Loss harvesting involves strategically selling securities at a loss to offset capital gains taxes, enhancing after-tax returns. Portfolio rebalancing adjusts asset allocations to maintain a desired risk profile and investment strategy over time. Explore the differences and benefits of these techniques to optimize your financial management.

Why it is important

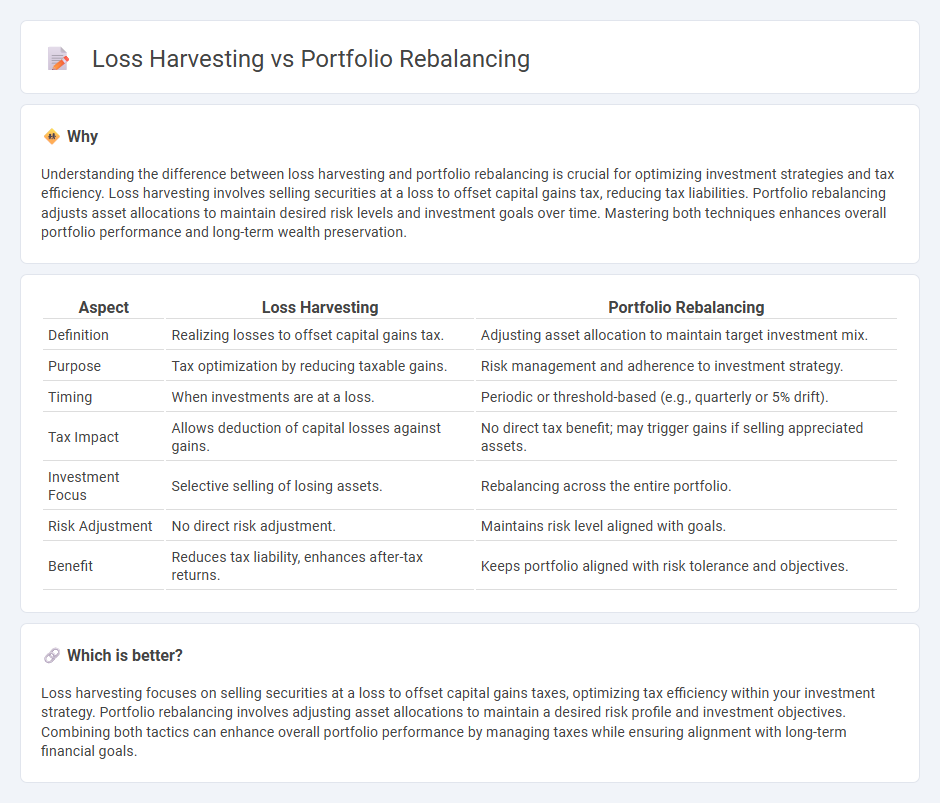

Understanding the difference between loss harvesting and portfolio rebalancing is crucial for optimizing investment strategies and tax efficiency. Loss harvesting involves selling securities at a loss to offset capital gains tax, reducing tax liabilities. Portfolio rebalancing adjusts asset allocations to maintain desired risk levels and investment goals over time. Mastering both techniques enhances overall portfolio performance and long-term wealth preservation.

Comparison Table

| Aspect | Loss Harvesting | Portfolio Rebalancing |

|---|---|---|

| Definition | Realizing losses to offset capital gains tax. | Adjusting asset allocation to maintain target investment mix. |

| Purpose | Tax optimization by reducing taxable gains. | Risk management and adherence to investment strategy. |

| Timing | When investments are at a loss. | Periodic or threshold-based (e.g., quarterly or 5% drift). |

| Tax Impact | Allows deduction of capital losses against gains. | No direct tax benefit; may trigger gains if selling appreciated assets. |

| Investment Focus | Selective selling of losing assets. | Rebalancing across the entire portfolio. |

| Risk Adjustment | No direct risk adjustment. | Maintains risk level aligned with goals. |

| Benefit | Reduces tax liability, enhances after-tax returns. | Keeps portfolio aligned with risk tolerance and objectives. |

Which is better?

Loss harvesting focuses on selling securities at a loss to offset capital gains taxes, optimizing tax efficiency within your investment strategy. Portfolio rebalancing involves adjusting asset allocations to maintain a desired risk profile and investment objectives. Combining both tactics can enhance overall portfolio performance by managing taxes while ensuring alignment with long-term financial goals.

Connection

Loss harvesting involves selling securities at a loss to offset capital gains taxes, thereby enhancing after-tax returns in a portfolio. Portfolio rebalancing systematically adjusts asset allocation back to target weights, maintaining risk tolerance and investment objectives. Combining loss harvesting with rebalancing creates tax-efficient opportunities to realign portfolios while optimizing tax liabilities.

Key Terms

**Portfolio Rebalancing:**

Portfolio rebalancing involves periodically adjusting asset allocations to maintain a desired risk level and investment strategy, which helps optimize portfolio performance and manage volatility. It ensures alignment with target allocations by buying or selling assets, often in response to market fluctuations or investment goals. Explore more to understand how rebalancing strategies can enhance your long-term financial outcomes.

Asset Allocation

Portfolio rebalancing involves adjusting asset allocation to maintain a target risk profile by periodically buying or selling assets to restore desired portfolio weights. Loss harvesting focuses on selling securities at a loss to offset capital gains and reduce tax liability without altering the overall asset allocation strategy. Explore how these strategies can optimize your investment returns and tax efficiency.

Risk Tolerance

Portfolio rebalancing involves adjusting asset allocations to maintain a target risk tolerance, ensuring the portfolio aligns with an investor's long-term goals. Loss harvesting strategically sells assets at a loss to offset gains, optimizing tax efficiency without altering the overall risk profile. Explore how understanding these strategies can enhance your investment approach while managing risk effectively.

Source and External Links

Rebalancing your investments - Portfolio rebalancing is the process of buying and selling investments to keep your portfolio aligned with your investment strategy by adjusting asset allocations back to target percentages.

What is Portfolio Rebalancing and Why Should You Care? - Rebalancing involves selling some assets and buying others to maintain your target asset allocation, helping manage risk and keep your portfolio's risk-reward profile consistent over time.

Rebalancing investments - Common rebalancing strategies include periodic (e.g., annual) rebalancing, rebalancing when allocations deviate beyond a threshold, and using contributions/withdrawals to adjust holdings, with some strategies like over-rebalancing aiming to exploit market dips.

dowidth.com

dowidth.com