Private credit offers businesses debt financing with fixed repayment terms and interest rates, typically involving less dilution of ownership than equity financing. Equity financing allows companies to raise capital by selling shares, providing investors with ownership stakes and potential dividends but diluting control. Explore the advantages and risks of private credit versus equity financing to determine the best funding strategy for your business.

Why it is important

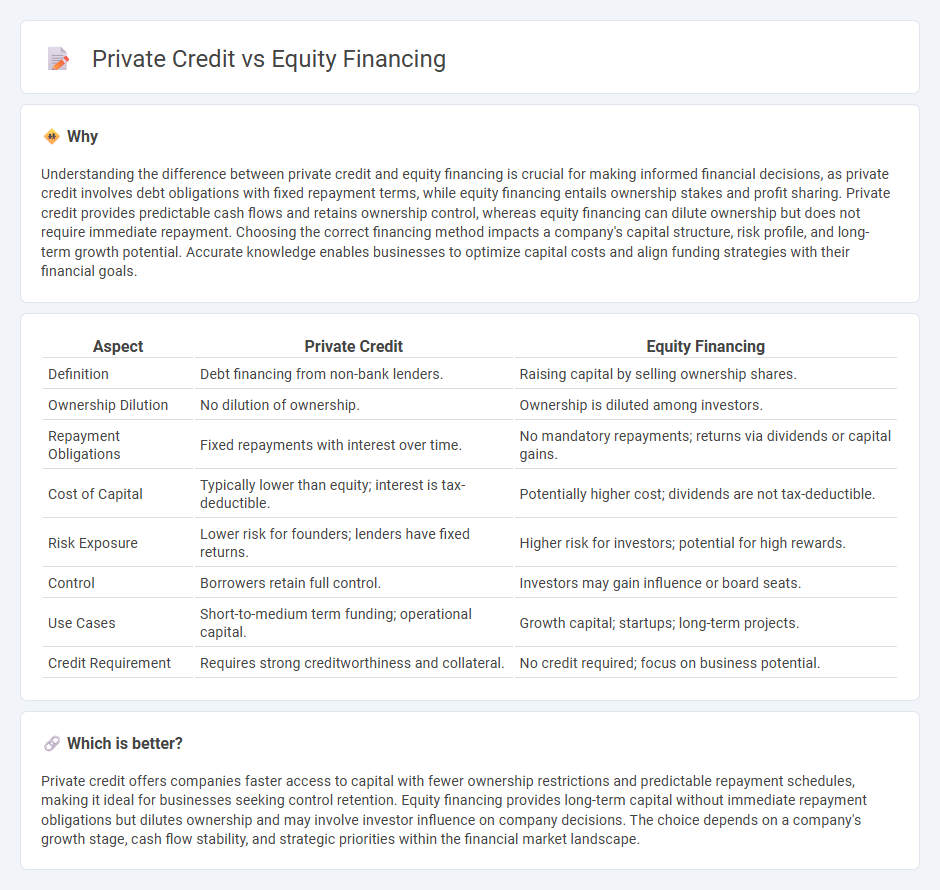

Understanding the difference between private credit and equity financing is crucial for making informed financial decisions, as private credit involves debt obligations with fixed repayment terms, while equity financing entails ownership stakes and profit sharing. Private credit provides predictable cash flows and retains ownership control, whereas equity financing can dilute ownership but does not require immediate repayment. Choosing the correct financing method impacts a company's capital structure, risk profile, and long-term growth potential. Accurate knowledge enables businesses to optimize capital costs and align funding strategies with their financial goals.

Comparison Table

| Aspect | Private Credit | Equity Financing |

|---|---|---|

| Definition | Debt financing from non-bank lenders. | Raising capital by selling ownership shares. |

| Ownership Dilution | No dilution of ownership. | Ownership is diluted among investors. |

| Repayment Obligations | Fixed repayments with interest over time. | No mandatory repayments; returns via dividends or capital gains. |

| Cost of Capital | Typically lower than equity; interest is tax-deductible. | Potentially higher cost; dividends are not tax-deductible. |

| Risk Exposure | Lower risk for founders; lenders have fixed returns. | Higher risk for investors; potential for high rewards. |

| Control | Borrowers retain full control. | Investors may gain influence or board seats. |

| Use Cases | Short-to-medium term funding; operational capital. | Growth capital; startups; long-term projects. |

| Credit Requirement | Requires strong creditworthiness and collateral. | No credit required; focus on business potential. |

Which is better?

Private credit offers companies faster access to capital with fewer ownership restrictions and predictable repayment schedules, making it ideal for businesses seeking control retention. Equity financing provides long-term capital without immediate repayment obligations but dilutes ownership and may involve investor influence on company decisions. The choice depends on a company's growth stage, cash flow stability, and strategic priorities within the financial market landscape.

Connection

Private credit and equity financing are interconnected as complementary funding sources that support business growth and restructuring. Private credit provides debt capital with fixed returns, enabling companies to leverage expansion without diluting ownership, while equity financing involves selling ownership stakes to raise capital, sharing both risk and reward with investors. Together, these financing methods optimize capital structure, balancing risk, control, and cost of capital for private companies.

Key Terms

Ownership Dilution

Equity financing involves raising capital by selling shares, which results in ownership dilution as existing shareholders' stakes decrease. In contrast, private credit provides debt financing without affecting ownership percentages, allowing businesses to maintain control. Discover the key differences and strategic implications of each funding option for your company's growth.

Debt Covenants

Equity financing provides capital in exchange for ownership stakes without imposing debt covenants, allowing more operational flexibility for businesses. Private credit involves loans with detailed debt covenants that restrict financial metrics and operational decisions to protect lenders' interests and ensure timely repayment. Explore how these covenant structures impact control and risk in funding solutions.

Risk-Return Profile

Equity financing involves raising capital by selling ownership stakes, typically offering higher potential returns but with increased risk due to market volatility and business performance fluctuations. Private credit provides loans from non-bank lenders with fixed interest payments, delivering more predictable income and lower risk but limited upside compared to equity. Explore detailed comparisons to understand which risk-return profile aligns best with your investment strategy.

Source and External Links

How equity financing works for startups - J.P. Morgan - Equity financing is raising capital by selling ownership stakes to investors who become long-term partners sharing the company's future success without repayment obligations like debt.

Equity Financing - Definition, How it Works, Pros, Cons - Equity financing is the sale of company shares to raise capital, typically from angel investors, venture capital firms, or crowdfunding, where investors gain ownership rights and potential dividends or price appreciation.

Advantages and Disadvantages of Equity Financing - Equity financing allows companies to raise funds without repayment, gain expert investors, and reduce debt but requires giving up ownership and possibly consulting investors on decisions.

dowidth.com

dowidth.com