Liquidity staking allows investors to earn rewards while retaining the ability to trade or use staked assets, increasing flexibility compared to traditional staking which typically locks assets for a fixed period. Traditional staking often involves higher entry barriers and longer lock-up durations, limiting liquidity but providing network security and consistent rewards. Explore the differences and benefits of liquidity staking versus traditional staking to optimize your investment strategy.

Why it is important

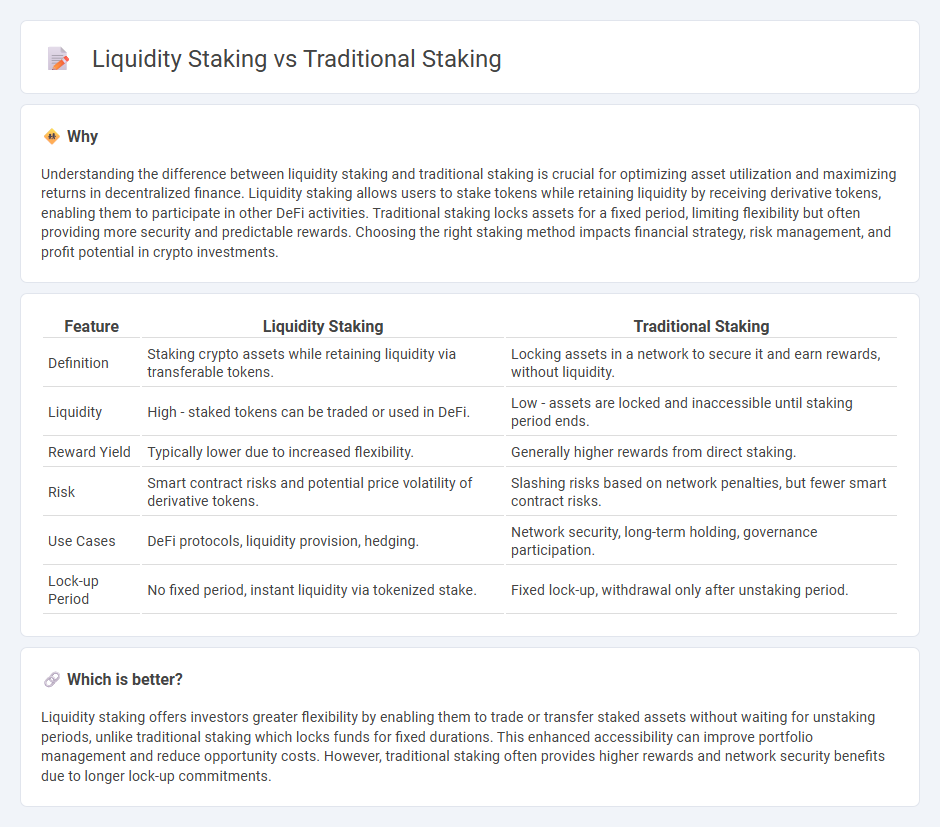

Understanding the difference between liquidity staking and traditional staking is crucial for optimizing asset utilization and maximizing returns in decentralized finance. Liquidity staking allows users to stake tokens while retaining liquidity by receiving derivative tokens, enabling them to participate in other DeFi activities. Traditional staking locks assets for a fixed period, limiting flexibility but often providing more security and predictable rewards. Choosing the right staking method impacts financial strategy, risk management, and profit potential in crypto investments.

Comparison Table

| Feature | Liquidity Staking | Traditional Staking |

|---|---|---|

| Definition | Staking crypto assets while retaining liquidity via transferable tokens. | Locking assets in a network to secure it and earn rewards, without liquidity. |

| Liquidity | High - staked tokens can be traded or used in DeFi. | Low - assets are locked and inaccessible until staking period ends. |

| Reward Yield | Typically lower due to increased flexibility. | Generally higher rewards from direct staking. |

| Risk | Smart contract risks and potential price volatility of derivative tokens. | Slashing risks based on network penalties, but fewer smart contract risks. |

| Use Cases | DeFi protocols, liquidity provision, hedging. | Network security, long-term holding, governance participation. |

| Lock-up Period | No fixed period, instant liquidity via tokenized stake. | Fixed lock-up, withdrawal only after unstaking period. |

Which is better?

Liquidity staking offers investors greater flexibility by enabling them to trade or transfer staked assets without waiting for unstaking periods, unlike traditional staking which locks funds for fixed durations. This enhanced accessibility can improve portfolio management and reduce opportunity costs. However, traditional staking often provides higher rewards and network security benefits due to longer lock-up commitments.

Connection

Liquidity staking enhances traditional staking by allowing users to lock their crypto assets while receiving liquid tokens representing staked assets, facilitating asset utility and trading. Traditional staking involves locking coins to support blockchain security and earn rewards, but lacks liquidity during the staking period. The connection lies in liquidity staking's ability to merge staking rewards with asset liquidity, improving capital efficiency in decentralized finance ecosystems.

Key Terms

Validator

Traditional staking involves locking cryptocurrencies to support blockchain security and earn rewards, with validators responsible for validating transactions and maintaining network consensus. Liquidity staking allows users to stake assets while retaining liquidity through tokenized derivatives, enabling validators to receive staking rewards without sacrificing asset mobility. Explore more to understand how validators' roles differ between these staking methods and impact network performance.

Liquidity Pool

Traditional staking involves locking cryptocurrency in a blockchain network to support security and consensus, earning rewards based on the amount staked. Liquidity staking, particularly within a liquidity pool, requires users to provide assets to decentralized exchanges or protocols, enhancing market liquidity while earning fees and staking rewards simultaneously. Explore deeper insights into how liquidity pools optimize staking returns and reduce risk exposure.

Derivative Token

Traditional staking involves locking up native tokens to secure a blockchain network and earn rewards, while liquidity staking allows users to stake tokens and receive derivative tokens that represent their staked assets. Derivative tokens provide liquidity and flexibility as they can be traded, transferred, or used in DeFi protocols, enhancing capital efficiency compared to traditional staking. Explore the advantages and use cases of derivative tokens in liquidity staking to understand its transformative impact on decentralized finance.

Source and External Links

Liquid Staking vs Traditional Staking vs Pool Staking - Traditional staking involves locking up cryptocurrency to support blockchain operations, earning rewards but with limited liquidity and potential technical complexity, including risks like slashing penalties.

Liquid Staking vs Traditional Staking vs Pool Staking - Traditional staking requires setting up a validator node or delegating to a third party, suits users with technical skills and substantial resources, and involves locking assets for network security in proof-of-stake blockchains.

What is the Difference Between Crypto Staking and Traditional Interest Earning Accounts? - Compared to traditional accounts, crypto traditional staking typically offers higher but less predictable returns, has locked liquidity due to staking periods, and carries additional risks from cryptocurrency volatility and network factors.

dowidth.com

dowidth.com