Green bonds finance projects with positive environmental impacts, primarily targeting renewable energy, energy efficiency, and climate change mitigation. Blue bonds specifically fund marine and ocean-based initiatives, including sustainable fisheries, pollution reduction, and coastal ecosystem preservation. Explore how these innovative financial instruments drive sustainable development by learning more about their unique objectives and benefits.

Why it is important

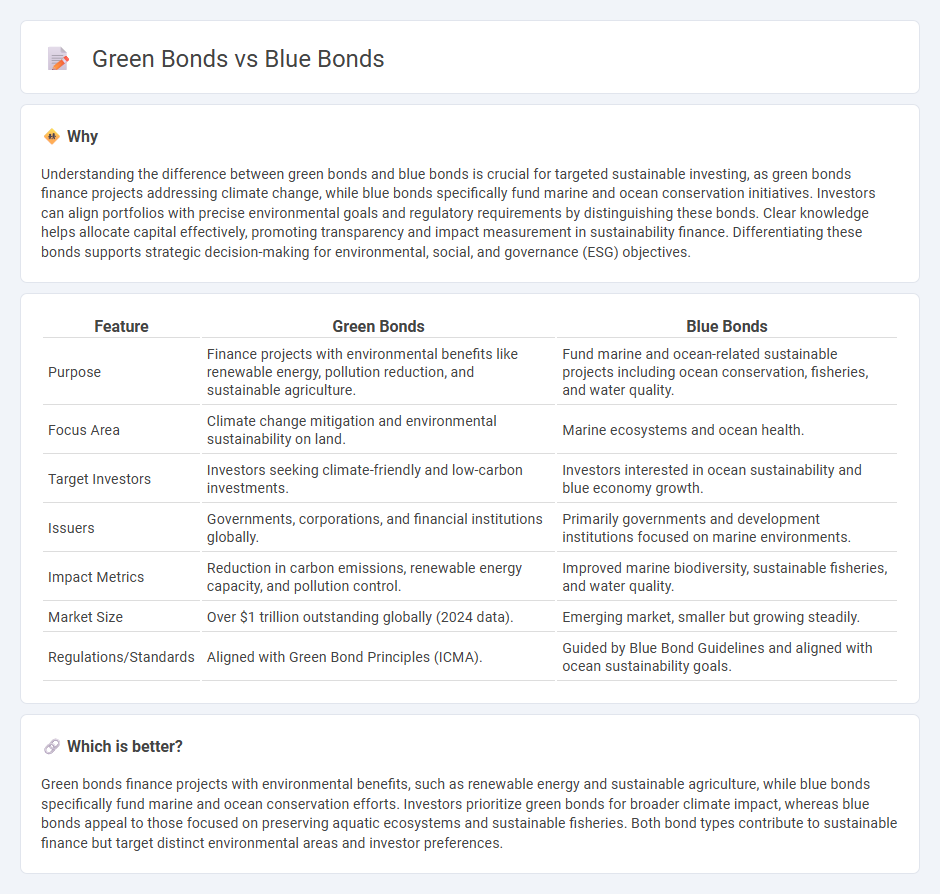

Understanding the difference between green bonds and blue bonds is crucial for targeted sustainable investing, as green bonds finance projects addressing climate change, while blue bonds specifically fund marine and ocean conservation initiatives. Investors can align portfolios with precise environmental goals and regulatory requirements by distinguishing these bonds. Clear knowledge helps allocate capital effectively, promoting transparency and impact measurement in sustainability finance. Differentiating these bonds supports strategic decision-making for environmental, social, and governance (ESG) objectives.

Comparison Table

| Feature | Green Bonds | Blue Bonds |

|---|---|---|

| Purpose | Finance projects with environmental benefits like renewable energy, pollution reduction, and sustainable agriculture. | Fund marine and ocean-related sustainable projects including ocean conservation, fisheries, and water quality. |

| Focus Area | Climate change mitigation and environmental sustainability on land. | Marine ecosystems and ocean health. |

| Target Investors | Investors seeking climate-friendly and low-carbon investments. | Investors interested in ocean sustainability and blue economy growth. |

| Issuers | Governments, corporations, and financial institutions globally. | Primarily governments and development institutions focused on marine environments. |

| Impact Metrics | Reduction in carbon emissions, renewable energy capacity, and pollution control. | Improved marine biodiversity, sustainable fisheries, and water quality. |

| Market Size | Over $1 trillion outstanding globally (2024 data). | Emerging market, smaller but growing steadily. |

| Regulations/Standards | Aligned with Green Bond Principles (ICMA). | Guided by Blue Bond Guidelines and aligned with ocean sustainability goals. |

Which is better?

Green bonds finance projects with environmental benefits, such as renewable energy and sustainable agriculture, while blue bonds specifically fund marine and ocean conservation efforts. Investors prioritize green bonds for broader climate impact, whereas blue bonds appeal to those focused on preserving aquatic ecosystems and sustainable fisheries. Both bond types contribute to sustainable finance but target distinct environmental areas and investor preferences.

Connection

Green bonds and blue bonds both serve as financial instruments designed to fund environmentally sustainable projects, with green bonds focusing on general environmental benefits such as renewable energy and pollution reduction, while blue bonds specifically target marine and ocean conservation initiatives. Both bond types attract investors interested in ESG (Environmental, Social, and Governance) criteria, facilitating capital flow into projects that mitigate climate change and promote ecological resilience. The connectivity between green and blue bonds lies in their shared goal of advancing sustainability through targeted investment strategies in different but complementary environmental sectors.

Key Terms

Ocean Conservation (Blue Bonds)

Blue bonds are debt instruments specifically designed to fund projects that promote ocean conservation, such as marine habitat restoration, sustainable fisheries, and pollution reduction in coastal areas. Unlike green bonds, which finance a broader range of environmental projects including renewable energy and clean transportation, blue bonds target the health of marine ecosystems and sustainable ocean economies. Explore how blue bonds can drive impactful ocean conservation and support sustainable blue growth initiatives.

Renewable Energy Projects (Green Bonds)

Green bonds specifically fund renewable energy projects, supporting the transition to solar, wind, and other clean energy sources. Blue bonds target ocean-related initiatives, including marine renewable energy and sustainable fisheries, addressing water resources and ocean ecosystem health. Explore further to understand how these bonds impact sustainable investment portfolios.

Environmental Impact

Blue bonds finance marine and freshwater projects addressing ocean conservation, sustainable fisheries, and water quality improvement, directly targeting aquatic ecosystem preservation. Green bonds support a broader range of environmental initiatives, including renewable energy, pollution reduction, and sustainable agriculture, with wider environmental impact beyond water-related concerns. Explore the unique environmental benefits of blue and green bonds to determine the best investment for promoting sustainability.

Source and External Links

Blue Bond | Research and Innovation - European Union - Blue Bonds are debt instruments issued by governments, development banks, or corporations to finance marine and ocean-based projects with long-term sustainability objectives, operating similarly to conventional bonds but with proceeds dedicated to blue economy activities.

Blue Bonds - NAP Global Network - Blue Bonds are a subtype of green bonds specifically aimed at improving marine resources, funding projects like mangrove restoration, marine protected areas, water management, and climate adaptation, with guidelines defining eligible project categories and impact indicators.

Blue Finance - Institutions like IFC have catalyzed the issuance of Blue Bonds in regions such as East Asia Pacific to support water management, fisheries, aquaculture, and other blue economy projects, demonstrating growing private sector involvement in blue finance.

dowidth.com

dowidth.com