Revenue-based financing offers flexible capital repayment tied directly to a company's revenue, enabling businesses to avoid fixed monthly payments common in debt financing. Debt financing typically involves predetermined interest rates and fixed repayment schedules, which can strain cash flow during low revenue periods. Explore the intricacies of each financing option to determine the best fit for your financial strategy.

Why it is important

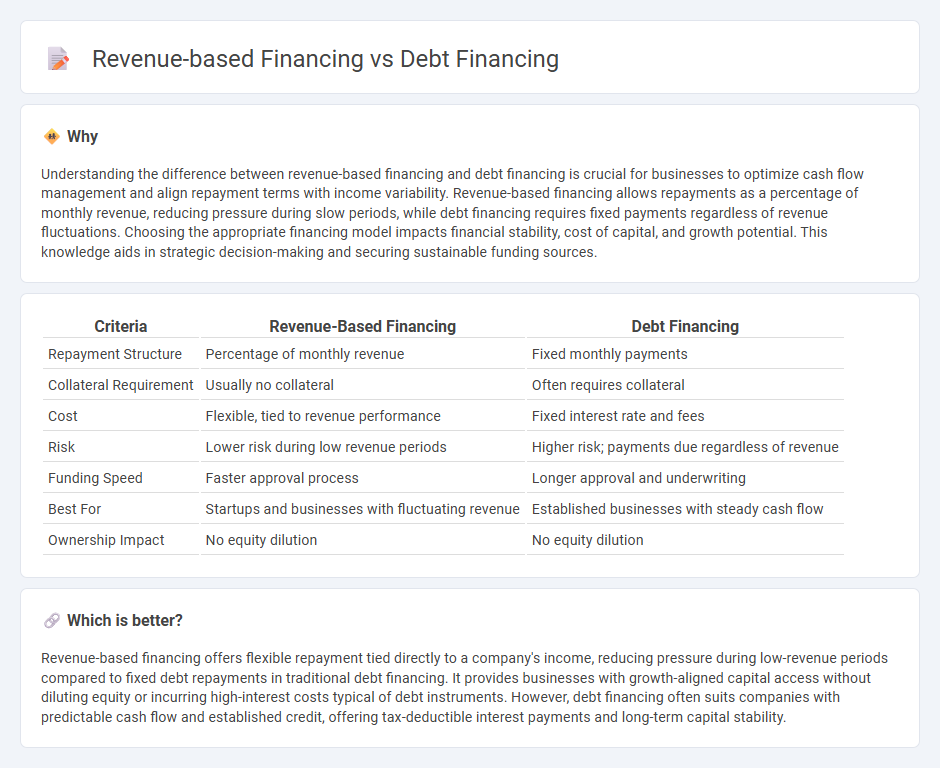

Understanding the difference between revenue-based financing and debt financing is crucial for businesses to optimize cash flow management and align repayment terms with income variability. Revenue-based financing allows repayments as a percentage of monthly revenue, reducing pressure during slow periods, while debt financing requires fixed payments regardless of revenue fluctuations. Choosing the appropriate financing model impacts financial stability, cost of capital, and growth potential. This knowledge aids in strategic decision-making and securing sustainable funding sources.

Comparison Table

| Criteria | Revenue-Based Financing | Debt Financing |

|---|---|---|

| Repayment Structure | Percentage of monthly revenue | Fixed monthly payments |

| Collateral Requirement | Usually no collateral | Often requires collateral |

| Cost | Flexible, tied to revenue performance | Fixed interest rate and fees |

| Risk | Lower risk during low revenue periods | Higher risk; payments due regardless of revenue |

| Funding Speed | Faster approval process | Longer approval and underwriting |

| Best For | Startups and businesses with fluctuating revenue | Established businesses with steady cash flow |

| Ownership Impact | No equity dilution | No equity dilution |

Which is better?

Revenue-based financing offers flexible repayment tied directly to a company's income, reducing pressure during low-revenue periods compared to fixed debt repayments in traditional debt financing. It provides businesses with growth-aligned capital access without diluting equity or incurring high-interest costs typical of debt instruments. However, debt financing often suits companies with predictable cash flow and established credit, offering tax-deductible interest payments and long-term capital stability.

Connection

Revenue-based financing and debt financing are connected through their shared purpose of providing capital to businesses while requiring repayment over time. Both financing methods involve structured repayment obligations, but revenue-based financing bases repayments on a percentage of future revenues, whereas debt financing typically involves fixed interest payments and principal repayment schedules. This connection allows companies to choose financing options aligned with their cash flow variability and growth projections.

Key Terms

Interest Rate

Debt financing typically involves fixed interest rates, requiring regular loan repayments regardless of business revenue, while revenue-based financing adjusts payments based on a percentage of monthly revenue, often resulting in variable effective interest costs. Interest rates in traditional debt financing can range from 4% to 15% annually, influenced by creditworthiness and loan terms, whereas revenue-based financing doesn't specify a conventional interest rate but incorporates repayment caps usually between 1.3x to 3x the financed amount. Explore deeper insights on how interest rate structures affect your choice between debt and revenue-based financing.

Repayment Structure

Debt financing requires fixed periodic repayments of principal and interest, creating predictable cash flow obligations for the borrower. Revenue-based financing ties repayments to a percentage of the company's ongoing gross revenues, allowing for variable payments aligned with business performance. Explore the advantages and suitability of each repayment structure to determine the best financing option for your business needs.

Ownership Dilution

Debt financing involves borrowing funds that must be repaid with interest, causing no ownership dilution since lenders do not acquire equity in the company. Revenue-based financing provides capital in exchange for a percentage of future revenues, allowing founders to retain ownership but sharing a portion of income until repayment is completed. Explore how these financing options impact your business's equity and control to make informed decisions.

Source and External Links

Debt Financing - Overview, Options, Pros and Cons - Debt financing is when a company raises money by selling debt instruments such as bank loans or bonds, promising to repay the loan with interest, often used by well-established businesses for capital expenditures or working capital needs.

Debt Financing: Definition & How It Works - Debt financing includes methods like SBA loans, credit lines, and bonds and involves borrowing money to pay back typically with interest, with options including bank loans and private credit like venture debt for startups.

Debt Financing 101: The Basics, Benefits & Drawbacks - Debt financing means borrowing money to be repaid over time with interest, involving steps such as assessing needs, applying, credit evaluation, and agreeing on repayment schedules that can vary from fixed to balloon payments.

dowidth.com

dowidth.com