Dim sum bonds are yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, attracting investors looking to tap into China's economic growth. Bulldog bonds are sterling-denominated bonds issued in the UK by foreign entities, offering diversification for investors seeking exposure to British markets. Explore the nuances and investment opportunities of these bond types to optimize your global portfolio strategy.

Why it is important

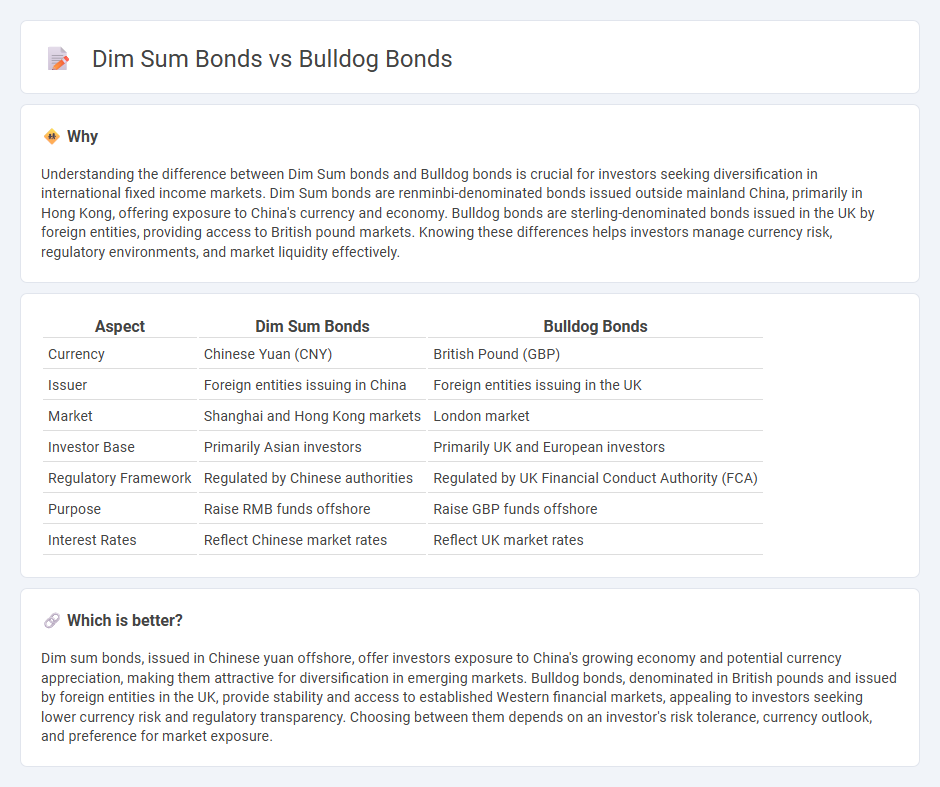

Understanding the difference between Dim Sum bonds and Bulldog bonds is crucial for investors seeking diversification in international fixed income markets. Dim Sum bonds are renminbi-denominated bonds issued outside mainland China, primarily in Hong Kong, offering exposure to China's currency and economy. Bulldog bonds are sterling-denominated bonds issued in the UK by foreign entities, providing access to British pound markets. Knowing these differences helps investors manage currency risk, regulatory environments, and market liquidity effectively.

Comparison Table

| Aspect | Dim Sum Bonds | Bulldog Bonds |

|---|---|---|

| Currency | Chinese Yuan (CNY) | British Pound (GBP) |

| Issuer | Foreign entities issuing in China | Foreign entities issuing in the UK |

| Market | Shanghai and Hong Kong markets | London market |

| Investor Base | Primarily Asian investors | Primarily UK and European investors |

| Regulatory Framework | Regulated by Chinese authorities | Regulated by UK Financial Conduct Authority (FCA) |

| Purpose | Raise RMB funds offshore | Raise GBP funds offshore |

| Interest Rates | Reflect Chinese market rates | Reflect UK market rates |

Which is better?

Dim sum bonds, issued in Chinese yuan offshore, offer investors exposure to China's growing economy and potential currency appreciation, making them attractive for diversification in emerging markets. Bulldog bonds, denominated in British pounds and issued by foreign entities in the UK, provide stability and access to established Western financial markets, appealing to investors seeking lower currency risk and regulatory transparency. Choosing between them depends on an investor's risk tolerance, currency outlook, and preference for market exposure.

Connection

Dim sum bonds and Bulldog bonds are both types of foreign bonds issued in currencies different from the issuer's home country to attract international investors. Dim sum bonds are renminbi-denominated bonds issued in Hong Kong, targeted mainly at offshore investors seeking exposure to Chinese currency. Bulldog bonds are pound sterling-denominated bonds issued in the UK by foreign entities, allowing issuers to tap into the British capital market while diversifying currency risk and investor base.

Key Terms

Currency denomination

Bulldog bonds are sterling-denominated bonds issued in the UK by foreign entities, while Dim Sum bonds are yuan-denominated bonds issued outside mainland China, primarily in Hong Kong. The currency denomination distinguishes their market appeal, with Bulldog bonds catering to investors seeking exposure to British pounds and Dim Sum bonds attracting those interested in Chinese yuan assets. Discover more about the impact of currency choice on global bond investment strategies.

Issuance location

Bulldog bonds are issued in the United Kingdom by foreign entities denominated in British pounds, while Dim Sum bonds are issued in Hong Kong by foreign entities but denominated in Chinese yuan. The issuance location significantly impacts regulatory frameworks, investor base, and currency risk associated with each bond type. Explore the distinct advantages and market dynamics of Bulldog and Dim Sum bonds to optimize your investment strategy.

Investor base

Bulldog bonds are sterling-denominated bonds issued in the UK by foreign entities, attracting institutional investors such as pension funds and insurance companies seeking stable returns in British pounds. Dim sum bonds, issued in offshore Hong Kong and denominated in Chinese yuan, appeal primarily to investors aiming for exposure to China's growing economy and yuan appreciation potential, including multinational corporations and regional funds. Explore further to understand how these bonds serve diverse investor bases and their strategic roles in global fixed-income portfolios.

Source and External Links

Bulldog Bond: A Comprehensive Guide to UK's Unique Investment - Bulldog Bonds are foreign bonds issued by non-British corporations denominated in British pounds (GBP) and traded in the UK, allowing foreign companies to raise capital in the UK market while mitigating exchange rate risks.

Bulldog Bond Definition - Fixed Income - Acquire.Fi - These bonds offer higher yields than UK Government Bonds and provide non-UK companies access to British investors, with the first Bulldog Bond issued in 1870 by Buenos Aires Western Railway Company.

The Definition of a Bulldog Bond, Its Opportunities, and Its Risks - Bulldog Bonds are underwritten by British banks, trade in GBP, and provide issuers and investors with diversification benefits and access to a liquid, trusted market, though investors face currency exchange risks.

dowidth.com

dowidth.com