Bucket investing divides assets into separate portfolios based on time horizons and risk tolerance, aiming for tailored financial goals and cash flow stability. Value investing focuses on identifying undervalued stocks with strong fundamentals to achieve long-term capital appreciation. Explore the key differences and benefits of bucket investing versus value investing to determine the best strategy for your financial objectives.

Why it is important

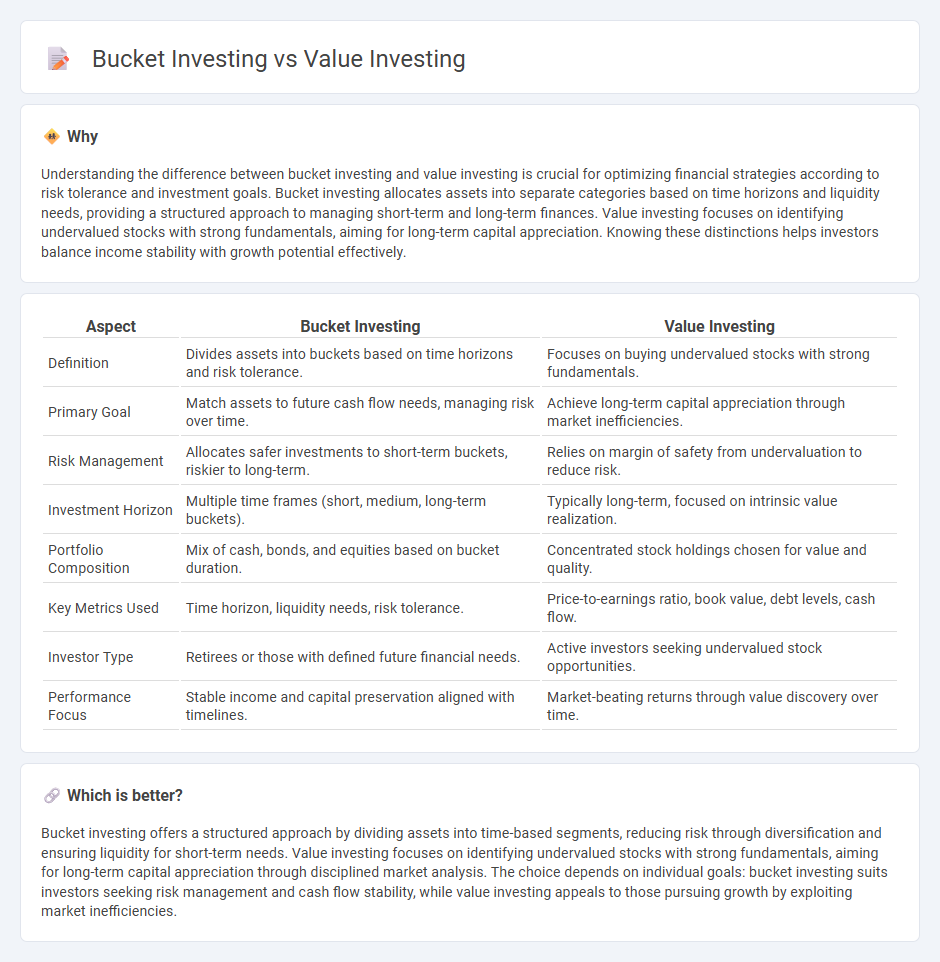

Understanding the difference between bucket investing and value investing is crucial for optimizing financial strategies according to risk tolerance and investment goals. Bucket investing allocates assets into separate categories based on time horizons and liquidity needs, providing a structured approach to managing short-term and long-term finances. Value investing focuses on identifying undervalued stocks with strong fundamentals, aiming for long-term capital appreciation. Knowing these distinctions helps investors balance income stability with growth potential effectively.

Comparison Table

| Aspect | Bucket Investing | Value Investing |

|---|---|---|

| Definition | Divides assets into buckets based on time horizons and risk tolerance. | Focuses on buying undervalued stocks with strong fundamentals. |

| Primary Goal | Match assets to future cash flow needs, managing risk over time. | Achieve long-term capital appreciation through market inefficiencies. |

| Risk Management | Allocates safer investments to short-term buckets, riskier to long-term. | Relies on margin of safety from undervaluation to reduce risk. |

| Investment Horizon | Multiple time frames (short, medium, long-term buckets). | Typically long-term, focused on intrinsic value realization. |

| Portfolio Composition | Mix of cash, bonds, and equities based on bucket duration. | Concentrated stock holdings chosen for value and quality. |

| Key Metrics Used | Time horizon, liquidity needs, risk tolerance. | Price-to-earnings ratio, book value, debt levels, cash flow. |

| Investor Type | Retirees or those with defined future financial needs. | Active investors seeking undervalued stock opportunities. |

| Performance Focus | Stable income and capital preservation aligned with timelines. | Market-beating returns through value discovery over time. |

Which is better?

Bucket investing offers a structured approach by dividing assets into time-based segments, reducing risk through diversification and ensuring liquidity for short-term needs. Value investing focuses on identifying undervalued stocks with strong fundamentals, aiming for long-term capital appreciation through disciplined market analysis. The choice depends on individual goals: bucket investing suits investors seeking risk management and cash flow stability, while value investing appeals to those pursuing growth by exploiting market inefficiencies.

Connection

Bucket investing and value investing both focus on managing risk and optimizing returns through strategic asset allocation. Bucket investing segments assets into time-based categories to balance liquidity and growth, while value investing seeks undervalued securities to achieve long-term capital appreciation. Integrating value investing principles within bucket investing enhances portfolio resilience by combining disciplined stock selection with time-targeted financial planning.

Key Terms

Intrinsic Value

Value investing centers on identifying stocks trading below their intrinsic value by analyzing fundamentals such as earnings, dividends, and cash flow. Bucket investing divides assets into different "buckets" based on time horizons and risk profiles, prioritizing liquidity and income rather than intrinsic valuation. Explore how these strategies impact long-term portfolio performance and risk management to make informed investment decisions.

Asset Allocation

Value investing centers on selecting undervalued stocks with strong fundamentals to generate long-term growth, emphasizing careful company analysis and market timing. Bucket investing prioritizes asset allocation by dividing investments into distinct "buckets" based on time horizons and risk tolerance, ensuring a balanced mix that supports income needs and capital preservation. Explore detailed strategies to decide which approach aligns best with your financial goals and risk appetite.

Margin of Safety

Value investing emphasizes purchasing undervalued securities with a significant margin of safety to protect against market volatility and potential losses. Bucket investing allocates assets into different buckets based on time horizons and risk tolerance, ensuring liquidity and capital preservation through diversified investment vehicles. Explore more about how margin of safety principles apply in various investment strategies to optimize portfolio risk management.

Source and External Links

Value investing - Wikipedia - Value investing is an investment strategy that involves buying securities that appear underpriced based on fundamental analysis, focusing on purchasing stocks below their intrinsic value to achieve a margin of safety as taught by Benjamin Graham and Warren Buffett.

What is value investing? | iShares - BlackRock - Value investing targets companies that are cheap compared to their real worth using financial metrics like price to book and price to earnings, and can now be accessed easily through ETFs like the iShares MSCI World ex Australia Value ETF.

10 Principles of Value Investing - Heartland Advisors - This approach focuses on fundamental research, seeking stocks trading at significant discounts to intrinsic value, prioritizing strong cash flows, low debt, and valuation metrics such as low price/earnings and price/book ratios.

dowidth.com

dowidth.com