Fractional shares allow investors to buy a portion of a single stock, enabling diversified portfolios with minimal capital. Unit trusts pool investor funds to purchase a diversified portfolio managed by professionals, offering access to broader market exposure and reduced risk. Explore the advantages and differences between fractional shares and unit trusts to optimize your investment strategy.

Why it is important

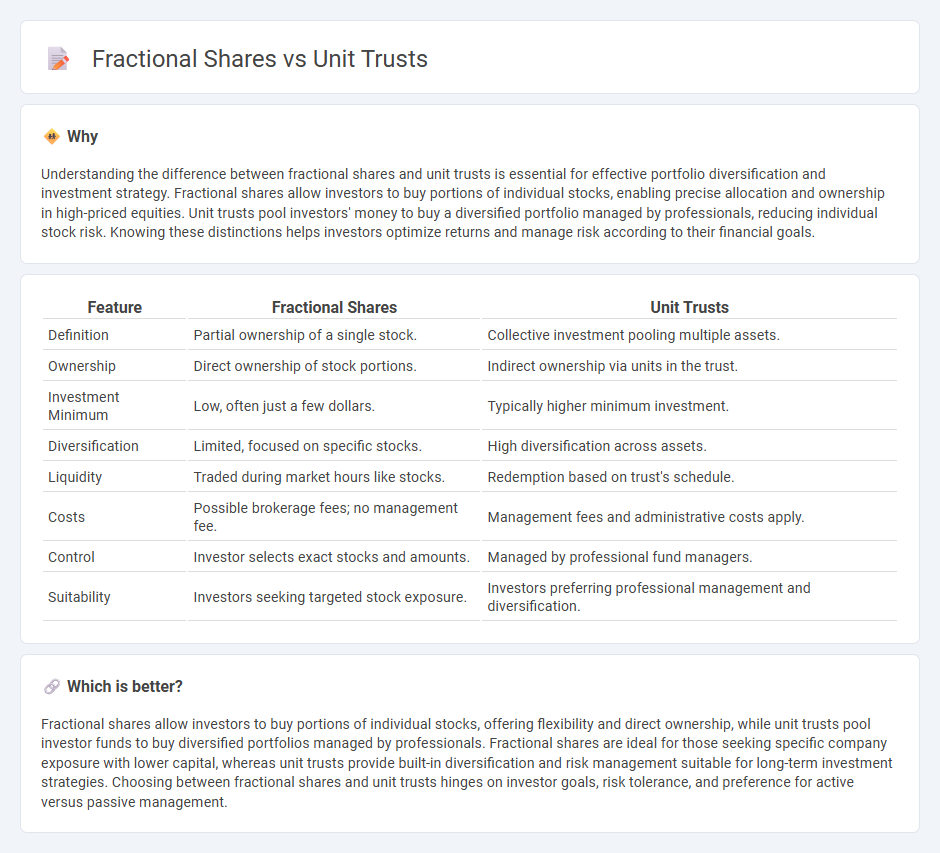

Understanding the difference between fractional shares and unit trusts is essential for effective portfolio diversification and investment strategy. Fractional shares allow investors to buy portions of individual stocks, enabling precise allocation and ownership in high-priced equities. Unit trusts pool investors' money to buy a diversified portfolio managed by professionals, reducing individual stock risk. Knowing these distinctions helps investors optimize returns and manage risk according to their financial goals.

Comparison Table

| Feature | Fractional Shares | Unit Trusts |

|---|---|---|

| Definition | Partial ownership of a single stock. | Collective investment pooling multiple assets. |

| Ownership | Direct ownership of stock portions. | Indirect ownership via units in the trust. |

| Investment Minimum | Low, often just a few dollars. | Typically higher minimum investment. |

| Diversification | Limited, focused on specific stocks. | High diversification across assets. |

| Liquidity | Traded during market hours like stocks. | Redemption based on trust's schedule. |

| Costs | Possible brokerage fees; no management fee. | Management fees and administrative costs apply. |

| Control | Investor selects exact stocks and amounts. | Managed by professional fund managers. |

| Suitability | Investors seeking targeted stock exposure. | Investors preferring professional management and diversification. |

Which is better?

Fractional shares allow investors to buy portions of individual stocks, offering flexibility and direct ownership, while unit trusts pool investor funds to buy diversified portfolios managed by professionals. Fractional shares are ideal for those seeking specific company exposure with lower capital, whereas unit trusts provide built-in diversification and risk management suitable for long-term investment strategies. Choosing between fractional shares and unit trusts hinges on investor goals, risk tolerance, and preference for active versus passive management.

Connection

Fractional shares and unit trusts both enable investors to access diversified portfolios with lower capital outlay, improving affordability and market participation. Fractional shares allow the purchase of portions of individual stocks, while unit trusts pool funds to invest in a range of assets, offering professional management and diversification. Both instruments reduce barriers to entry in finance, democratizing investment opportunities for retail investors.

Key Terms

Diversification

Unit trusts pool investors' funds to buy a diversified portfolio of assets, spreading risk across various securities and sectors, which enhances portfolio stability. Fractional shares allow investors to buy a portion of expensive stocks, but diversification depends on the number of different fractional shares purchased. Explore how each investment type fits your diversification strategy and risk tolerance to optimize returns.

Liquidity

Unit trusts offer liquidity through daily NAV calculations, enabling investors to buy or redeem units at the fund's net asset value at the end of each trading day. Fractional shares provide more immediate liquidity by allowing investors to trade portions of individual stocks in real-time during market hours, facilitating quicker entry and exit. Explore deeper insights into liquidity differences and investment strategies between unit trusts and fractional shares.

Ownership structure

Unit trusts pool investors' money into a managed fund owning diversified assets, with investors holding units representing their share in the collective portfolio. Fractional shares provide direct partial ownership of individual company stock, allowing investors to buy less than one full share while enjoying proportional voting rights and dividends. Explore how these ownership structures impact investment control and portfolio diversification strategies.

Source and External Links

Unit trust - Wikipedia - A unit trust is a collective investment scheme pooling investors' money into a single fund managed by a fund manager, offering access to diverse assets like shares, bonds, or properties, with investors owning units priced by net asset value (NAV).

Unit Investment Trusts (UITs) - Investor.gov - A UIT invests money raised in a one-time public offering into a fixed portfolio of securities, issues redeemable units, does not actively trade, and dissolves on a predetermined date.

Invest in Unit Trust Funds - UAP Old Mutual Uganda - Unit trusts pool investor contributions for professional fund management, enabling diversification and access to markets such as local stocks, bonds, and offshore investments, with objectives including income and capital gain.

dowidth.com

dowidth.com