Trader funding programs provide capital to skilled traders, allowing them to trade financial markets without personal risk, often requiring profit splits and performance milestones. Proprietary trading firms use their own capital to employ traders, offering salaries or profit sharing while maintaining strict risk management and training protocols. Discover the distinct advantages and opportunities of each approach to elevate your trading career.

Why it is important

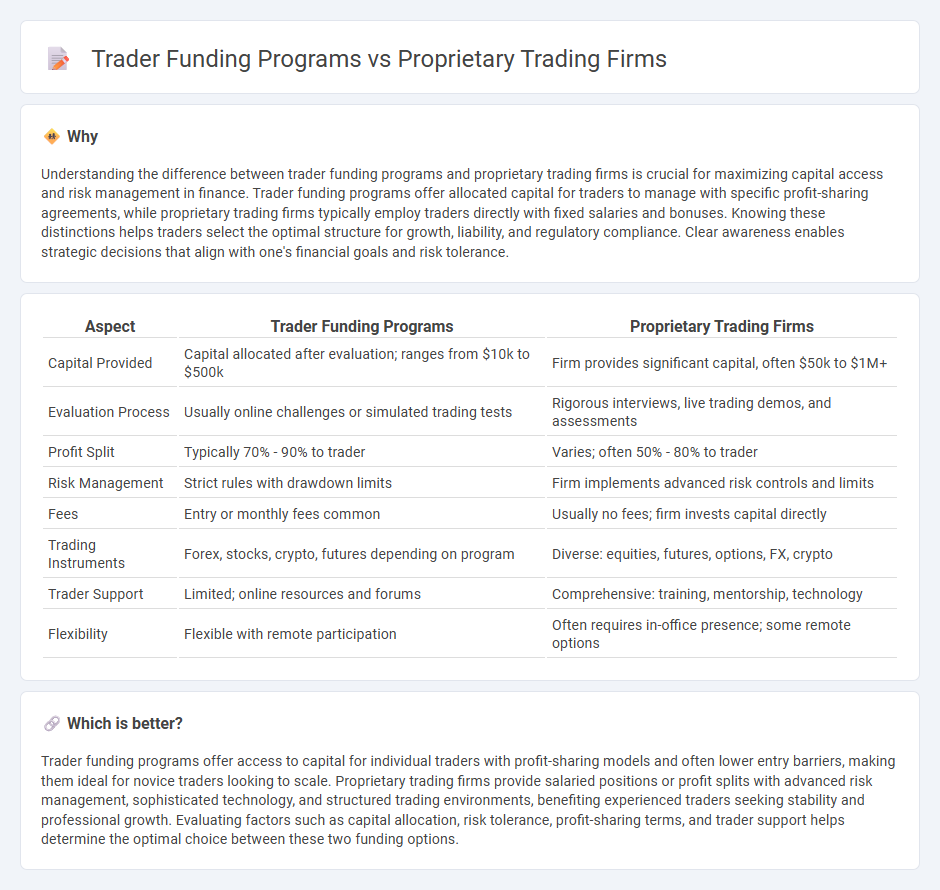

Understanding the difference between trader funding programs and proprietary trading firms is crucial for maximizing capital access and risk management in finance. Trader funding programs offer allocated capital for traders to manage with specific profit-sharing agreements, while proprietary trading firms typically employ traders directly with fixed salaries and bonuses. Knowing these distinctions helps traders select the optimal structure for growth, liability, and regulatory compliance. Clear awareness enables strategic decisions that align with one's financial goals and risk tolerance.

Comparison Table

| Aspect | Trader Funding Programs | Proprietary Trading Firms |

|---|---|---|

| Capital Provided | Capital allocated after evaluation; ranges from $10k to $500k | Firm provides significant capital, often $50k to $1M+ |

| Evaluation Process | Usually online challenges or simulated trading tests | Rigorous interviews, live trading demos, and assessments |

| Profit Split | Typically 70% - 90% to trader | Varies; often 50% - 80% to trader |

| Risk Management | Strict rules with drawdown limits | Firm implements advanced risk controls and limits |

| Fees | Entry or monthly fees common | Usually no fees; firm invests capital directly |

| Trading Instruments | Forex, stocks, crypto, futures depending on program | Diverse: equities, futures, options, FX, crypto |

| Trader Support | Limited; online resources and forums | Comprehensive: training, mentorship, technology |

| Flexibility | Flexible with remote participation | Often requires in-office presence; some remote options |

Which is better?

Trader funding programs offer access to capital for individual traders with profit-sharing models and often lower entry barriers, making them ideal for novice traders looking to scale. Proprietary trading firms provide salaried positions or profit splits with advanced risk management, sophisticated technology, and structured trading environments, benefiting experienced traders seeking stability and professional growth. Evaluating factors such as capital allocation, risk tolerance, profit-sharing terms, and trader support helps determine the optimal choice between these two funding options.

Connection

Trader funding programs provide capital to skilled traders, enabling them to trade with larger positions without risking personal funds. Proprietary trading firms utilize these programs to identify and support talented traders, sharing profits generated from successful trades. This symbiotic relationship fosters growth opportunities for traders while allowing firms to scale their market presence efficiently.

Key Terms

Capital Allocation

Proprietary trading firms allocate capital directly to skilled traders, allowing them to utilize firm resources for trading activities, often providing substantial leverage and risk management support. Trader funding programs grant access to allocated capital based on performance metrics or evaluation phases, enabling traders to trade with risk capital without personal financial exposure. Explore more to understand how these funding models impact trader autonomy and risk profiles.

Risk Management

Proprietary trading firms implement stringent risk management protocols, including daily loss limits, position size restrictions, and real-time monitoring to safeguard capital and ensure sustainable trading performance. Trader funding programs often emphasize risk controls through phased capital allocation, performance benchmarks, and drawdown thresholds to protect both trader and investor interests. Explore detailed risk management strategies to understand how each approach mitigates trading risks effectively.

Profit Sharing

Proprietary trading firms typically offer traders direct access to the firm's capital in exchange for a profit-sharing agreement where traders retain a significant percentage of earnings, often ranging from 50% to 80%. Trader funding programs, on the other hand, provide capital under predefined terms with varied profit split models but often include performance-based scaling and risk management rules to optimize returns. Explore detailed comparisons to understand how profit sharing can impact your trading career and maximize your growth potential.

Source and External Links

Proprietary trading - Wikipedia - Proprietary trading firms, or prop trading firms, trade financial instruments using the firm's own capital to generate profit, employing strategies such as arbitrage and volatility trading; notable firms include Citadel Securities, Jane Street, and Optiver.

Prop Trading Firms: Here's How They Work - Nasdaq - Prop trading firms trade with their own capital, profiting directly from market activity, and provide traders access to capital, technology, and mentorship while contributing to market liquidity and efficiency.

List Of Proprietary Trading Firms - Trading Interview - Prop trading firms operate by using internal capital to trade various financial instruments, aiming to profit directly from markets without managing external client assets; they differ from hedge funds by taking on risk solely for their own account.

dowidth.com

dowidth.com