Finfluencers leverage social media platforms to provide accessible financial advice and market insights, often targeting retail investors with engaging content. Asset managers, on the other hand, are professional firms or individuals managing investment portfolios on behalf of clients, focusing on long-term wealth growth and risk management. Explore how these distinct roles shape modern investing strategies and influence financial decisions.

Why it is important

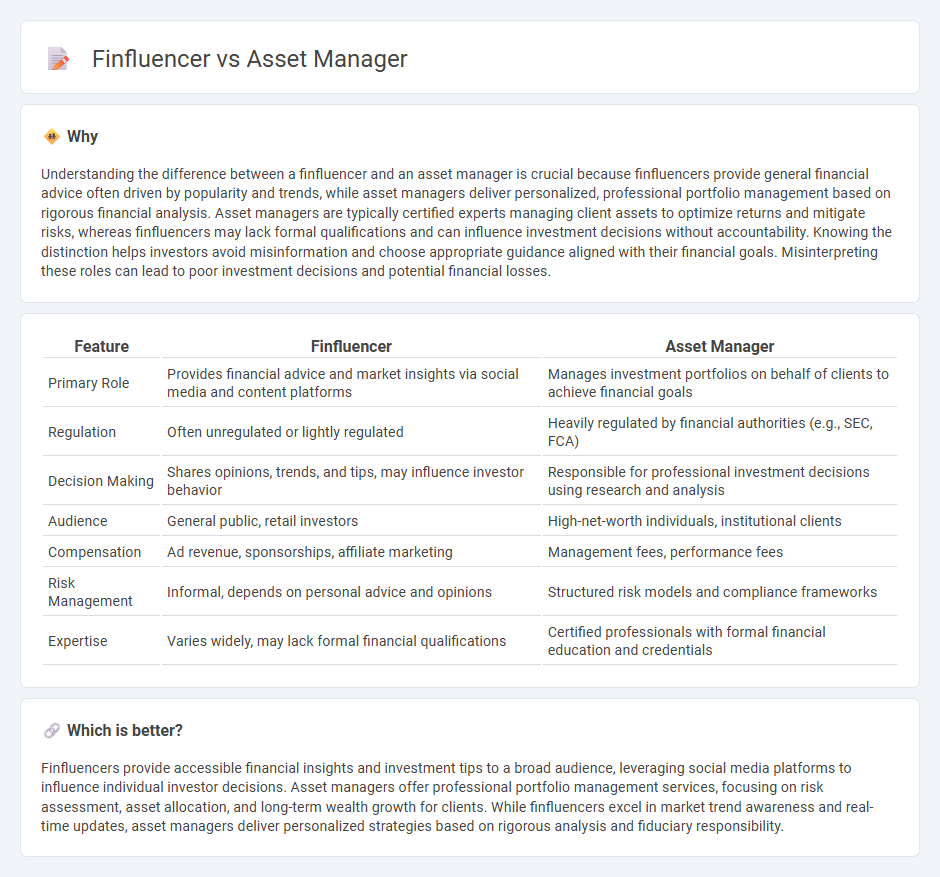

Understanding the difference between a finfluencer and an asset manager is crucial because finfluencers provide general financial advice often driven by popularity and trends, while asset managers deliver personalized, professional portfolio management based on rigorous financial analysis. Asset managers are typically certified experts managing client assets to optimize returns and mitigate risks, whereas finfluencers may lack formal qualifications and can influence investment decisions without accountability. Knowing the distinction helps investors avoid misinformation and choose appropriate guidance aligned with their financial goals. Misinterpreting these roles can lead to poor investment decisions and potential financial losses.

Comparison Table

| Feature | Finfluencer | Asset Manager |

|---|---|---|

| Primary Role | Provides financial advice and market insights via social media and content platforms | Manages investment portfolios on behalf of clients to achieve financial goals |

| Regulation | Often unregulated or lightly regulated | Heavily regulated by financial authorities (e.g., SEC, FCA) |

| Decision Making | Shares opinions, trends, and tips, may influence investor behavior | Responsible for professional investment decisions using research and analysis |

| Audience | General public, retail investors | High-net-worth individuals, institutional clients |

| Compensation | Ad revenue, sponsorships, affiliate marketing | Management fees, performance fees |

| Risk Management | Informal, depends on personal advice and opinions | Structured risk models and compliance frameworks |

| Expertise | Varies widely, may lack formal financial qualifications | Certified professionals with formal financial education and credentials |

Which is better?

Finfluencers provide accessible financial insights and investment tips to a broad audience, leveraging social media platforms to influence individual investor decisions. Asset managers offer professional portfolio management services, focusing on risk assessment, asset allocation, and long-term wealth growth for clients. While finfluencers excel in market trend awareness and real-time updates, asset managers deliver personalized strategies based on rigorous analysis and fiduciary responsibility.

Connection

Finfluencers leverage social media platforms to share investment insights, influencing retail investors' asset allocation decisions and market behavior. Asset managers monitor finfluencer trends to gauge investor sentiment, adapting portfolio strategies to capitalize on emerging market movements driven by social media buzz. This synergy enhances the flow of market information and can impact asset prices through collective investor actions.

Key Terms

Portfolio Diversification

Asset managers strategically diversify investment portfolios by allocating assets across various sectors, geographies, and risk levels to minimize risk and maximize returns. Finfluencers often emphasize portfolio diversification through social media, providing educational content and personal insights but may lack personalized, professional asset allocation strategies. Explore how professional asset management and finfluencer advice differ in portfolio diversification approaches to make informed investment decisions.

Risk Tolerance

Asset managers prioritize tailored risk tolerance assessments to create diversified portfolios that align with long-term investment goals and financial stability. Finfluencers, however, often emphasize trends and personal finance tips that may not fully account for individualized risk profiles, potentially encouraging impulsive decisions. Explore deeper insights into managing risk tolerance effectively to enhance your investment strategy.

Disclosure Compliance

Asset managers adhere strictly to regulatory disclosure compliance, ensuring transparent reporting of investment strategies, risks, and fees to protect investors and maintain market integrity. Finfluencers, while influential in shaping public opinion on financial matters, often face challenges in meeting formal disclosure requirements due to the informal nature of social media platforms. Explore how evolving regulations impact both asset managers and finfluencers to better understand disclosure compliance dynamics in finance.

Source and External Links

What is Asset Management and what does a Financial Asset Manager do? - A financial asset manager specializes in managing financial assets like stocks and bonds, conducting research, constructing portfolios, managing risks, monitoring investments, and communicating with clients to optimize returns according to their risk tolerance.

What Does an Asset Manager Do? (Plus Salary and Outlook) - Asset managers create and oversee investment portfolios tailored to clients' financial goals and risk tolerance, engage in buying and selling securities, and collaborate with finance professionals to reduce risks.

Asset management - Wikipedia - Asset management refers to the financial services sector wherein experts manage client investments actively or passively to optimize performance, often at varying costs, by either tailored strategies or mirroring market indices.

dowidth.com

dowidth.com