. Explore deeper distinctions and practical impacts of ESG and SRI to optimize your investment strategy.

Why it is important

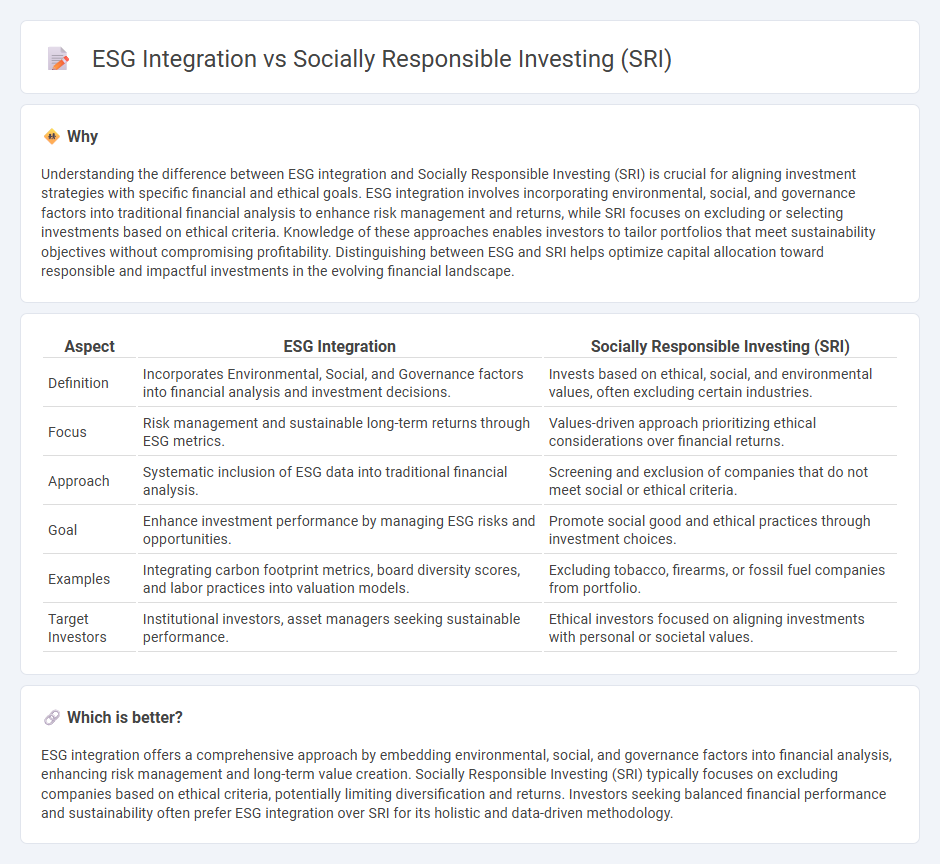

Understanding the difference between ESG integration and Socially Responsible Investing (SRI) is crucial for aligning investment strategies with specific financial and ethical goals. ESG integration involves incorporating environmental, social, and governance factors into traditional financial analysis to enhance risk management and returns, while SRI focuses on excluding or selecting investments based on ethical criteria. Knowledge of these approaches enables investors to tailor portfolios that meet sustainability objectives without compromising profitability. Distinguishing between ESG and SRI helps optimize capital allocation toward responsible and impactful investments in the evolving financial landscape.

Comparison Table

| Aspect | ESG Integration | Socially Responsible Investing (SRI) |

|---|---|---|

| Definition | Incorporates Environmental, Social, and Governance factors into financial analysis and investment decisions. | Invests based on ethical, social, and environmental values, often excluding certain industries. |

| Focus | Risk management and sustainable long-term returns through ESG metrics. | Values-driven approach prioritizing ethical considerations over financial returns. |

| Approach | Systematic inclusion of ESG data into traditional financial analysis. | Screening and exclusion of companies that do not meet social or ethical criteria. |

| Goal | Enhance investment performance by managing ESG risks and opportunities. | Promote social good and ethical practices through investment choices. |

| Examples | Integrating carbon footprint metrics, board diversity scores, and labor practices into valuation models. | Excluding tobacco, firearms, or fossil fuel companies from portfolio. |

| Target Investors | Institutional investors, asset managers seeking sustainable performance. | Ethical investors focused on aligning investments with personal or societal values. |

Which is better?

ESG integration offers a comprehensive approach by embedding environmental, social, and governance factors into financial analysis, enhancing risk management and long-term value creation. Socially Responsible Investing (SRI) typically focuses on excluding companies based on ethical criteria, potentially limiting diversification and returns. Investors seeking balanced financial performance and sustainability often prefer ESG integration over SRI for its holistic and data-driven methodology.

Connection

ESG integration involves incorporating environmental, social, and governance factors into financial analysis to enhance investment decisions. Socially Responsible Investing (SRI) aligns portfolios with ethical values by actively avoiding companies with negative social or environmental impacts. Both strategies prioritize sustainable financial performance by evaluating corporate responsibility and long-term risk management.

Key Terms

Values-based Screening

Values-based screening in Socially Responsible Investing (SRI) involves selecting investments that align with specific ethical, moral, or religious values, often excluding companies involved in tobacco, firearms, or gambling. ESG integration evaluates Environmental, Social, and Governance factors systematically in financial analysis to identify risks and opportunities, but does not necessarily exclude sectors based on value judgments. Explore how both approaches impact portfolio construction and investment performance to make informed decisions.

Materiality Assessment

Socially Responsible Investing (SRI) primarily excludes companies based on ethical criteria, while ESG integration emphasizes assessing financially material environmental, social, and governance factors to enhance investment decisions. Materiality assessment in ESG integration identifies issues that can significantly impact a company's financial performance, ensuring investments align with long-term value creation. Discover more about how materiality assessment shapes sustainable investment strategies and drives responsible capital allocation.

Impact Measurement

Socially Responsible Investing (SRI) centers on excluding companies based on ethical criteria, while ESG integration incorporates environmental, social, and governance factors into investment analysis to enhance financial performance. Impact measurement in SRI often involves qualitative assessments of social outcomes, whereas ESG integration relies on quantitative metrics and standardized reporting frameworks like SASB and GRI to evaluate corporate sustainability. Explore further to understand how precise impact measurement drives better investment decisions and aligns portfolios with stakeholder values.

Source and External Links

Socially responsible investing - Socially responsible investing (SRI) is an investment strategy that seeks to balance financial return with ethical, social, or environmental goals, often linked to environmental, social, and governance (ESG) criteria, and includes practices like impact investing and shareholder advocacy.

What Is Socially Responsible Investing (SRI) and How to ... - SRI aims to generate both social change and financial returns by investing in companies making positive social or sustainable impacts and avoiding those causing negative effects, also known as values-based or sustainable investing.

What is the Difference between Socially Responsible ... - Socially responsible investing integrates social/environmental factors to avoid harmful companies, while impact investing also proactively funds organizations whose core mission is positive social/environmental impact along with financial returns.

dowidth.com

dowidth.com