Loss harvesting involves selling investments at a loss to offset capital gains and reduce tax liability in the current year, while carryforward losses allow unused losses to be applied to future tax years. This strategic approach helps investors optimize tax outcomes by matching losses against gains over time. Explore detailed strategies and tax benefits to maximize your financial planning efficiency.

Why it is important

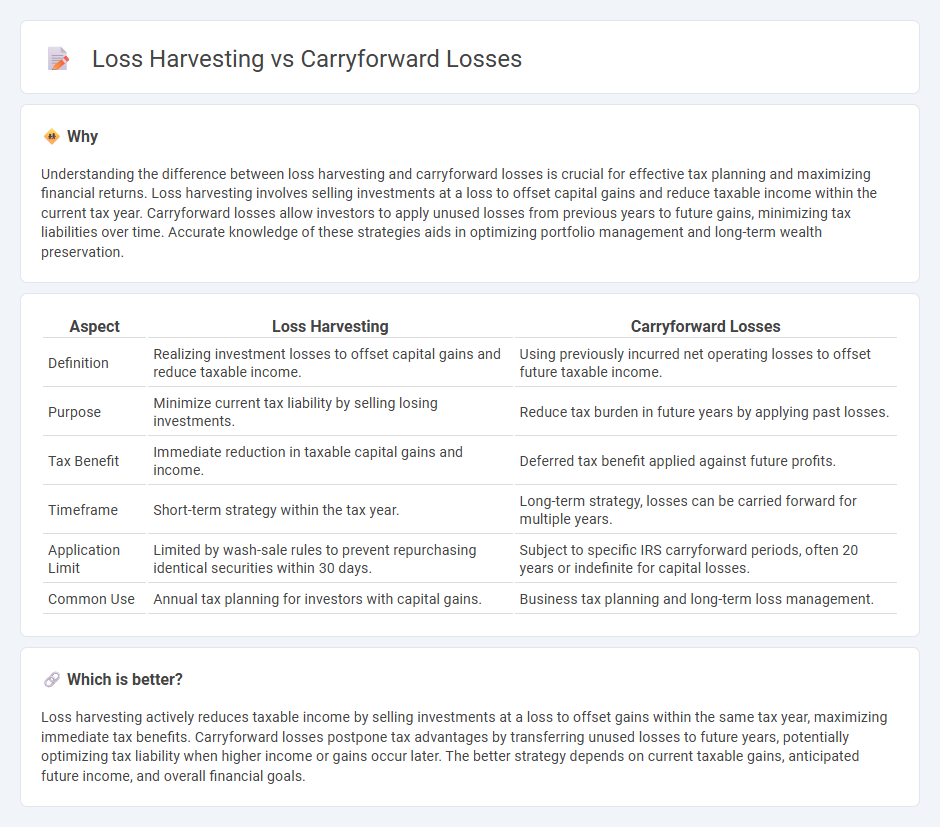

Understanding the difference between loss harvesting and carryforward losses is crucial for effective tax planning and maximizing financial returns. Loss harvesting involves selling investments at a loss to offset capital gains and reduce taxable income within the current tax year. Carryforward losses allow investors to apply unused losses from previous years to future gains, minimizing tax liabilities over time. Accurate knowledge of these strategies aids in optimizing portfolio management and long-term wealth preservation.

Comparison Table

| Aspect | Loss Harvesting | Carryforward Losses |

|---|---|---|

| Definition | Realizing investment losses to offset capital gains and reduce taxable income. | Using previously incurred net operating losses to offset future taxable income. |

| Purpose | Minimize current tax liability by selling losing investments. | Reduce tax burden in future years by applying past losses. |

| Tax Benefit | Immediate reduction in taxable capital gains and income. | Deferred tax benefit applied against future profits. |

| Timeframe | Short-term strategy within the tax year. | Long-term strategy, losses can be carried forward for multiple years. |

| Application Limit | Limited by wash-sale rules to prevent repurchasing identical securities within 30 days. | Subject to specific IRS carryforward periods, often 20 years or indefinite for capital losses. |

| Common Use | Annual tax planning for investors with capital gains. | Business tax planning and long-term loss management. |

Which is better?

Loss harvesting actively reduces taxable income by selling investments at a loss to offset gains within the same tax year, maximizing immediate tax benefits. Carryforward losses postpone tax advantages by transferring unused losses to future years, potentially optimizing tax liability when higher income or gains occur later. The better strategy depends on current taxable gains, anticipated future income, and overall financial goals.

Connection

Loss harvesting strategically realizes investment losses to offset capital gains, reducing taxable income in the current tax year. Carryforward losses allow investors to apply unused losses to future tax years, maximizing tax benefits over time. This connection enhances long-term tax efficiency by balancing realized losses with future capital gains.

Key Terms

Tax Deduction

Carryforward losses enable taxpayers to apply past financial losses to future taxable income, reducing their tax liability over subsequent years. In contrast, loss harvesting involves strategically selling investments at a loss within the same tax year to offset capital gains and maximize immediate tax deductions. Explore detailed strategies on how these tax deduction methods can optimize your financial planning and minimize tax burdens.

Capital Gains

Carryforward losses allow investors to offset future capital gains by applying past losses to reduce taxable income in subsequent years, thus minimizing tax liabilities over time. Loss harvesting involves strategically selling investments at a loss to offset current capital gains, optimizing tax efficiency within the same tax year. Explore detailed strategies to maximize tax benefits through effective management of capital gains and losses.

Offset

Carryforward losses enable taxpayers to offset future taxable income by applying previous years' losses, reducing tax liability over multiple periods. Loss harvesting involves strategically selling investments at a loss to offset gains within the same tax year, optimizing tax efficiency. Discover how optimizing carryforward losses and loss harvesting can maximize your tax offsets.

Source and External Links

Tax Loss Carryforward: What Is It and How Does It Work? - SoFi - A tax loss carryforward allows investors and businesses to offset capital losses realized in the current year against future capital gains, reducing taxable income and overall tax liability, with losses carried forward indefinitely at the federal level subject to rules and limitations.

Net Operating Loss Carryforward | TaxEDU Glossary - Tax Foundation - Net Operating Loss (NOL) carryforward permits businesses to deduct losses from one year against profits in future years, helping to average taxable income over time, with losses able to be carried forward indefinitely but limited to offsetting 80% of taxable income.

NOL Tax Loss Carryforward - Corporate Finance Institute - A net operating loss carryforward is a tax provision that lets firms apply losses from prior years to reduce future taxable profits, aiming to smooth out taxes over time so total lifetime taxes remain consistent regardless of profit timing.

dowidth.com

dowidth.com