Private credit offers higher yields by providing loans directly to companies, often with flexible terms and quicker access to capital compared to traditional bank financing. Municipal bonds are debt securities issued by state and local governments, offering tax-exempt income and relatively lower risk backed by public entities. Explore the key differences in risk, return, and tax benefits to determine the best fit for your investment portfolio.

Why it is important

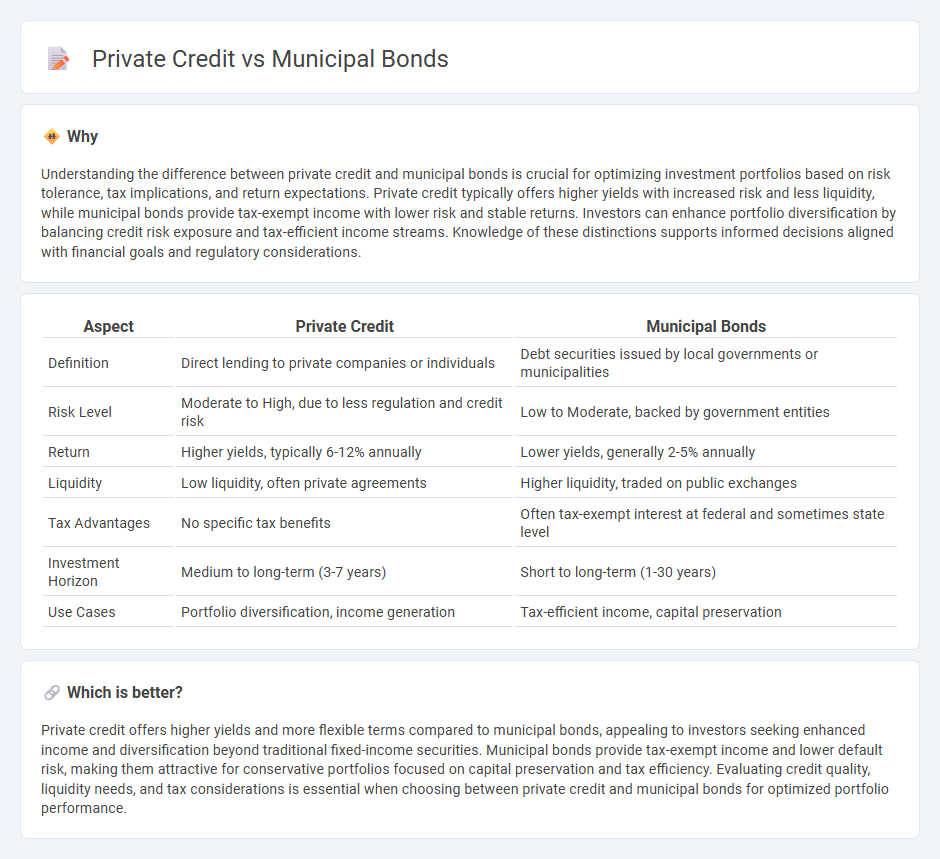

Understanding the difference between private credit and municipal bonds is crucial for optimizing investment portfolios based on risk tolerance, tax implications, and return expectations. Private credit typically offers higher yields with increased risk and less liquidity, while municipal bonds provide tax-exempt income with lower risk and stable returns. Investors can enhance portfolio diversification by balancing credit risk exposure and tax-efficient income streams. Knowledge of these distinctions supports informed decisions aligned with financial goals and regulatory considerations.

Comparison Table

| Aspect | Private Credit | Municipal Bonds |

|---|---|---|

| Definition | Direct lending to private companies or individuals | Debt securities issued by local governments or municipalities |

| Risk Level | Moderate to High, due to less regulation and credit risk | Low to Moderate, backed by government entities |

| Return | Higher yields, typically 6-12% annually | Lower yields, generally 2-5% annually |

| Liquidity | Low liquidity, often private agreements | Higher liquidity, traded on public exchanges |

| Tax Advantages | No specific tax benefits | Often tax-exempt interest at federal and sometimes state level |

| Investment Horizon | Medium to long-term (3-7 years) | Short to long-term (1-30 years) |

| Use Cases | Portfolio diversification, income generation | Tax-efficient income, capital preservation |

Which is better?

Private credit offers higher yields and more flexible terms compared to municipal bonds, appealing to investors seeking enhanced income and diversification beyond traditional fixed-income securities. Municipal bonds provide tax-exempt income and lower default risk, making them attractive for conservative portfolios focused on capital preservation and tax efficiency. Evaluating credit quality, liquidity needs, and tax considerations is essential when choosing between private credit and municipal bonds for optimized portfolio performance.

Connection

Private credit and municipal bonds both serve as alternative financing sources outside traditional bank loans and public equity markets. Private credit often funds infrastructure projects or local government initiatives that can enhance municipal bonds' creditworthiness and stability. The interplay between these financing methods supports diversified investment portfolios and stable community development.

Key Terms

Tax-Exemption

Municipal bonds offer tax-exempt interest income, making them attractive to investors in higher tax brackets seeking federal and often state tax advantages. In contrast, private credit typically provides taxable income but offers potentially higher yields due to increased risk and limited liquidity. Explore the benefits and drawbacks of tax-exempt municipal bonds versus taxable private credit to optimize your investment strategy.

Credit Risk

Municipal bonds typically exhibit lower credit risk due to backing by local government revenues and often enjoy tax advantages, making them attractive to conservative investors. Private credit involves lending to private companies with less regulatory oversight and higher default probabilities, reflecting a higher credit risk but potentially greater yields. Explore deeper insights into credit risk profiles to optimize your fixed income portfolio strategies.

Yield

Municipal bonds typically offer lower yields compared to private credit due to their tax-exempt status and lower risk profile, attracting conservative investors seeking stable income. In contrast, private credit provides higher yields by lending to mid-market companies with less access to traditional financing, bearing higher risk but generating enhanced returns. Explore the detailed risk-return profiles and market dynamics to better understand yield differences between these investment options.

Source and External Links

Municipal bond - Wikipedia - A municipal bond, or "muni," is a debt security issued by state or local governments or their entities to finance public projects, typically categorized into general obligation bonds secured by taxing power and revenue bonds backed by specific income streams like utilities or tolls.

Municipal Bonds - Fidelity Investments - Municipal bonds are debt obligations issued by public entities for funding projects like schools and hospitals, structured mainly as general obligation bonds backed by taxing authority or revenue bonds paid from project income, with various tax treatments.

Municipal Bonds for America - Municipal Bonds are vital for U.S. infrastructure investment, financing about 75% of infrastructure such as roads and airports, with a coalition devoted to promoting and protecting the tax exemption status crucial to the municipal bond market.

dowidth.com

dowidth.com